Exhibit A: John Bogle, founder of Vanguard and widely regarded father of low-cost investing, famously laid out a case that a 2% expense ratio could cost investors as much as two-thirds of their returns over 50 years, assuming annual returns of 7%.

Granted, a 2% expense ratio has become unusually high in today’s world — partly because of the investment revolution Bogle helped popularize — but his premise is still a strong reminder that high fees can be more harmful than many investors would have expected.

For cost-conscious advisors and clients, the cheapest funds these days are ETFs. Their impact can be seen in the broader investment world. Indeed, from 1996 to 2017, average expense ratios fell 67% for index equity mutual funds. Even expense ratios of actively managed equity funds declined 28% during that period, according to Bloomberg.

With the harmful effects of high fees in mind, we researched funds that posted strong performance at a low cost. We collected those funds with expense ratios of less than 10 basis points and assets of $100 million or more, then ranked them by 10-year annualized returns.

In addition to 10-year returns and expense ratios, we also show three-year returns and assets for each fund. Scroll through to see the cheapest, top-performing funds over the past 10 years. All data from Morningstar.

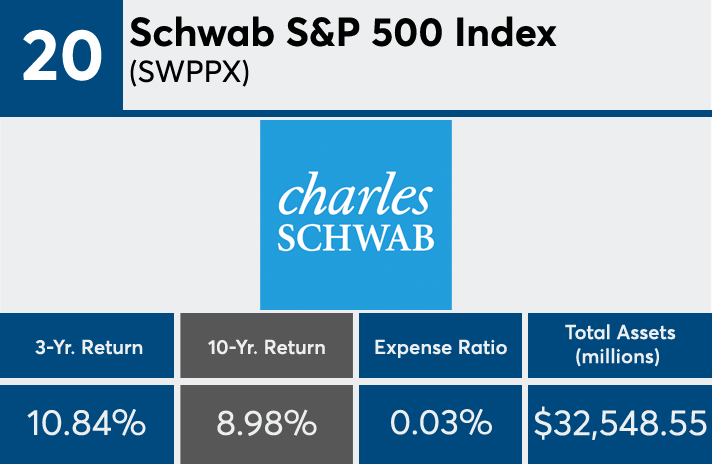

20. Schwab S&P 500 Index (SWPPX)

10-Yr. Return: 8.98%

Expense Ratio: 0.08%

Total Assets (millions): $32,548.55

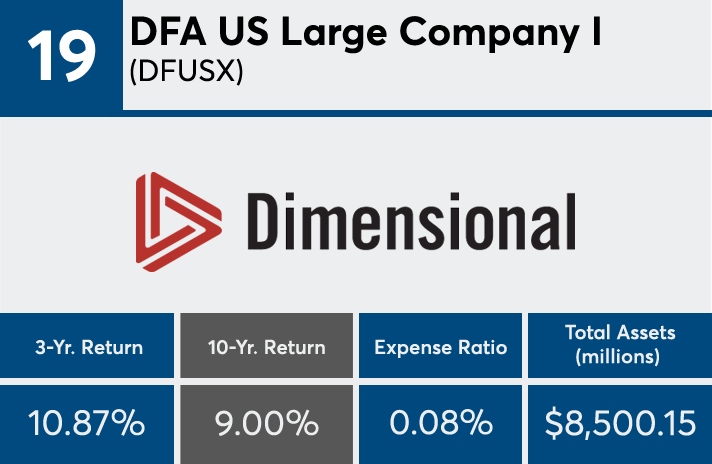

19. DFA US Large Company I (DFUSX)

10-Yr. Return: 9.00%

Expense Ratio: 0.08%

Total Assets (millions): $8,500.15%

18. Vanguard Mega Cap ETF (MGC)

10-Yr. Return: 9.018%

Expense Ratio: 0.07%

Total Assets (millions): $1,512.60

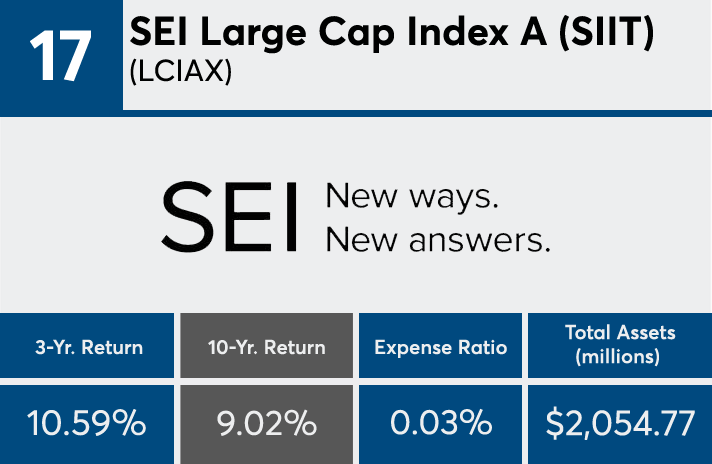

17. SEI Large Cap Index A (SIIT) (LCIAX)

10-Yr. Return: 9.021%

Expense Ratio: 0.03%

Total Assets (millions): $2,054.77

16. iShares Core S&P Total US Stock Mkt ETF (ITOT)

10-Yr. Return: 9.046%

Expense Ratio: 0.03%

Total Assets (millions): $13,809.49

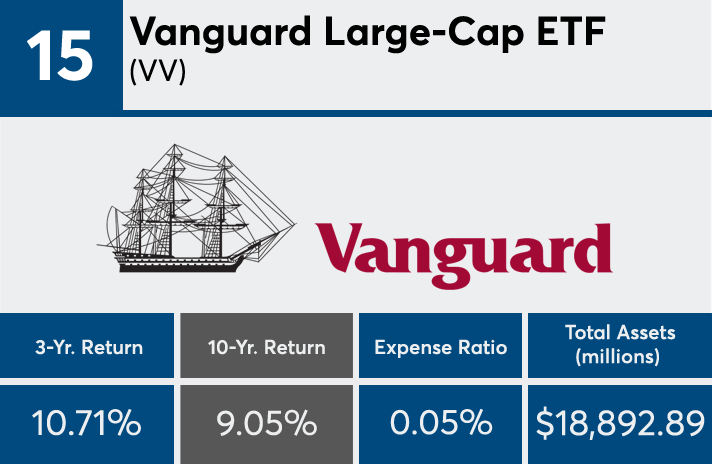

15. Vanguard Large-Cap ETF (VV)

10-Yr. Return: 9.049%

Expense Ratio: 0.05%

Total Assets (millions): $18,892.89

14. SPDR Portfolio Total Stock Market ETF (SPTM)

10-Yr. Return: 9.09%

Expense Ratio: 0.03%

Total Assets (millions): $1,986.55

13. Fidelity Total Market Index Investor (FSTMX)

10-Yr. Return: 9.12%

Expense Ratio: 0.09%

Total Assets (millions): $51,766.98

12. Schwab Total Stock Market Index (SWTSX)

10-Yr. Return: 9.23%

Expense Ratio: 0.03%

Total Assets (millions): $7,761.05

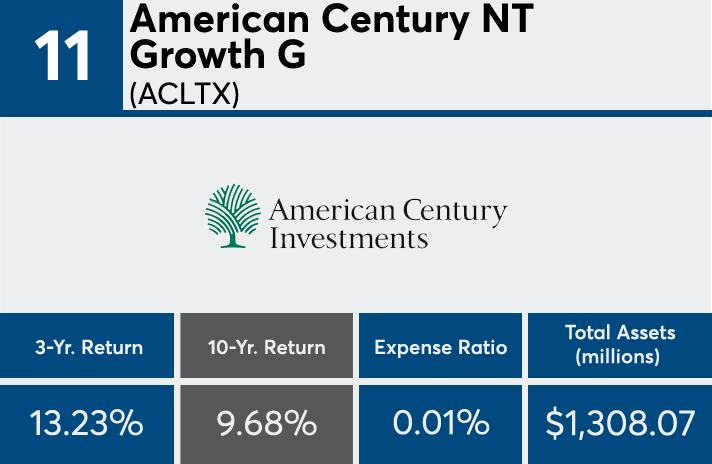

11. American Century NT Growth G (ACLTX)

10-Yr. Return: 9.68%

Expense Ratio: 0.01%

Total Assets (millions): $1,308.07

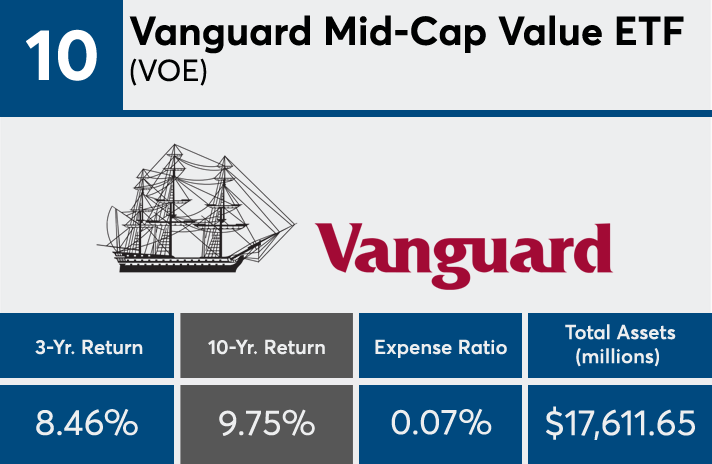

10. Vanguard Mid-Cap Value ETF (VOE)

10-Yr. Return: 9.75%

Expense Ratio: 0.07%

Total Assets (millions): $17,611.65

9. iShares Core S&P Mid-Cap ETF (IJH)

10-Yr. Return: 9.82%

Expense Ratio: 0.07%

Total Assets (millions): $46,664.76

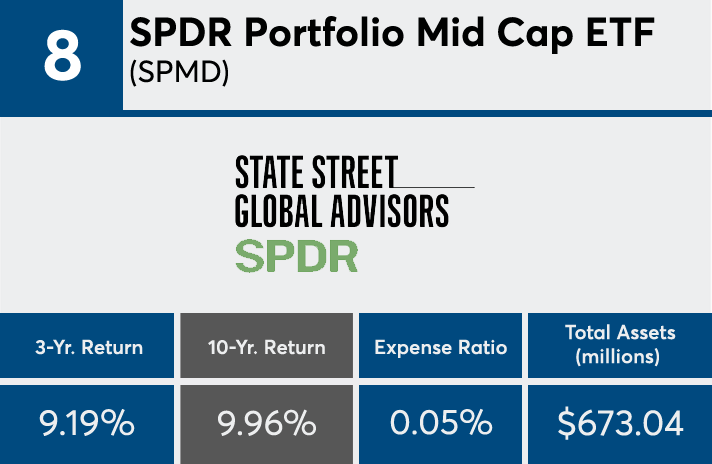

8. SPDR Portfolio Mid Cap ETF (SPMD)

10-Yr. Return: 9.96%

Expense Ratio: 0.05%

Total Assets (millions): $673.04

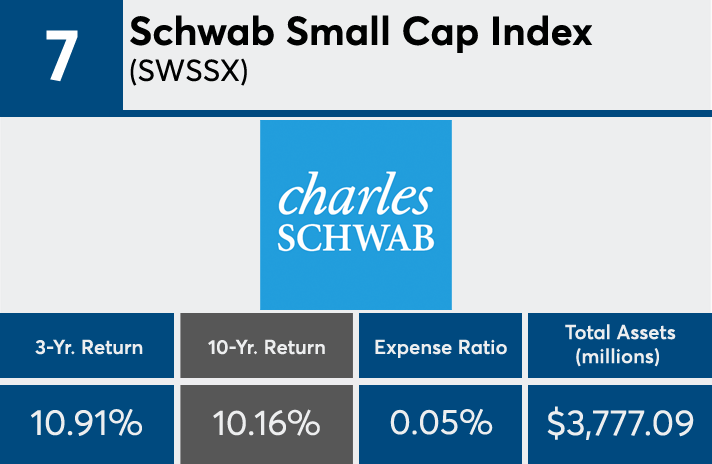

7. Schwab Small Cap Index (SWSSX)

10-Yr. Return: 10.16%

Expense Ratio: 0.05%

Total Assets (millions): $3,777.09

6. iShares Core S&P US Growth ETF (IUSG)

10-Yr. Return: 10.37%

Expense Ratio: 0.05%

Total Assets (millions): $3,997

5. Vanguard Mega Cap Growth ETF (MGK)

10-Yr. Return: 10.54%

Expense Ratio: 0.07%

Total Assets (millions): $3,591.33

4. SPDR Portfolio S&P 500 Growth ETF (SPYG)

10-Yr. Return: 10.66%

Expense Ratio: 0.04%

Total Assets (millions): $2,647.86

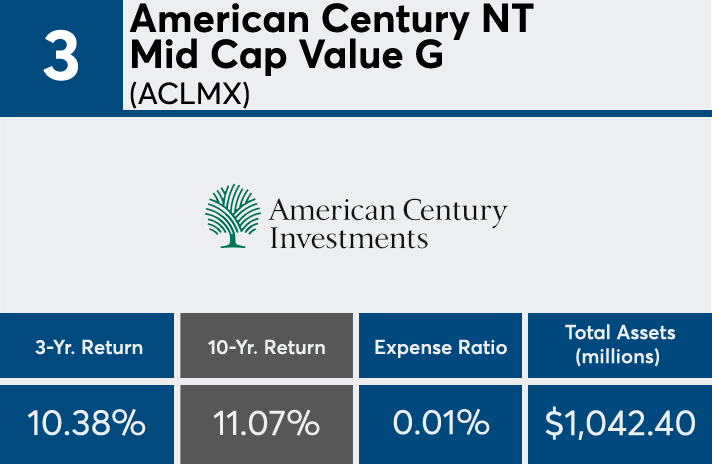

3. American Century NT Mid Cap Value G (ACLMX)

10-Yr. Return: 11.07%

Expense Ratio: 0.01%

Total Assets (millions): $1,042.40

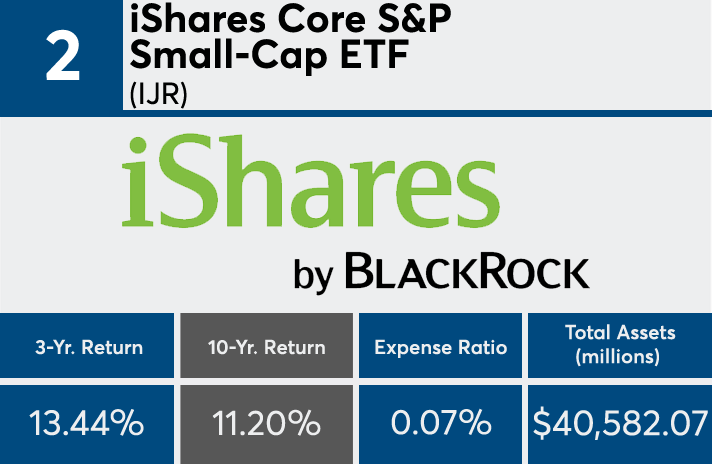

2. iShares Core S&P Small-Cap ETF (IJR)

10-Yr. Return: 11.20%

Expense Ratio: 0.07%

Total Assets (millions): $40,582.07

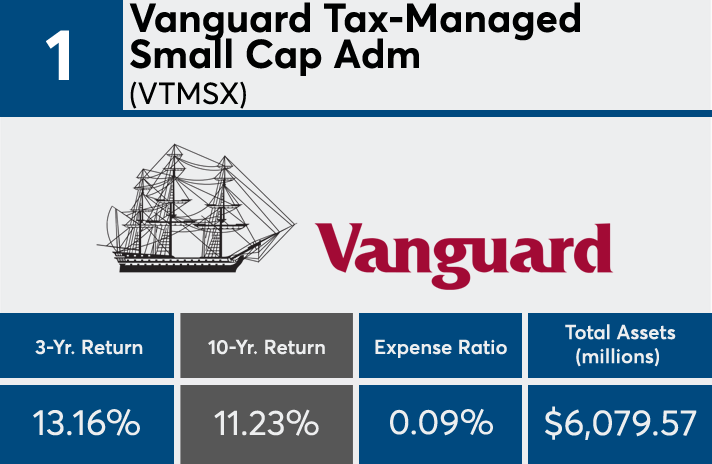

1. Vanguard Tax-Managed Small Cap Adm (VTMSX)

10-Yr. Return: 11.23%

Expense Ratio: 0.09%

Total Assets (millions): $6,079.57