-

The index rose more than 300 points, reaching its highest close ever.

January 17 -

Rarely have investors had such consistent, steady gains, and abundant anomalies, says one expert.

January 3Ritholtz Wealth Management -

Three popular debt ETFs reported nearly $1.4 billion in combined outflows this week.

December 8 -

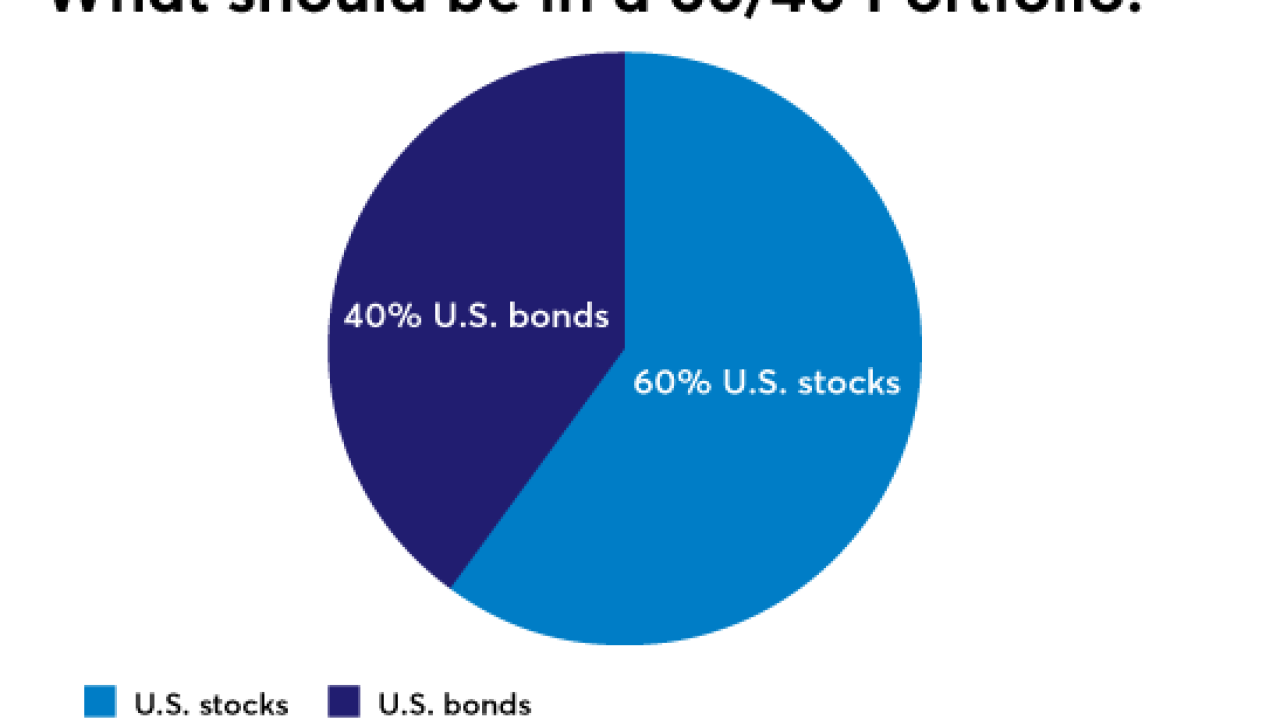

Conventional wisdom is that 60/40 portfolio is highly effective. But there could be a better way to accompany large-cap U.S. stocks than U.S. bonds.

November 27 -

The regulator was looking into customer complaints and arbitration claims that rep engaged in unsuitable trading.

November 7 -

The fund will give investors exposure to noninvestment-grade bonds for less than half the cost of its flagship high-yield offering.

October 27 -

These investments offered better returns than the broader fixed-income world in recent years, but the risk/reward equation leans heavier on risk.

September 28 -

The holdings in each of the three new offerings are rated A to BBB.

September 22 -

-

-

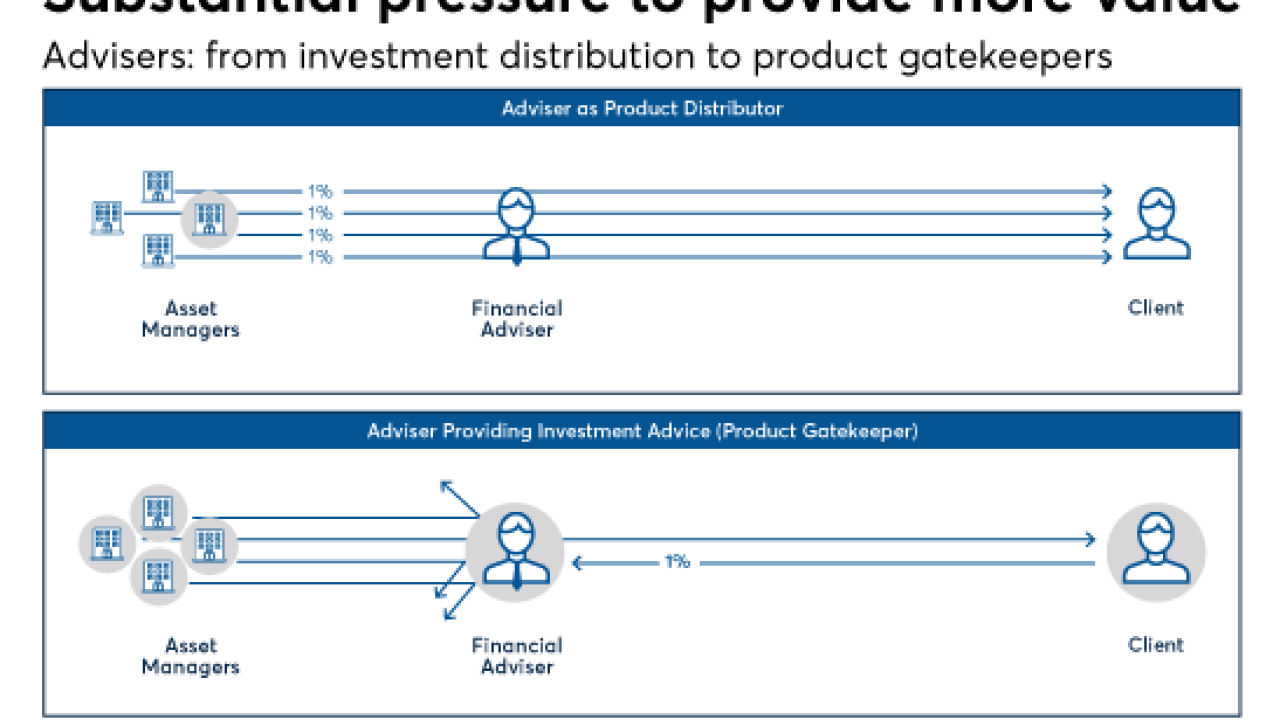

Advisers have turned into the new active investment managers.

August 1 -

Lawmakers are considering scrapping individual deductions, including tax breaks for certain plan contributions.

June 30 -

The agency's staff has recommended filing an enforcement action against two Barclays bankers, according to records filed with FINRA.

June 29 -

Passive investments garnered most of the investor cash so far in 2017, but beyond that it was a wide net: S&P 500, small cap, emerging markets, fixed income — anything that could be structured as an ETF.

June 7 -

Investors are fleeing debt-riddled companies amid the anticipation of rising rates and growing corporate leverage.

June 5 -

The funds' success at asset gathering underlines an increasing interest from retail buyers, in addition to institutional investors.

May 24 -

For clients who can’t stand being in the red, there are investment options. There are also caveats to consider, such as relatively high costs and lower returns.

May 9 -

Do they really deliver better risk-adjusted returns? A Morningstar panel said yes, but contributing writer Allan Roth disagrees.

April 27 Wealth Logic

Wealth Logic -

Index funds may not be the ideal choice, but there are better options than the active bond funds pushed at a Morningstar panel.

April 27 Wealth Logic

Wealth Logic -

Amid the ups and downs of the bond markets, these funds attracted new investors.

April 19