-

The fast money has more than three times the impact on equity valuations than long-term investors like pension funds, according to a recent paper.

July 22 -

Using machine-learning algorithms, the firm's $106 billion systematic active equity group researches social media pages and online job postings to build portfolios.

July 22 -

The $217 billion alternative asset manager reported its biggest loss as a public company in the first quarter.

July 21 -

The manager joins firms including JPMorgan and Arena Investors in seeking opportunities in the sector, particularly in the wake of the coronavirus pandemic.

July 13 -

Almost 90% of smaller fund managers would no longer have to report their investments and their firms would save $136 million a year, the agency estimates.

July 13 -

Mass exodus from the market has forced managers to dump securities to raise cash, sending prices tumbling the most in at least four decades.

July 9 -

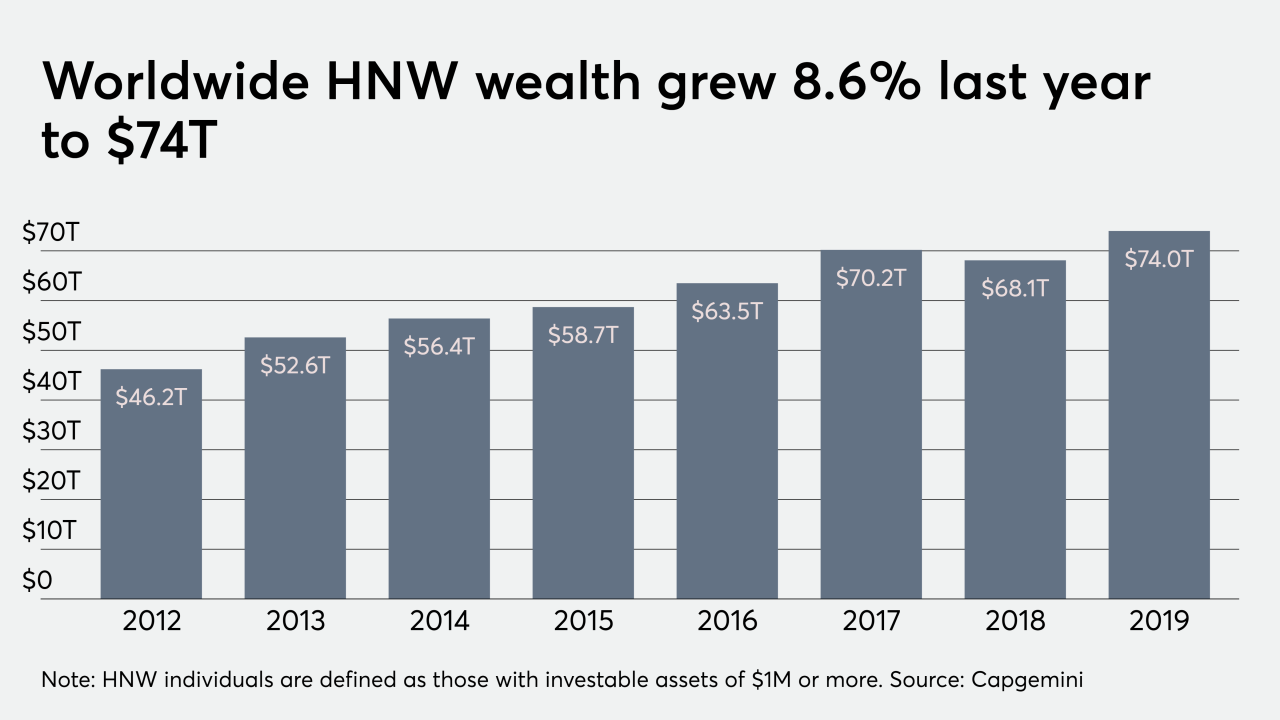

Affluent investors are concerned about transparency, performance and value, according to a new report by Capgemini.

July 9 -

Its rivals have been building out their own insurance arms in recent years and have brought on executives who can help them attract more business.

July 9 -

The leaders raked in a combined $949 billion over the past decade.

July 7 -

A “distribution bump” from the commission-free trading trend that took hold late last year may be behind the surge, analysts say.

July 7 -

Jacob Gottlieb, whose $8 billion fund shuttered amid an insider trading scandal two years ago, received a $150,000 to $350,000 loan for his new shop.

July 7 -

The manager is still recovering from losses that started in 2015, when his main fund fell 20%, and deepened with a record 34% decline three years later.

July 1 -

As more active strategies embrace the exchange-traded model, the landscape may be shifting.

June 29 -

Cboe’s first new entry will be a suite of four volatility indexes with different tenors based on the iShares 20+ Year Treasury Bond ETF.

June 25 -

Asset manager Blueprint Capital Advisors claims they stole confidential business information and discriminated against the Black-owned firm.

June 24 -

Here's how the largest groups have fared during unprecedented market activity.

June 23 -

Still, clients continue to invest their assets into the industry’s cheapest funds and are saving billions as a result.

June 17 -

Almost all of the decline reflects performance-related losses rather than client withdrawals, according to a person familiar with the matter.

June 16 -

The ETF aims to track companies specializing in remote-working, learning and entertainment.

June 16 -

As asset managers launch funds with this new structure, lack of familiarity may hinder advisors’ adoption of them.

June 12