According to data tracked by Financial Planning’s exclusive annual FP50 survey, just three firms saw their assets drop.

For more in-depth coverage, please see

Data is of year-end 2016.

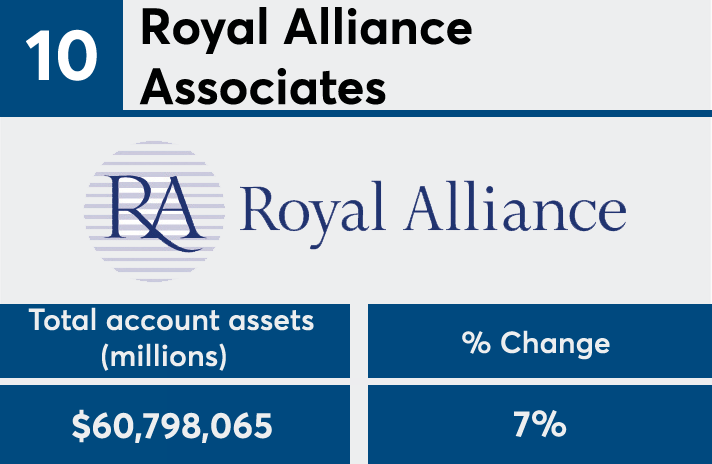

10. Royal Alliance Associates

% Change: 7%

9. Securities America

% Change: 14%

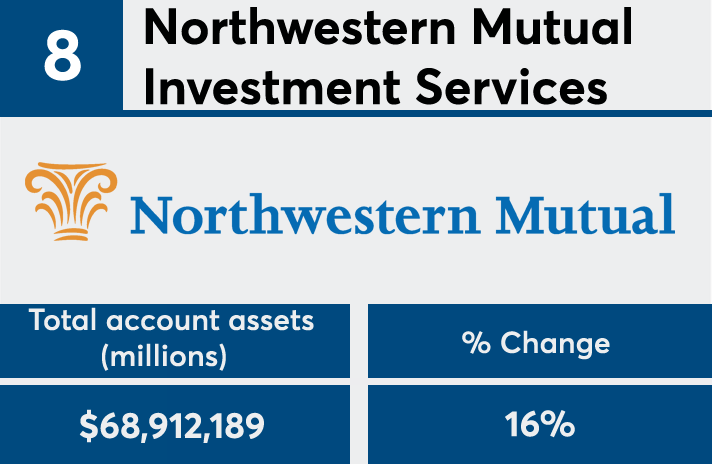

8. Northwestern Mutual Investment Services

% Change: 16%

7. MML Investors Services

% Change: 3%

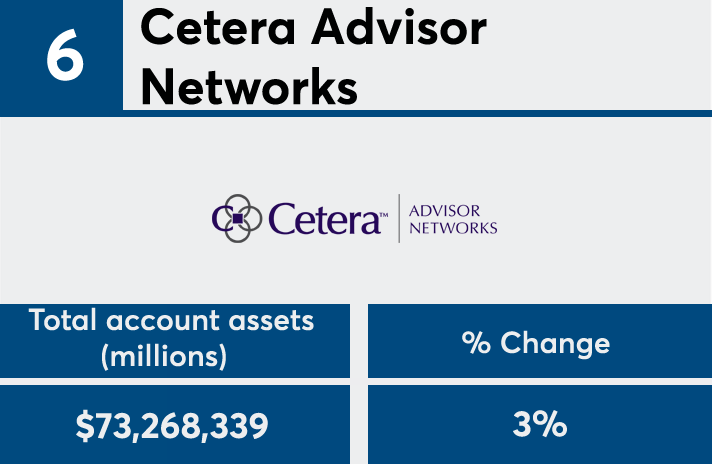

6. Cetera Advisor Networks

% Change: 3%

5. Kestra Financial

% Change: 7%

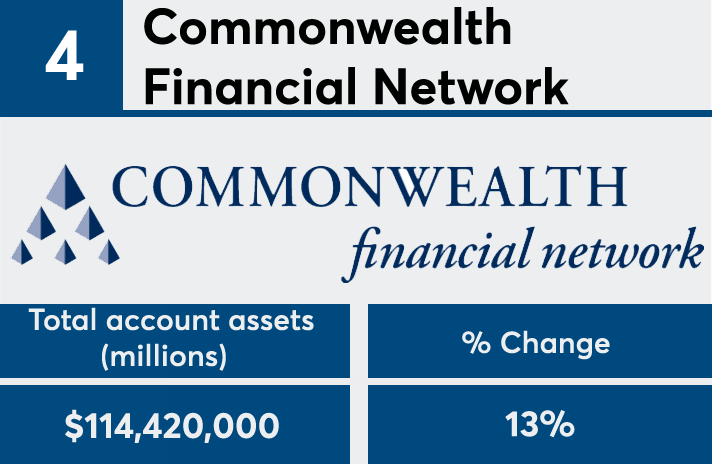

4. Commonwealth Financial Network

% Change: 13%

3. AXA Advisors

% Change: 8%

2. Raymond James Financial Services

% Change: 16.5%

1. LPL Financial

% Change: 7%