-

State Treasurer John Chiang says that Wells Fargo is keeping patterns of abuse hidden from view by resolving customer disputes through private arbitration.

August 23 -

The proposals failed to show how exchanges would “prevent fraudulent and manipulative acts and practices," the commission said.

August 23 -

The firm "deprived its clients of unbiased financial advice," the regulator says.

August 21 -

Here's what I've realized since I penned my original missive to the commission.

August 17 Financial Planning

Financial Planning -

Five fired and barred former registered reps stole more than $1 million from clients over a four-year period, according to the regulator.

August 15 -

The SEC, wary of bringing crypto to the masses, postponed a decision last week from VanEck and SolidX and rejected a proposal from the Winklevoss twins.

August 14 -

The advisor used about $410,000 to pay back investors in Ponzi-like fashion to keep the scheme alive, the regulator says.

August 10 -

State Street and Goldman Sachs are planning a series of funds that would invest in everything from robotics to deep-sea exploration.

August 9 -

"The process has become enervating and exhausting and to the point where you don't even want to look at it anymore," an expert says.

August 9 -

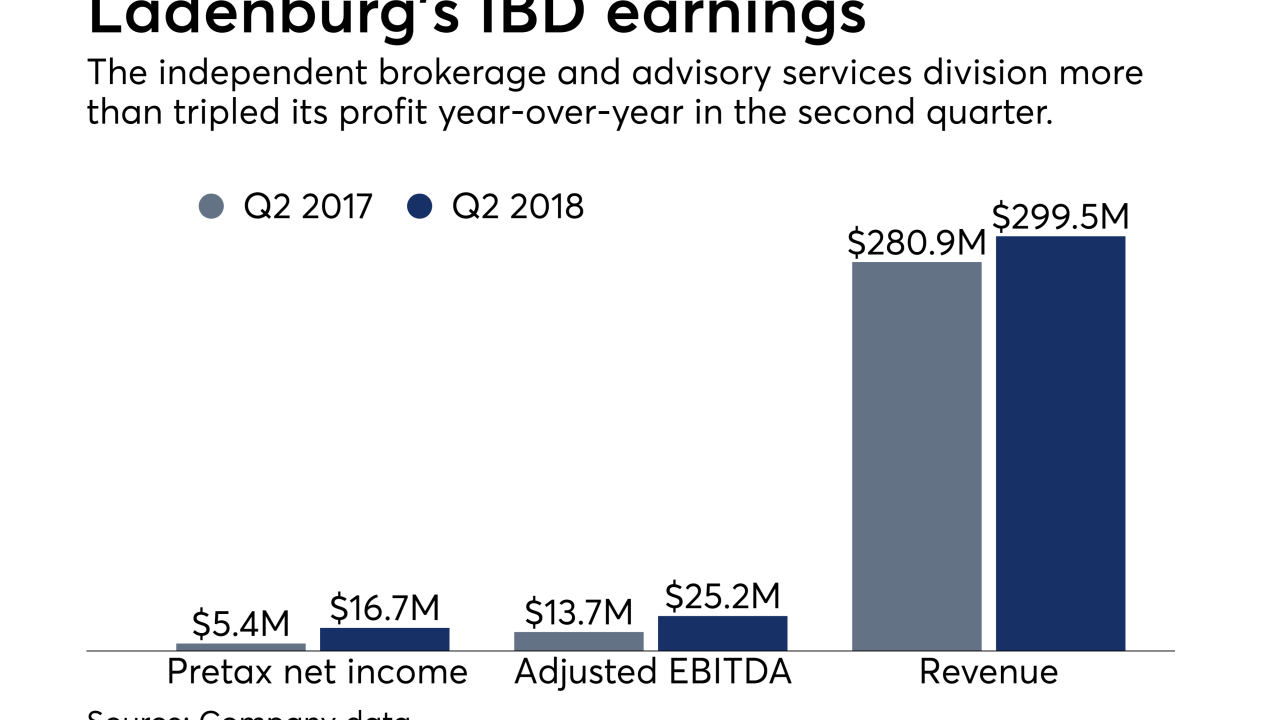

The IBD network disclosed the renewal of its clearing agreement, along with three firms’ intention to self-report possible mutual fund violations to the SEC.

August 8 -

An overreliance on disclosure isn't enough to protect clients from bad brokers, the investor advocacy group says.

August 7 -

It's not too late for the the SEC to fix its flawed proposal before it issues its final rule, says the Democratic senator from Massachussetts.

August 6 -

The commission’s draft fails miserably as a consumer protection measure for the public and actually makes matters worse.

August 3 Moisand Fitzgerald Tamayo

Moisand Fitzgerald Tamayo -

The SEC called into question the ability of the cryptocurrency’s exchanges to sufficiently police trading.

July 27 -

George L. Taylor and Temenos Advisory violated their fiduciary duty by pocketing commissions and concealing conflicts while the firm was in financial distress, the commission charges.

July 26 -

At least 17 individuals invested $13 million in the scheme, and many lost 'substantial portions' of their life savings, prosecutors say.

July 26 -

The funds allegedly paid for summer camp fees and a 1976 Corvette.

July 25 -

The broker forged client signatures on annuity withdrawal requests and misled clients into making what they thought were tax payments, the SEC claims.

July 20 -

The proposal would lay out formal steps for setting up less-complicated funds.

July 19 -

The industry is imagining more vibrant, more agile and more inclusive processes that deliver results, says Confluence CEO Mark Evans.

July 16 Confluence

Confluence