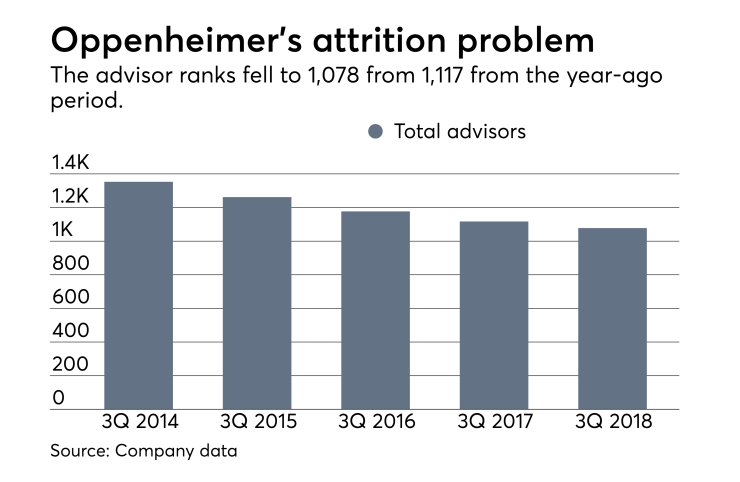

When Ed Harrington takes the helm of Oppenheimer & Co.’s private client group next year as part of its leadership change, he’ll be overseeing a shrinking advisor force.

Head count dropped to 1,078 advisors at the end of third quarter, down from 1,117 for the year-ago period. That figure is also down from 1,177 for the third quarter of 2016 and from 1,262 for the same period in 2015.

Oppenheimer has said its focus on advisor productivity has resulted in attrition of lower producing brokers. A spokesperson did not return a request for additional comment.

While the number of advisors shrank, revenue for the firm’s private client group has grown, increasing 7.2% year-over-year to $158 million, according to Oppenheimer's Oct. 26 earnings report. The firm attributed the bump to increased advisory fee revenue and higher fees earned on client deposits.

Pretax income for the private client group grew at a slower pace, increasing 1.8% to $37.6 million.

At $86.9 billion,client assets under administration were unchanged compared to the same period last year.

On Oct. 22, the company announced that Harrington would replace Mark Whaley as executive vice president overseeing its private client group. Whaley is retiring and the leadership change takes effect Feb. 1.

The crash of 2008 was intense but, in hindsight, short-lived. Market gains began a few months afterward and have continued with few exceptions.

Harrington has been serving as the firm’s head of sales and marketing for its asset management business. During his 25-year tenure with the company, Harrington has helped implement new product capabilities and investment management distribution efforts across 92 retail locations, according to Oppenheimer.

CEO Bud Lowenthal said in a statement that Harrington’s expertise made him a good fit for the position. He'll be expected to “recruit the next generation of advisors and continue to move the business forward.”

Companywide, the firm reported net income fell about 35% to $5 million. Oppenheimer attributed the drop to losses on auction rate securities and higher compensation costs. Revenue rose 5.1% to $237 million but expenses grew at a faster clip, rising 7.6% to $230 million.