-

The low interest rates pushing down sales across most fixed and variable lines are also boosting certain products.

November 25 -

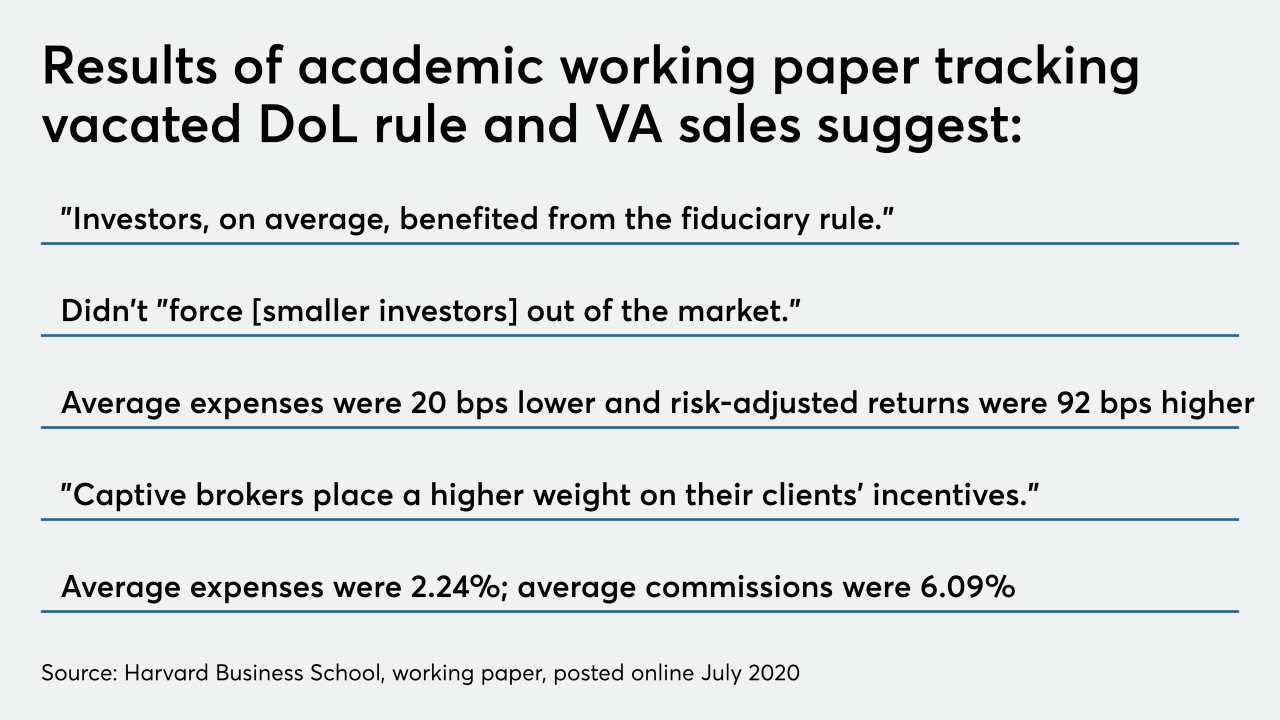

A recent study suggests sales of "expensive" VAs fell as a result of the vacated rule. But there are other factors at play, writes Raymond James' Scott Stolz.

October 16 Raymond James Insurance Group

Raymond James Insurance Group -

“If insurance and annuities had always been commission free, RIAs would be power users,” says David Lau, CEO of DPL Financial which is partnering with SS&C Advent.

October 13 -

Expenses fell by 20 basis points and risk-adjusted returns climbed 92 bps, according to the study.

September 24 -

Could single premium immediate annuities be the answer to ultralow rates?

September 21 Wealth Logic

Wealth Logic -

Sales are tumbling and gravitating to different products as Wells Fargo settles a FINRA case and researchers examine the defunct fiduciary rule.

September 3 -

Northwestern Mutual’s practices raise difficult questions about the nature of retail advice just as wealth management faces greater scrutiny under new rules.

July 17 -

Companies that connect advisors and carriers are seeing a surge in use.

June 17 -

“It is amazing that annuity sales are only down in the single digits, given the devastating effects that COVID-19 has wreaked on the annuity industry,” an expert says.

June 1 -

The Internal Revenue Service and the Treasury Department issued proposed regulations Wednesday to update the income tax withholding rules for periodic retirement and annuity payments made after Dec. 31, 2020.

May 27 -

The percentage of workers who say they are ready to retire has dropped by more than 5% in last month, a survey found.

April 24 -

Just as in the wake of the 2008 financial crisis, experts say there's rising interest in the products among advisors.

April 15 -

Retirees tapping their long-term savings accounts for income in an emergency are advised to strongly consider reducing their withdrawal rates.

March 16 -

To ensure their investments stretch as long as they live, clients are advised to develop a sustainable withdrawal plan and consider annuities.

March 6 -

To start, these clients are advised to start saving as early and contribute enough to their 401(k)s to qualify for their employer's matching contribution.

March 3 -

Taking advantage of catch-up contributions is one of several methods that can help them get back on track.

February 12 -

The HSA has become increasingly valuable for future medical expenses, "and the triple tax benefit simply can’t be ignored,” an expert says.

February 11 -

Seniors may consider working longer or relocating somewhere where their benefits are not subject to state taxes.

February 7 -

Clients can void overspending by seeking out sales and discounts to lower their food and entertainment costs.

February 5 -

Sixty percent of advisors cited estimating health care costs as one of the biggest headaches when helping retirees plan for the future.

January 3