(Bloomberg View) -- I begin today’s column with a mea culpa: I have been expecting the imminent death of the brokerage industry for about 20 years. This is something I have been dead wrong about.

Since the mid-1990s, I have been astonished by the idea that anyone would ever buy stocks over the phone from a cold-calling stranger; I couldn’t believe that anyone would find the large advertising campaigns for expensive products persuasive; or that something as important as saving for buying a home, or paying for your kids’ college or even retirement could be treated so cavalierly.

Despite my insistent warnings, brokers have ― wisely as it turns out ― ignored my entreaties over those decades to move away from a commission-based model and toward a fee-based one.

I have since wised up.

A combination of years of experience and a deep, decades-long dive into behavioral finance has provided lots of insight into the way investors operate. Emotions remain a powerful driver of investor behavior, and very good sales people know precisely how to use this to their advantage.

I was reminded of this courtesy of a

"Wall Street’s brokerage model is under assault—from within. A growing number of brokers, disillusioned with pay hurdles and strict corporate cultures at the so-called wirehouses, are taking their billions of dollars under management and going independent. In doing so, many also say they are pursuing more control over their practices and a higher standard of care for clients that focuses more on service and less on pitching proprietary products."

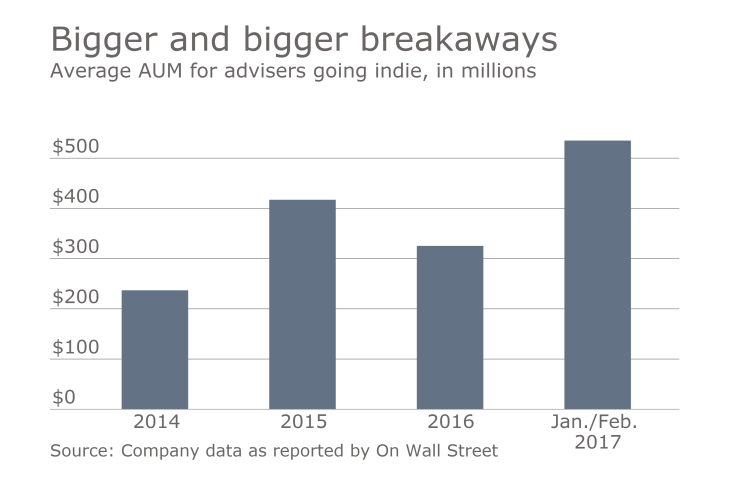

The data is pretty discouraging for the traditional brokerages: In 2010, they had about 63% of what the Journal calls “the advice market.” By 2015, that had fallen to 59%. At the same time, RIAs saw market share gains from 37% to 41%. The Journal article cited a forecast by Cerulli Associates that independent advisers will control more assets than the major brokerage firms by 2020.

The firm isn't the only one benefiting from a still strong breakaway movement.

This isn't an especially new phenomena ― money has been flowing from the brokerage side of the street (with its suitability standard and mandatory arbitrations) toward the RIA side (a fiduciary relationship).

Indeed, this change has been taking place within the big wirehouses themselves. As of 2014, 37% of Morgan Stanley Wealth Management’s assets were in fee-based RIA accounts, rather than commission-based, brokerage accounts. Since then, it has only gone up. Same at Bank of America Merrill Lynch’s wealth division, Wells Fargo, JPMorgan Chase and UBS.

Just a few years ago, the breakaway brokers discussed in the Journal article would have stayed put, working as RIAs within the larger brokerage firm itself. The advantages of being associated with a large organization are many, and the costs of leaving were great.

DETERMINING FACTOR

So what has changed so dramatically in a few short years to lead so many brokers to leave? Several things. The financial crisis where so many big firms almost went out of business before they were bailed out earned a them a black eye. Potential customers rightly wonder about the credibility of businesses that failed at managing their own finances. The shift toward a fiduciary standard, in which the interests of the client come first, also pressured some firms.

But perhaps the most significant factor is technology.

In past years, the most challenging part of starting an independent firm was the back-office requirements. You needed to be able to do accounting, legal, compliance, payroll, record-keeping, custodial/trade assets, manage portfolios, report performance and communicate with clients. Maybe you wanted to have a few computers in the office or build a website. All of that is before you even begin to think about marketing or acquiring new clients.

You could attempt to do all of that yourself, but you would quickly come to realize that almost all of it is far beyond your skill set. You could outsource it, but the costs would exceed the revenues of all but the largest startup firm.

Nearly two-thirds of advisors surveyed this month said that internal training programs or workshops were offered by their firms.

Virtually every major firm on Wall Street has joined the push into private markets, with many trying to get in early on the biggest "next big thing" to hit financial services since the exchange-traded fund.

Traci Parks has been a copy editor at American Banker since 2023. She's worked at Scholastic National Partnerships and many fashion magazines, including V Magazine where she was also a contributing writer. As a playwright, her work has been produced in New York, Seattle and Los Angeles.

Or, you could simply deploy the modern tools that the field of financial technology has put at the disposal of those in the business of offering advice. What used to be a complex and expensive barrier to entry for independent RIAs has now become much simpler and cheaper. It is reasonable to assume that we will see more independent shops, more breakaway groups, as the larger firms slowly see their cost and marketing advantage erode.

I will note that we have yet to see how the wirehouses will respond to this latest threat to their bottom lines. Perhaps they will figure out a way to remain competitive.

As for my long-standing prediction of the withering away of the commission-based brokerage business, my excuse is a variant of what we hear from everyone who makes a money-losing trade: “I wasn’t wrong, I was just early.” In this case, though, the business really is slowly heading in the direction I forecast so long ago.