Top funds: Highest returns, lowest costs

That's why we've long added expense ratios to our fund slideshows. Usually a secondary category, this time we used costs as part of the ranking by limiting our search to only those mutual funds and ETFs with expense ratios of 10 basis points or less. We also set our usual parameters of requiring at least $100 million in assets and three years of operating history. And this time, we also excluded any funds with a minimum investment of more than $10,000.

Then we ranked those ultra-cheap funds by three-year returns. The resulting list was dominated by large-cap funds, mostly ETFS and mostly Vanguard products. Scroll through to see the top names, along with returns and expenses. All data is from Morningstar.

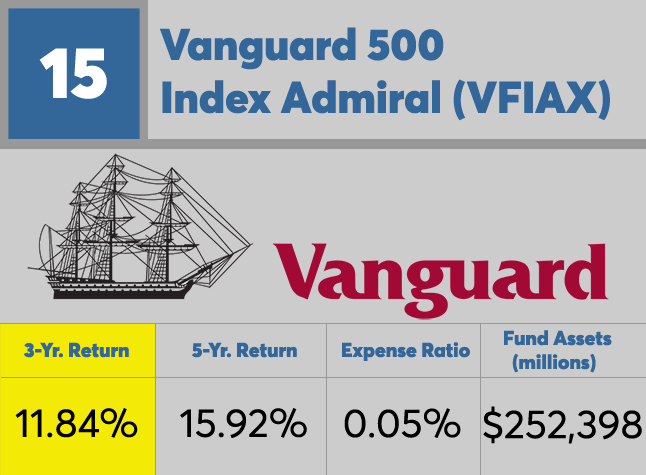

15. Vanguard 500 Index Admiral (VFIAX)

5-Yr. Return: 15.92%

Expense Ratio: 0.05%

Fund Assets (millions): $2,120

There are a number of other S&P 500 index funds, including offerings from Fidelity and Schwab, which have nearly identical return figures. Those others, however, are hundredths of a percentage point lower in returns, and ever slightly higher in expense ratios. Vanguard also offers an ETF version of this, which is not listed here, with identical returns, expenses and asset levels.

14. Vanguard Consumer Discretionary ETF (VCR)

5-Yr. Return: 19.46%

Expense Ratio: 0.10%

Fund Assets (millions): $2,120

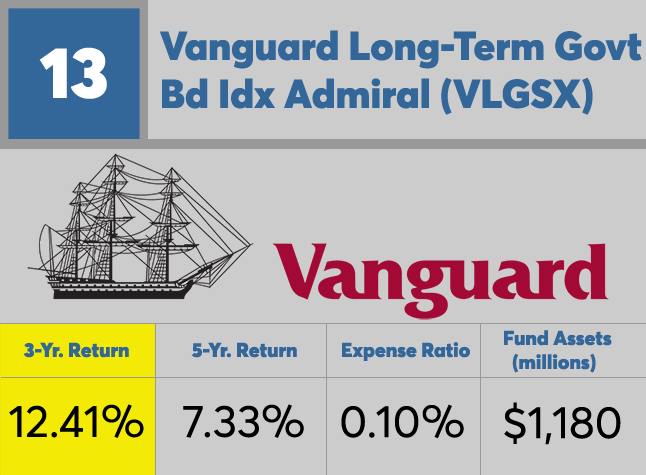

13. Vanguard Long-Term Govt Bd Idx Admiral (VLGSX)

5-Yr. Return: 7.33%

Expense Ratio: 0.10%

Fund Assets (millions): $1,180

Vanguard also offers an ETF version of this, not listed, with identical returns, expenses and asset levels.

12. Fidelity Long-Term Treasury Bd Idx Prem (FLBAX)

5-Yr. Return: 7.38%

Expense Ratio: 0.10%

Fund Assets (millions): $1,598

11. iShares Core Russell US Growth (IUSG)

5-Yr. Return: 15.91%

Expense Ratio: 0.08%

Fund Assets (millions): $933

10. Vanguard Growth Index Admiral (VIGAX)

5-Yr. Return: 16%

Expense Ratio: 0.08%

Fund Assets (millions): $52,486

Vanguard also offers an ETF version of this, not listed, with identical returns, expenses and asset levels.

9. Schwab US Large-Cap Growth ETF (SCHG)

5-Yr. Return: 16.36%

Expense Ratio: 0.07%

Fund Assets (millions): $3,009

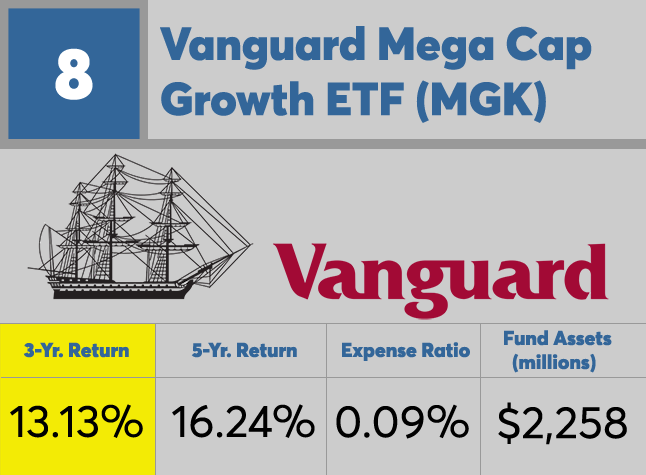

8. Vanguard Mega Cap Growth ETF (MGK)

5-Yr. Return: 16.24%

Expense Ratio: 0.09%

Fund Assets (millions): $2,258

7. Vanguard Consumer Staples ETF (VDC)

5-Yr. Return: 15.78%

Expense Ratio: 0.10%

Fund Assets (millions): $4,219

6. Vanguard Utilities ETF (VPU)

5-Yr. Return: 13.30%

Expense Ratio: 0.10%

Fund Assets (millions): $3,173

5. Fidelity Real Estate Index Premium (FSRVX)

5-Yr. Return: 14.55%

Expense Ratio: 0.09%

Fund Assets (millions): $843

Fund launched Sept. 8, 2011, just shy of 5 years ago. The 5-year return listed is the return since inception.

4. Schwab US REIT ETF (SCHH)

5-Yr. Return: 14.42%

Expense Ratio: 0.07%

Fund Assets (millions): $2,832

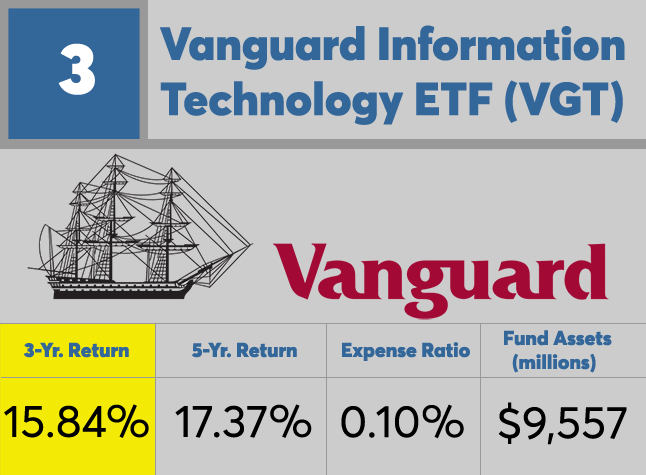

3. Vanguard Information Technology ETF (VGT)

5-Yr. Return: 17.37%

Expense Ratio: 0.10%

Fund Assets (millions): $9,557

2. Vanguard Health Care ETF (VHT)

5-Yr. Return: 20.86%

Expense Ratio: 0.09%

Fund Assets (millions): $6,671

1. Vanguard Extended Duration Treasury ETF (EDV)

5-Yr. Return: 11.49%

Expense Ratio: 0.10%

Fund Assets (millions): $1,556