Expenses for retirees are increasing faster than their Social Security benefits.

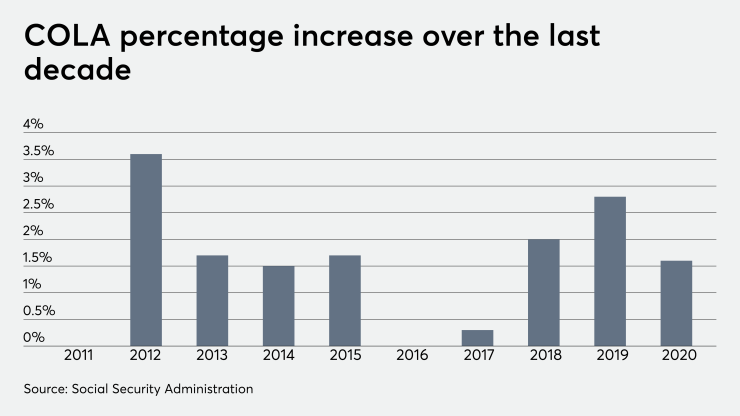

While the Social Security Administration announced a 2020 cost-of-living increase of 1.6%, retirees will pay, on average, 5.6% more next year for health care insurance premiums alone, according to the National Active and Retired Federal Employees Association. The COLA annual increase is the smallest since 2017, when it was 0.3%. Last year, the administration boosted COLA by 2.8%.

“Retirees disproportionately incur greater medical costs than any other segment of the population,” according to NARFE National President Ken Thomas.

This latest adjustment means that, on average, Social Security retirement benefits will rise by $24, to $1,503 per month. The cost of Medicare B will rise next year by an average of $8.80. Because the cost is automatically deducted from clients' benefits, the average retiree will only see an approximate $15 increase in benefits says Bill Meyer, managing principal of Social Security Solutions.

To compensate for possible income shortfalls, planners should be realistic about how much clients are really spending, according to Bill Meyer, managing principal of Social Security Solutions. To that end, he recommends applying different discount rates and inflation factors retiriees portfolios so clients' spending would appear to be rising faster than Social Security so it mirrors real life.

“Doing general financial planning, where you're not able to change the inflation or discount rates, could cause you to make errors,” says Meyer. Instead, planners should undertake detailed annual spending analyses for their clients. These analyses are more effective if they use an index more closely aligned with the reality of the senior clients' cost of living, he says. One such index is the CPI-E, or the Consumer Price Index for the Elderly, which factors in medical care, services, commodities and health insurance. This is a more accurate representation for some clients than the CPI-W which does not account for retiree-specific expenses such as prescription medications, healthcare costs and housing.

Prices rise for seniors by 0.2% more, on average, than for the population measured by the CPI-W, according to a release from the National Active and Retired Federal Employees Association.

“The CPI index used to calculate the Social Security inflation could be better for retirees if [advisors] use the CPI-E,” Meyer says. “The result is that that COLA tends to be lower and the increase doesn't cover as much of the spending for retirees.”

Benefits payable to Social Security beneficiaries will begin Dec. 31.