-

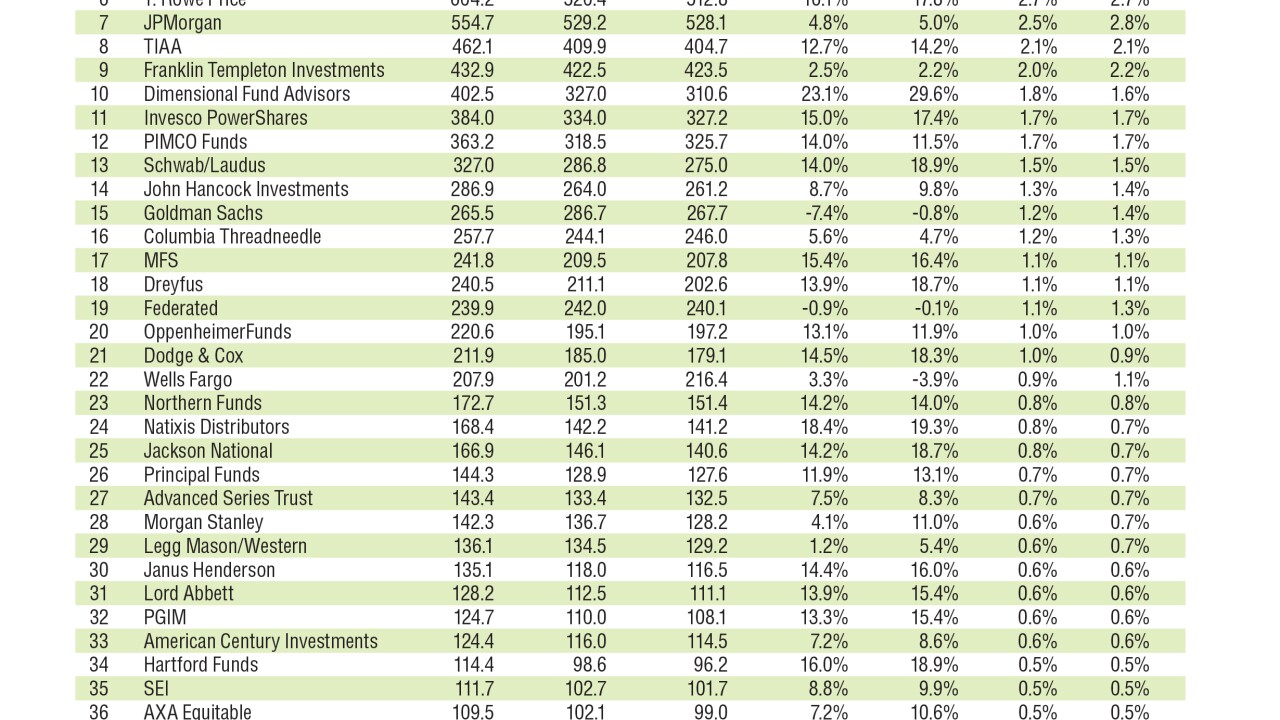

Data reported by FUSE Research.

November 22 -

Coming up with a solution will be challenging because of U.S. sanctions.

November 22 -

Nov. 20: Security, ease of workflow and the ability to work across platforms are key features RIAs demand.

November 17 -

Following in the footsteps of Chase, Wells Fargo and others, Fidelity is launching an application programming interface to let third-party apps access customer data — as long as the customers grant permission.

November 14 -

Nov. 13: Planners behind the curve may lose out on productivity and quality of service offered to clients.

November 10 -

Emerging markets, value and small-cap funds dominate the list, but other factors need to be considered, as well.

November 8 -

Positioning clients to weather market volatility and potential correction has become a top concern.

November 7 -

The firm recently dismissed two portfolio managers due to inappropriate behavior.

October 27 -

Oct. 30: After experiencing two major bear markets, younger generations are demanding products that are easy to understand and offer transparency.

October 27 -

The funds gained an average of 13.3% a year over the past decade, which began before the financial crisis.

October 25 -

Oct. 23: The custodian plans to offer advisors and retail investors access to 296 commission-free ETFs.

October 20 -

Data reported by FUSE Research.

October 20 -

In price wars wars, the firm bolts ahead in the race to zero by nearly tripling its roster of commission-free funds.

October 19 -

The manager’s third quarter revenue topped analysts’ expectations thanks to its iShares business.

October 19 -

Various measures of what constitutes cash can produce different analyses. This list uses net cash positions at the largest funds.

October 18 -

Frequent buying and selling increases expenses and taxes — are these solid three-year returns worth it?

October 4 -

These investments offered better returns than the broader fixed-income world in recent years, but the risk/reward equation leans heavier on risk.

September 28 -

While the SEC does its due diligence into the new European rules, some of the world’s largest money managers have started to make independent decisions.

September 25 -

All posted positive returns over five years, but active saw the largest outflows.

September 20 -

Clients will flock to digital advice, but conditions favor incumbent firms, a study found.

September 18