-

Here's what to watch for just before the counting of ballots begins.

November 4 -

A bond subsector worth looking at. Plus, help clients keep what they owe the government to a minimum with a roadmap for drawing down assets.

October 21 -

Advisers and clients stockpile cash while waiting for better buying opportunities.

October 13 -

Wide adoption by global money managers and ETFs could set off a new wave of buying, according to Morningstar.

October 6 -

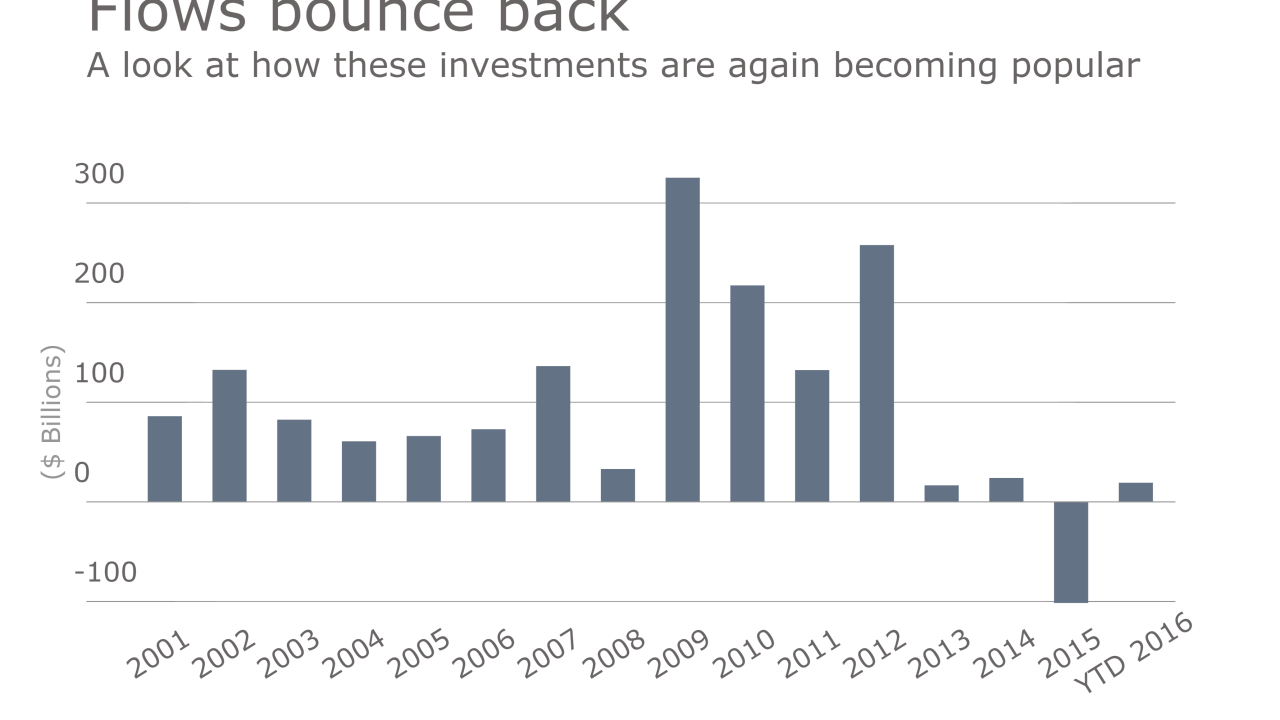

The funds have had the fastest growth since 2012, with nearly $100 billion of inflows, helped by record emerging-market investments.

October 4 -

The wirehouse has served as a major banker for the island commonwealth, which has been defaulting on a growing share of its debt and has been placed under federal financial oversight.

September 28 -

The simple analogy of a boat can help clients understand a sometimes complex investment strategy.

September 26 Ameriprise

Ameriprise -

The firm's expansion may also include assignments on private placements and unsecured-debt from real estate investment trusts, an executive says.

August 30 -

Traders have piled into global equities, heartened by deal activity and better-than-expected corporate earnings.

August 15 -

First time since heady days of 1999 that all three major stock benchmarks hit high marks on the same day.

August 11 -

Performance demonstrates instruments’ strength and ability to offer protection.

August 10 -

Investors have once again taken a liking to taxable bond funds — a marked difference from last year. Advisers may find that clients are taking notice, too.

August 4 -

Municipal debt has become more concentrated in the hands of the wealthiest investors, which may prompt lawmakers to rethink the tax-exempt benefits.

July 15 -

Here's how to bring in the cash without paying a nickel to the government. Plus, 11 big mistakes to avoid and qualified charitable distributions that yield big benefits.

July 14 -

It's safety first for investors around the world as they assess the significance of Britain's vote to leave the European Union.

July 6 -

FIAs may generate upside with limited downside, a package that appeals to some advisers and clients — as long as some hurdles can be cleared.

July 5 -

Brexit isn't seen having fallout as severe as the 2008 financial crisis, but you wouldn't know it from the rush to safety in the global market for sovereign debt.

June 30 -

Fixed income has posted steady returns in these markets, while once high-flying equities have come crashing down.

June 29 -

Strategists across Wall Street have been paring back 2016 calls on benchmark Treasury yields, as expectations for global economic growth decline and central banks in Europe and Asia introduce additional policy easing.

June 27 -

Despite market volatility at least one expert expects "business as usual for munis after the dust of today's rally settles."

June 24