What will advisors get paid this year?

It’s a perennial question particularly from wirehouse advisors whose employers make annual tweaks to compensation. Last year, the coronavirus pandemic upended expectations, forcing some firms to postpone changes made to their 2020 comp plans — but it didn’t derail what industry insiders say are the long-term trends in advisor pay: stable core grids and perpetual tweaking around the margins.

“The large companies over the past 20 years have been evolutionary rather than revolutionary,” says Andy Tasnady, a compensation consultant.

In years past, brokerages have put in place major changes, such as the move toward fee-based business models, that have affected what they pay their advisors. But there aren’t similar changes in flight this year, he says: “You’ve had evolutionary shifts like that that have kind of completed their process.”

In the near future, tectonic shifts are unlikely to shake advisor pay. For starters, there’s too much

“I think that for the major wirehouses, grids will stay where they are. Changes will be around the margin. You’ll see more behavioral modifications, rewarding advisors for growing assets and new accounts,” recruiter Mark Elzweig says.

He adds: “It’s just too competitive a world and there is just more interest in the RIA and independent channels than there ever was.”

Sometimes corporate plans get derailed thanks to external problems. Last year, several firms were forced to offer FAs compensation relief after the coronavirus pandemic wrought upheaval across wealth management.

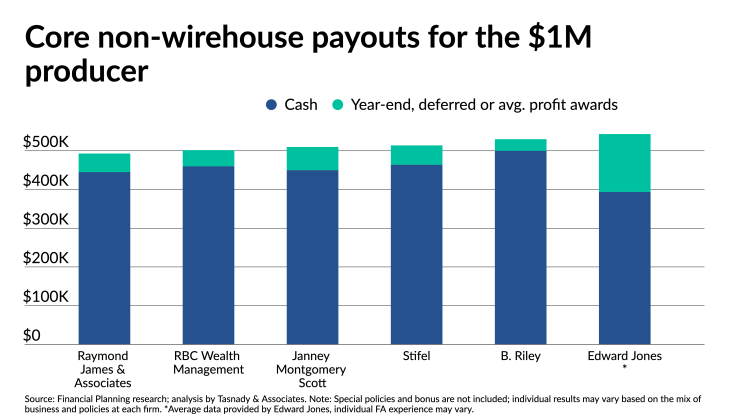

“For some firms, comp changes were deferred due to the pandemic and then went into effect later in 2020,” says Tasnady, who also helped develop Financial Planning’s annual compensation survey of wirehouse and regional and national broker-dealers.

For example, Morgan Stanley had intended on increasing thresholds on its grid below the $5 million mark by approximately 10% for 2020,

Wells Fargo had planned to tighten its policy on small household accounts last year, but held off on implementing the change because of coronavirus pressures. As part of its 2020 comp plan, Wells Fargo’s advisors were to be paid a flat 20% rate for households under $250,000. Previously, it was a flat rate for households under $100,000.

Our annual analysis of core compensation components at wirehouses, regional and national BDs.

Wells Fargo was one of a few firms to make notable changes to its 2021 comp plan, unveiling new monthly revenue hurdles to meet, some deferred compensation changes and new opportunities to earn bonuses.

Industry insiders say advisors could expect future tweaks to policies like payouts on small household accounts. Wirehouses and other large firms prefer small accounts be served by their call centers and robo advisors, where profit margins can be higher. And they’re making it easier for clients to sign up for these lower-end options;

Of course, if a company replaces its strategy or is acquired by a firm with a different operating model, it’s possible even core compensation changes could be in the pipeline for advisors.

“If their strategies change, the corresponding compensation approach might change,” Tasnady says.

But in the meantime, advisors can expect comp changes to come slowly — or not at all.