Wells Fargo

Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

-

Other banks, including Bank of America, Citigroup, JPMorgan Chase and Wells Fargo, have yet to resume giving to federal candidates or committees.

July 9 -

The stress tests used to trigger anxiety across Wall Street, but the banks’ solid showing underscores how comfortable the industry has grown with the exercises.

June 29 -

The California team wanted to keep serving international clients after the wirehouse elected to focus on domestic wealth management.

June 24 -

The advisors went independent in part because Wells Fargo halted its wealth management business outside the U.S. earlier this year.

June 23 -

Julie Caperton, a longtime executive at the $1.9 trillion-asset bank, succeeds Julia Wellborn, who left the company in April.

June 18 -

Records obtained by Financial Planning detail dozens of worker safety complaints related to COVID. But the problem could be as much about employee relations as it is about the pandemic.

May 27 -

Senator Elizabeth Warren and other critics plan to ask whether banks are prioritizing buying back stock and rewarding employees over supporting the real economy.

May 24 -

The advisor, who is Egyptian American, lost most of his client accounts to a white rep who poached them with support from management, a new lawsuit claims.

May 20 -

Ta is aiming to reduce turnover at Wells Fargo Advisors by revamping the succession planning program.

May 5 -

Profits slumped last year and many investors are now voicing their displeasure with the compensation awarded to senior leaders. A nonbinding “say on pay” vote taken Tuesday passed narrowly, but Chairman Charles Noski indicated that the board will take the results into account when designing future pay packages.

April 27 -

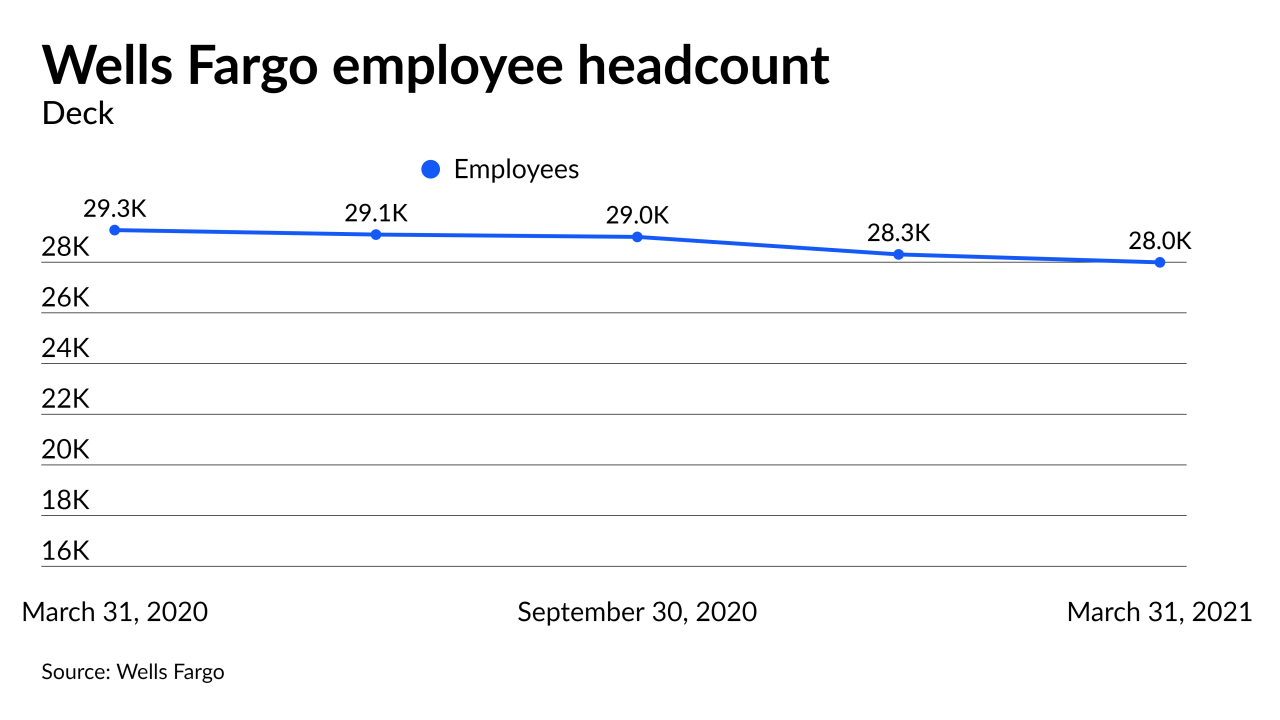

A net 236 brokers left the wirehouse in the three months ending in March, the company said in its latest quarterly report.

April 14 -

Lisa Quadrini had worked with the practice during her earlier tenure with Merrill Lynch, and she’s now launching its new office.

April 13 -

The largest brokerages typically make comp changes that are ‘evolutionary, rather than revolutionary.’

April 7 -

“The name may change but our commitment to the business, our clients and our advisors serving these clients is steadfast,” said division head Barry Sommers.

March 12 -

The bank had nearly 270,000 employees at the end of last year.

March 5 -

The unit has $603 billion of assets under management and employs more than 450 investment professionals.

February 23 -

The bank is winding down the roughly $40 billion international segment of its wealth management business.

February 8 -

Net interest income, the firm’s biggest source of revenue, sank 16% last year.

February 1 -

“As of today, Wells Fargo Advisors is not allowing solicitation of those two securities,” a spokesperson for the bank said Wednesday.

January 28 -

CEO Charlie Scharf’s long-awaited expense-reduction plan got a chilly reception from investors.

January 15