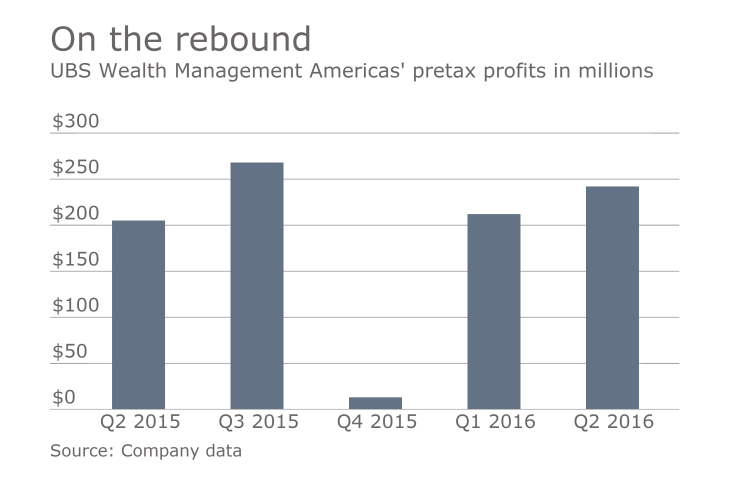

Pretax profits soared 18% to $242 million at UBS Wealth Management Americas, driven by growth in lending and cost cutting, the company reported on Friday.

Lending and banking products have become a more important part of the business mix at the wirehouses and other firms, which are increasingly relying on them to boost wealth management profits.

UBS' net interest income rose to $357 million from $301 million for the same period a year ago, an increase of 19%. Total operating revenue for the quarter fell 1% year-over-year, dropping to $1.9 billion.

Other firms have reported similar increases. Morgan Stanley said interest income for its wealth management unit climbed 18%.

The growth in this area of the business has become even more important this year as asset growth has stalled at many firms, in part due to market volatility and client nervousness. Client asset growth at Morgan Stanley was flat. At Bank of America's wealth management unit, which includes Merrill Lynch, client balances actually fell 1.2% year-over-year.

-

Net revenues fell 2% in the second quarter compared to a year ago, according to the firm.

July 27 -

The wirehouse has faced a difficult business environment so far this year, and additional headwinds may be coming during the second half of 2016, top executives say.

July 20 -

Headcount at the fast-growing firm was up 327 year-over-year.

July 20

UBS said client assets increased 3%, rising to $1.127 trillion. But net new money at $2.4 billion was down compared to the previous quarter when the wirehouse reported $13.6 billion.

The adviser ranks dipped slightly, falling to 7,116 from 7,145 for the prior quarter. A spokesman for the Swiss firm said that invested assets per financial adviser hit a record of $151 million, up from $147 million for the prior quarter and $150 million for the year-ago period.

"At this stage, our job is to try and find the right risk profile for clients," says UBS CEO Sergio Ermotti.

BEATING EXPECTATIONS

Companywide, UBS beat analysts' second-quarter profit estimates and said it's on track to cut costs by 2.1 billion Swiss francs ($2.2 billion) through 2017, with CEO Sergio Ermotti struggling with a slump at the non-U.S. wealth management and securities-trading units.

Net income slipped to 1.03 billion francs from 1.2 billion francs a year ago, the Zurich-based bank said in a statement Friday. That beat the 668 million-franc average of five analyst estimates compiled by Bloomberg. Pretax profit at the investment bank, led by Andrea Orcel, dropped 48%, while the wealth management unit covering the area outside the Americas saw a 31% decrease.

"It's a challenging environment," Ermotti told Manus Cranny in an interview on Bloomberg Television on Friday. "At this stage, our job is to try and find the right risk profile for clients. Many of them want to be extremely conservative."

The wealth management division, led by Jurg Zeltner, reported a pretax profit of 518 million francs, down from 756 million francs a year earlier. Net new money at the division was 6 billion francs, down from 15.5 billion francs in the first quarter.

Some of Europe's largest banks have been hurt by volatile markets and record-low interest rates, with Deutsche Bank, Barclays and Credit Suisse all reporting a drop in second-quarter earnings. While Ermotti, 56, has achieved more than half of his targeted cost cuts through 2017, he remained cautious on the outlook, saying there's "very little visibility."

Earnings have been soft for the industry's biggest brokerages, but lending has helped bolster performance.

"On the cost side, things appear to be moving forward," said Andreas Venditti, an analyst at Vontobel with a buy recommendation on the shares. "The target is still far away, so if they make it that's certainly going to be positive."

UBS jumped 2.6% to 13.63 francs at 2:02 p.m. in Zurich. The shares have declined about 30% this year, while Credit Suisse and Deutsche Bank both lost almost half of their market value, partly hurt by a wider market selloff in the wake of the U.K.'s decision to exit the European Union.

With additional reporting by Bloomberg News.