At Wells Fargo, the losses keep mounting.

Jack Hafner, an advisor who was

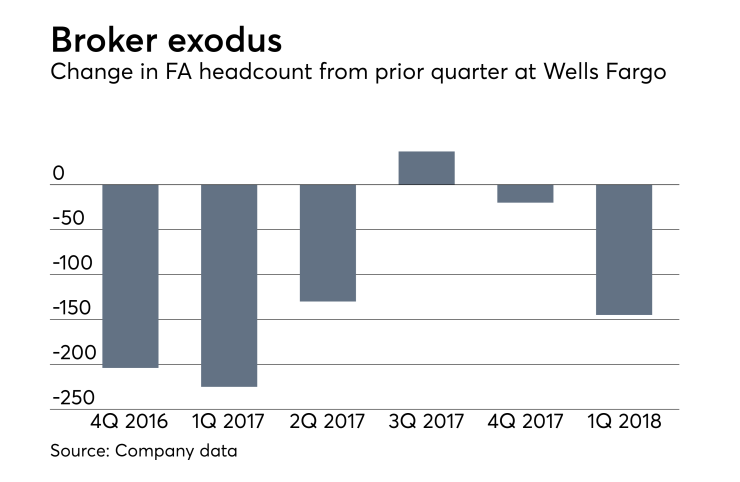

Wells Fargo has been suffering from advisor attrition, as brokers jump ship to smaller regional and independent rivals. The wirehouse's

Wells Fargo has been buffeted by scandals on the consumer banking side of its business, resulting in massive fines and penalties as well as heightened scrutiny from regulators.

Last week,

"Bad publicity affects clients' perception. That doesn't help," recruiter Michael King says.

A Wells Fargo spokeswoman declined to comment. The company has previously stated that recruiting remains a top priority and that Wells Fargo has had strong revenue growth and a robust pipeline of new trainees.

"We feel no need to focus on raw headcount numbers," the company said.

Hafner's departure may be a sign that Wells Fargo's attrition problems are reaching into the elite ranks. Hafner came to the wirehouse through an exclusive deal Wells Fargo reached with Credit Suisse, which encouraged brokers at the Swiss firm to transition their practices to Wells Fargo (Credit Suisse exited the U.S. market in 2016).

One of the biggest notable losses came from Merrill Lynch, which lost a team managing $1 billion to the independent space.

Hafner, who has past work experience at Lehman Brothers and Barclays, had been with Credit Suisse for eight years, according to FINRA BrokerCheck records. He highlighted J.P. Morgan Securities brand and intellectual capital as reasons he made the career switch.

"Over the past two decades in the industry, I have found that a boutique culture like that at JPMS is best for serving my clients. Many high caliber advisors have joined JPMS over the past 18 months, and I am excited to join the ranks," he said in a statement, referring to the firm's aggressive recruiting efforts.

Last year, J.P. Morgan Securities picked up about three dozen advisors managing more than $13 billion in client assets, according to hiring announcements.