“There’s a whole class of investors that have grown increasingly fee conscious but are not willing to settle for the broader market,” says Ben Johnson, director of global ETF research at Morningstar. Strategic beta ETPs are filling the void for advisors with clients who want an active allocation without paying high fees.

The global strategic beta ETP market has skyrocketed in recent years. So far in 2017, assets have grown 18% to $818 billion, according to data from Morningstar Direct.

Competition has led to lower fees and forced strategic funds to distinguish themselves from cheaper traditional ETFs. Elisabeth Kashner, director of ETF research at FactSet, compares today’s strategic fund to “an independent bookseller trying to compete with Amazon.”

While strategic beta may be the cool new kid on the block, so-called vanilla index funds are still favored by ETF investors, with 72% of total assets. Strategic beta funds have a 22% share of the ETF market. Within strategic funds, investors favor approaches that target growth, value and dividends.

Click through the images above for more insights on the state of the strategic beta market.

Strategic beta assets have been climbing a trillion-dollar hill

But that success comes with problems for new entrants. As with the overall ETF market, the strategic space has become crowded, and fee competition is intense. “As an issuer, you are compelled to do something different,” says FactSet’s Kashner.

Competition drives fees down

“The same degree of fee pressure that you see in the bulk beta space has been spilling over into the strategic space,” says Morningstar’s Johnson.

The U.S. appetite for strategic beta dwarfs all other markets

Also, U.S.-based ETFs benefit from foreign investors, says Johnson. He estimates that 20-30 cents of every dollar invested in U.S. ETFs comes from abroad.

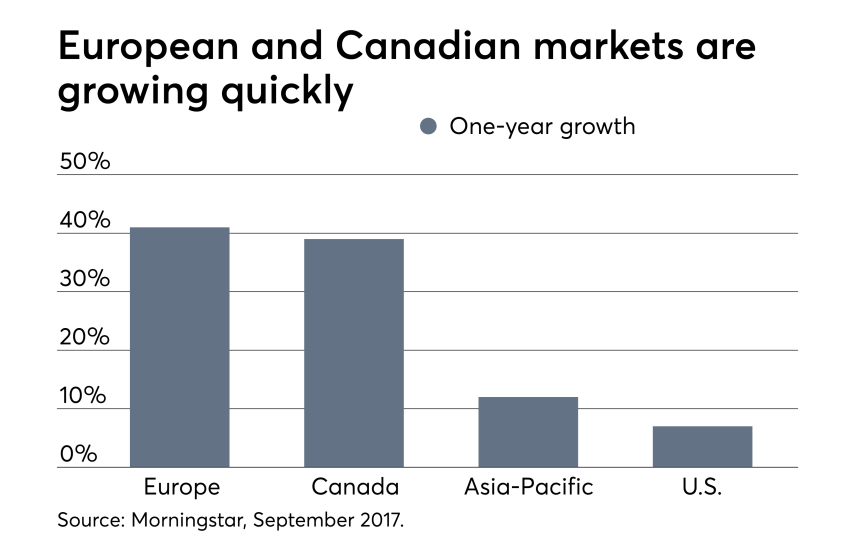

European and Canadian markets are growing quickly

The move toward fee-based advisory models in Europe and Canada may also be a factor, he adds, as brokers have less incentive to push costlier products that pay them a commission.

Investors prefer time-tested investment strategies

BlackRock and Vanguard funds lead the pack

Institutions say they use strategic ETPs for four main reasons

Nearly half of institutional investors own strategic beta

Factor allocations are expected to continue growing

In ETF war, plain-vanilla funds claim victory

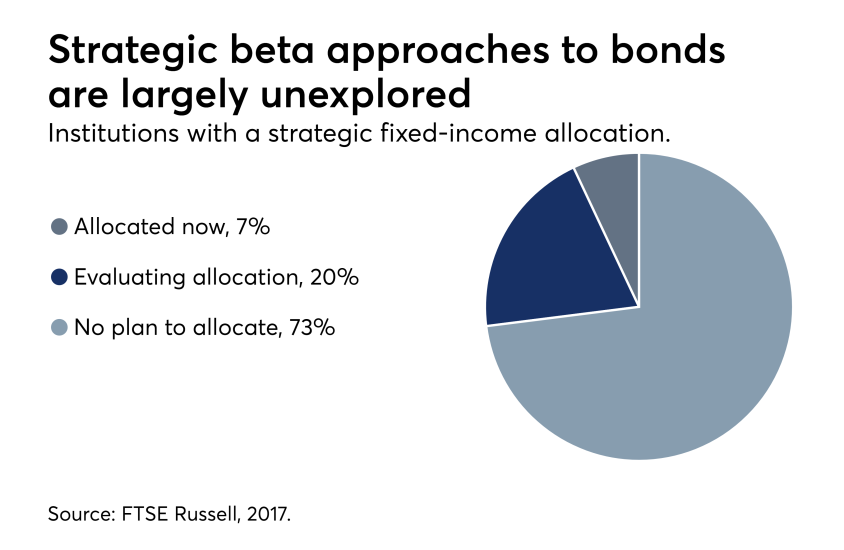

Strategic beta approaches to bonds are also largely unexplored

Another component, Kashner says, is the overall lack of time-tested options. “These are relatively newer products,” she says.