-

These turbulent times of regulatory upheaval have raised the existential question of how to adapt and protect profitability.

September 15 -

Contrary to industry chatter, the new standards will likely benefit advisors working with actively managed funds, Michael Kitces writes.

September 5 -

The change is attributed in part to the cost of managing dividends.

September 1 -

USAA Capital held over $513 million in market value of the Wall Street giant’s large-cap, emerging market and international ActiveBeta funds.

September 1 -

A cornerstone of what drives American capitalism, the number of IPOs has plunged even as the stock market, and tech stocks in particular, have been hitting new highs.

August 31 -

The real concern is not just that actively managed funds could disappear but that the entire market could be left for dead.

August 29 -

Directors suggested firm head John Rogers make reductions at his $11.8 billion mutual fund that either meet or undercut the industry average.

August 29 -

Opened in the Roaring Twenties, the Massachusetts Investors Trust has weathered 16 recessions, roughly 20 bear markets and worse.

August 18 -

New bond ETFs from the firm use alternative weightings to chase "superior risk adjusted and total returns” compared with market-cap weighted products.

August 11 -

Aug. 7: The firm aims to mix innovation with old fashioned salesmanship, and is even considering a robo, according to the president of its broker-dealer.

August 4 -

Investors in his $1.4 billion closed-end offering saw huge gains as a result of stellar performance from his $88.9 billion Income Fund.

August 2 -

Many firms are finding new ways to incorporate computer models and data science into their research.

August 1 -

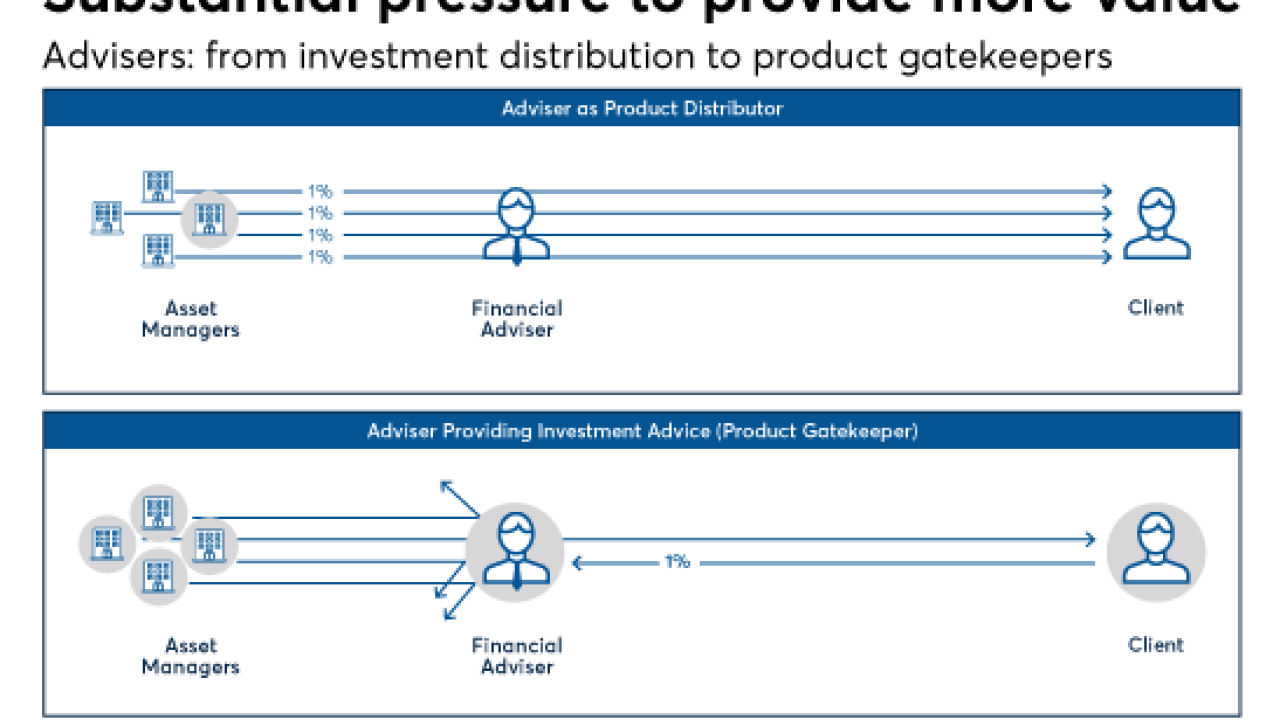

Advisers have turned into the new active investment managers.

August 1 -

Active management supplemented by local knowledge cannot be easily manufactured or automated, an expert says.

July 31 -

The firm is pushing into Europe and Asia-Pacific, but rolling back on the products that brought 75% of its assets in favor of actively managed funds.

July 27 -

In an effort to weather the assault from index funds, a Scottish firm cuts fees but bets that performance is still key to attract clients.

July 17 -

The firm’s growth last quarter was the biggest since the 2014 departure of its co-founder Bill Gross.

July 14 -

Actively managed mutual funds and ETFs that own domestic stocks experienced $98.5 billion in net redemptions in the first six months of 2017, according to Morningstar.

July 14 -

For those worried that high valuations guarantee trouble in the markets, data shows pricey equities can get even pricier.

July 13 -

Fundamental indexing is drawing more scrutiny, and greater concern about how these indexes are assembled.

July 13Ritholtz Wealth Management