What adviser wouldn’t want to rekindle a client relationship with the click of a button?

In recent weeks, a select group of Morgan Stanley advisers has been participating in a pilot project to test new technologies designed to blend high-tech with high-touch advice.

The firm is calibrating the work of its advisers, employing algorithms to identify clients’ unmet needs or interests, and then presenting advisers with ready-made yet customizable messages to send those clients on topics ranging from 529 plans to health care. The project is led by Naureen Hassan, who joined the wirehouse from Charles Schwab, where she was critical in that firm’s development of its robo adviser platform.

For Gregg Cuvin, an adviser on a team overseeing $500 million in client assets, its value was apparent shortly after he sent out the first batch of 25 emails; he started talking with a client who had recently had two kids, and he ended up working on a new financial plan.

“The technology was the spark. Maybe if I called her, we would have had the same conversation. But if the technology can help us be more efficient, then we’ll be able to better serve our clients,” Cuvin says.

Each enhancement in an adviser’s efficiency may seem small at the level of the individual interaction. But these small steps add up when measured across an adviser’s book of business, or across an entire firm. And, for a client, the impact can be huge.

Morgan Stanley, the 40-year-old adviser says, is on to something. “I’m seeing how this can be potentially very efficient.”

Pilot programs such as this are a sneak peek into what a future digital Morgan Stanley Wealth Management will look like — and what it’ll be capable of. Over the next year, the firm plans to unveil new technologies and capabilities, including an automated investing platform. In doing so, Morgan Stanley may offer a template for how advisers can thrive in an environment of stiffer competition, greater pressure on fees and rapidly evolving technologies.

“I would be hard-pressed to think of a bigger priority than this,” says Andy Saperstein, who is one of two co-heads of wealth management at Morgan Stanley. The other is Shelley O’Connor.

Digital, Saperstein says, “affects everything we do behind the scenes and every touch point with a client.”

Of course, Morgan Stanley isn’t alone.

“There is a sea of change in the way wealth management executives are looking at digital,” says Uday Singh, a partner in the financial institutions practice of consulting firm A.T. Kearney.

The focus has shifted from investing technology to the user experience, Singh says, pointing to the variety of ways that even high-net-worth clients want to be served.

“Digital advice is here to stay,” he says. “The price compression that will take place in the overall industry will be massive, and all firms will have to retool their operating model.”

DIGITAL DISRUPTION

Of course, finance being changed by technology is not a new theme. One does not need to look too far back to find other examples of disruption, such as the ascent of online brokerage firms in the 1990s.

“I think we are in a continual evolution. When I think back to the 1970s, my dad had a Merrill Lynch stockbroker. He helped my dad pick stocks and he put the orders in. That world has changed, obviously,” Hassan says.

What’s new, perhaps, is the depth and speed of recent change.

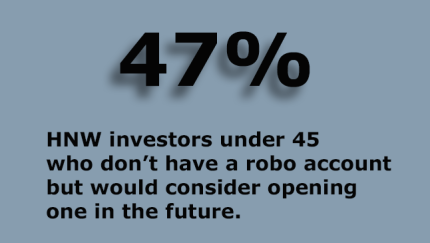

Robo advisers have been one of the key catalysts spurring on the industry’s evolution. Although the first wave of digital startups initially focused on clients with relatively small asset levels, the technology was soon successfully picked up by some traditional industry stalwarts.

Charles Schwab’s robo platform, called Schwab Intelligent Portfolios, had $10.2 billion in AUM as of Sept. 30, up from $4.1 billion a year ago, according to the firm. In total, Schwab has $2.73 trillion in client assets. The success of robos has caught the attention of other firms, and there are now a number of brokerages and banks with plans to launch automated investing platforms this year or next.

Some will be standalone offerings available directly to clients, such as that of Bank of America Merrill Lynch. The bank will offer its robo to clients in the first quarter of 2017 and charge a 0.45% annual fee, according to a spokeswoman. The robo, dubbed Merrill Edge Guided Investing, will have a $5,000 minimum, and is being developed in-house.

Other firms, such as UBS and RBC, have partnered with outside developers to create robo offerings that will be used in conjunction with their advisers. Singh says he’s seeing wider adoption of a hybrid offering.

“Digital plus is overwhelmingly winning in the marketplace in terms of what people want in the future. And we see that in terms of what offerings are coming out,” Singh says. “All the traditional players have the bench, the training and the compliance to do that.”

“I would be hard-pressed to think of a bigger priority than this,” says Andy Saperstein, who is one of two co-heads of wealth management at Morgan Stanley

Morgan Stanley’s robo plans fall somewhat into this latter camp. Although the firm didn’t want to go into too much detail on its forthcoming automated investing platform, it will be made available in 2017, leverage Morgan Stanley’s research capabilities and be offered primarily through its advisers.

“Our expectation is that our offering will be as good as if not better than Merrill’s offering,” Saperstein says.

But, as executives are quick to point out, digital is more than a robo.

“When the press says digital, they mean robo. What we are doing is far more than that. We are trying to use digital to support the FA and client relationship,” Hassan says.

She adds: “We want to make sure our financial advisers have all the tools that are in the marketplace, and are never on their back foot and have to say, ‘Yes we know you can get that elsewhere but you can’t get it here at Morgan Stanley.’”

Hassan says her efforts have been focused on providing more scale to FAs, identifying new opportunities to serve clients and improving efficiency in general.

“It takes too long to get the basics done, such as authorizing a wire transfer or opening an account,” she says. “Everything we do has to be at the pace at which people are managing their lives.”

Executives are also quick to note that client expectations are increasingly being set at a higher bar by other industries. Morgan Stanley is exploring ways to improve upon the client’s experience when interacting with the firm, from opening accounts to reviewing their portfolios to completing transactions.

“Currently, it takes 65 different fields that an adviser or his/her assistant has to fill out to open a new account,” O’Connor says.

Improvements on the client experience can also be driven by having better tools in the hands of advisers, executives say. The pilot program Cuvin is engaged in, along with other advisers in San Francisco and New York, is an example of how Morgan Stanley is trying to do that. The technology, if successful and adopted across the firm, could dramatically improve adviser productivity by making easier to find new ways to serve clients.

“Instead of having the FA hunt for these opportunities, we tee it up and make it easier for them to take action on it,” Hassan says.

And executives, pointing to the firm’s banking and lending services as an example, note that there can be a beneficial feedback loop when the firm can show clients how it can meet an ever broader range of their needs.

“Clients who do their banking and lending here do 10% more business on the wealth management side,” says Eric Heaton, head of the firm’s private banking group.

Blockbuster industry deals and unforeseen shifts in client attitudes are altering future forecasts for digital advice.

WHAT THE CLIENT WANTS

Morgan’s core client base consists of high-net-worth individuals. The sweet spot, an executive says, is a client over the age of 50 and with $1 million or more in assets.

“We’ve done a lot of work over the past several years on where the money is actually going,” says Jed Finn, COO of Morgan Stanley Wealth Management. “Despite all the hype and discussion around millennials and intergenerational wealth transfer, and while that is occurring, we think the timeline for that is much longer than is thought.”

Though digital is often synonymous with youth, the firm’s technology projects are critical to its future success due to the growing appeal of digital offerings to all clients.

“When you take the high-net-worth client, they may have a different lens on risk-taking and, generally, their portfolio may contain different investments. They may not be in a place for a standardized robo solution. So there is a role for an adviser there,” Singh says.

But, he adds, when it comes to the user interface, even high-net-worth clients will want to interact with their wealth in digital ways. “They’ll want to look up reports, see renderings or projections that take it out in the future — they’ll want to do all that in a digital way, and maybe on their phone or tablet.”

Wealth management leaders are aware of this shift. Several Morgan Stanley executives say they see outside companies, such as Uber and Apple, setting new expectations for customers in terms of the accessibility and ease with which they can use those services.

“That’s merging with how we provide capabilities to our clients. We look at different client age groups and segments, and the adoption of technology goes across all those groups,” Chris Randazzo, chief information officer at the wirehouse, says.

Randazzo adds: “We see it with our mobile app. We have more and more adoption amongst our current client base.”

To meet the challenge and opportunity represented by technology, Morgan has been upping the resources it devotes to this area. For example, Randazzo says he oversees more than 4,000 employees, a number that has grown by about 1,000 over the past three years.

‘DIGITAL IS NOT EVERYONE GETS AN EMAIL’

Big data is another area to which the firm’s executives look to boost efficiency.

Jeff McMillan helps oversee a team of more than a 100 individuals working on big-data applications intended to assist Morgan Stanley advisers in serving clients holistically. He has been with the firm since 2009, but his current role as chief data officer of Morgan Stanley Wealth Management was created about six months ago.

“What we are effectively in the process of building is a whole analytical framework that will be the most advanced in the industry. We are looking at historical client behavior, their goals and objectives, and looking at the advisers’ behavior and objectives,” says McMillan, who reports directly to O’Connor and Saperstein.

The tools his team are developing may help advisers look at their books of business in new ways, he says. There are more than 60 ongoing active data-analysis projects looking at client and adviser behavior in order to identify how to create better client outcomes.

“Digital is not everyone gets an email. Digital is about creating capacity,” McMillan adds.

His team is also looking at ways to use advances in artificial intelligence, language processing and cognitive learning techniques. Their efforts may sound like science fiction, but the objective is simple: Give advisers more opportunities to identify and serve needs.

“The single most powerful thing that drives customer satisfaction is when advisers engage with their clients,” McMillan says.

PRACTICE PERFECT

Singh says that, because clients increasingly “trust the algorithm more than the person” when it comes to investment allocations, the role of the adviser has to evolve.

Indeed, one could also say that the way the industry delivers for the adviser also has to change.

Among the wirehouse’s other projects that go beyond robo are efforts to build a new client data hub and to integrate financial planning tools in new ways into the adviser desktop.

“We’ll have the ability to get really rich, meaningful content right on the advisers’ desktop,” O’Connor says.

Jim Tracy, head of the wirehouse’s Consulting Group, says the firm will be rolling out online practice management modules, which advisers can customize to their own agendas. The modules last about 30 to 45 minutes each.

“Literally, every two weeks, we’ll be hosting webinars, and advisers can do it at their own pace or do it around the modules we built,” Tracy says. “It’s based on the future model, on what the business will look like over the next five years, not what it looked like five years ago. So it’s all fresh content.”

Tracy, who has been with the firm since 1988, notes that most training in the industry is done in person.

“If you think about the magnitude of training 16,000 people across the country … this allows us to continue to do that, but now all 16,000 advisers have access to the same resources, same content, and they can access it on their own time,” he says.

Automated investing platforms are making it tougher to charge for some financial advice, says Tiburon Strategic Advisors.

BETTER ARMED, YET FEWER ADVISERS?

Morgan Stanley isn’t alone in striving to leverage technologies to gain more efficiencies for its advisers. And the move among some firms may also be driven by a desire — perhaps a need – to buttress a shrinking adviser force.

The industry’s ranks have been grayer for years, and training programs are smaller than they used to be — meaning there are fewer young advisers to take the place of their retiring elders. But a tech-enabled adviser might one day be able to serve the same number of clients that once took the effort of two advisers.

“Will the industry shrink? Absolutely,” Alois Pirker, research director at Aite Group, says. “But is everyone equally affected by it? No. I think the shrinkage will be higher in other parts of the industry.”

Pirker notes that wirehouse advisers have actually become more productive even as the industry’s overall ranks shrink.

“There’s a high-end group of professionals serving their clients. But the narrowing will continue, and technology will play a role there,” he says.

Singh is even more categorical about the shrinkage of adviser ranks: “That’s absolutely going to happen. The logic here is that the technology will streamline things like it has in other industries.”

Morgan Stanley’s leaders do not anticipate any significant shrinkage of their nearly 16,000-adviser force. Privately, some executives acknowledge that the industry may shrink further even while serving more clients in more ways.

“What you might also have is bigger teams with more specialized roles within the teams,” Saperstein says. As you are serving clients across the breadth of their needs, you’ll have alts specialists, lending specialists. You’ll have maybe advisers that are just good at the tools and technology. There are different ways that this could evolve.”

“Digital is not everyone gets an email. Digital is about creating capacity,” says Jeff McMillan, chief data officer of Morgan Stanley Wealth Management

STAYING AHEAD OF THE CURVE

When O’Connor joined the firm in 1984 as a young college graduate, Morgan Stanley had about 1,000 employees. “It was a pretty tiny business back then,” she says.

She notes the many ways in which the industry has evolved, from transactional brokers to financial planners concerned with holistic wealth management. But even as the business changes, she emphasizes that the core mission hasn’t.

“In 1984, one of the first things I heard, maybe the first week, was that Morgan Stanley does a first-class business in a first-class way. That has stuck with me,” she says.

To keep doing that, the firm needs to help advisers adapt new technologies to their practices, executives say. Like engineers tweaking a rocket, each new technology, app or desktop function will boost an adviser’s performance and lead to more-satisfied clients.

Morgan may develop some of this in-house and may leverage existing technologies developed elsewhere, but the goal will be to stay ahead of the curve from a technology perspective, O’Connor and Saperstein say.

“Like every industry out there, things are evolving quickly,” Saperstein says.