-

Should advisor retention go as planned, Blucora's agreement to purchase the firm would boost its IBD headcount to 4,500 reps.

March 19 -

Commissions and cash-sweep revenue jumped by more than a combined $100 million in 2018 — even as the parent firm’s longtime chairman left the company.

March 15 -

The 12-advisor practice serves clients in a group often neglected by the industry, its managing directors say.

March 13 -

Woodbury Financial Services has added 572 advisors with $22 billion in client assets since the fall of 2017, CEO Rick Fergesen says.

March 5 -

More wealth management pros are joining mastermind groups, driven by the growing realization that the isolation that comes with running a business can hold back the business’s success.

March 1 CEG Worldwide

CEG Worldwide -

The No. 1 IBD is pitching advisors on the merits of its offerings — but rivals have also added major teams from its ranks.

February 22 -

The CEO said his decision to resign followed a physician’s recommendation in connection with an undisclosed medical problem.

February 19 -

The No. 1 IBD is reaping the benefits of learning the lesson that it “can never move away from the advisor,” according to its head of business development.

February 11 -

Securities Service Network is pitching advisors on its tax offerings, access to management and parent-firm resources.

February 8 -

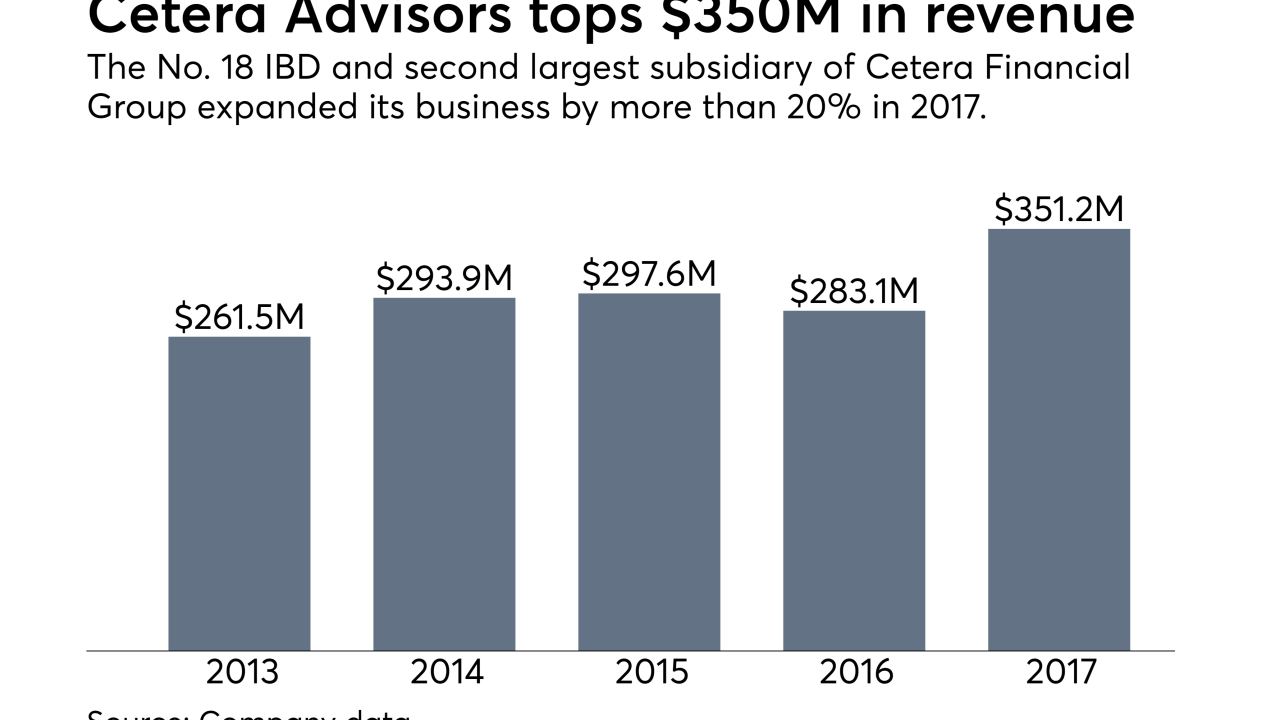

The past year brought major changes to the IBD network, including the sale of its majority stake and a structural reorganization.

February 5 -

Some owners are reluctant to give away an equity stake. Here is one solution.

January 30Momentum Advisors -

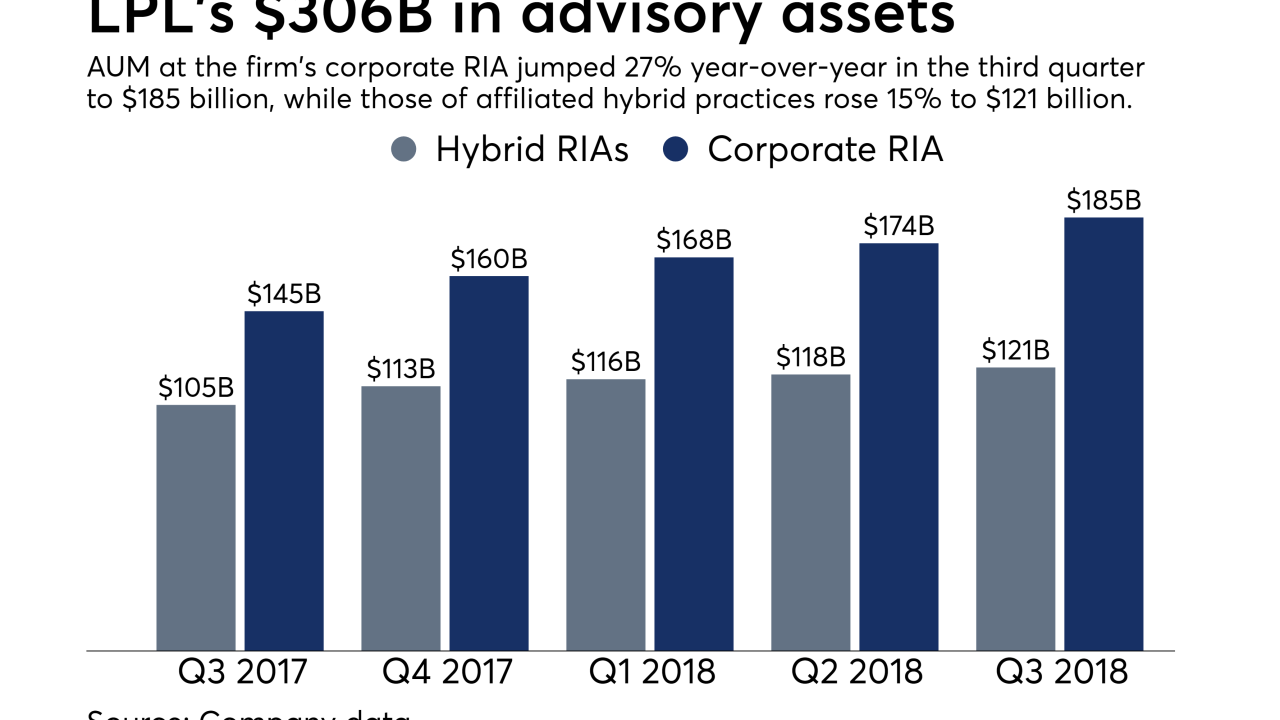

The No. 1 IBD’s advisory AUM flows show results from the company’s efforts to reward advisors for choosing its custody instead of outside firms.

December 19 -

The 50 largest teams and OSJs to change their affiliations show both the threat to incumbent firms posed by RIAs and the scale afforded by acquisitions.

December 17 -

Executives say valuing friendliness alongside other factors is helping to drive a record $66 million in incoming production this year.

November 28 -

The advisors retained from shuttering Broker Dealer Financial Services will add more than 80 advisors now able to tap into the buying firm’s offerings.

November 14 -

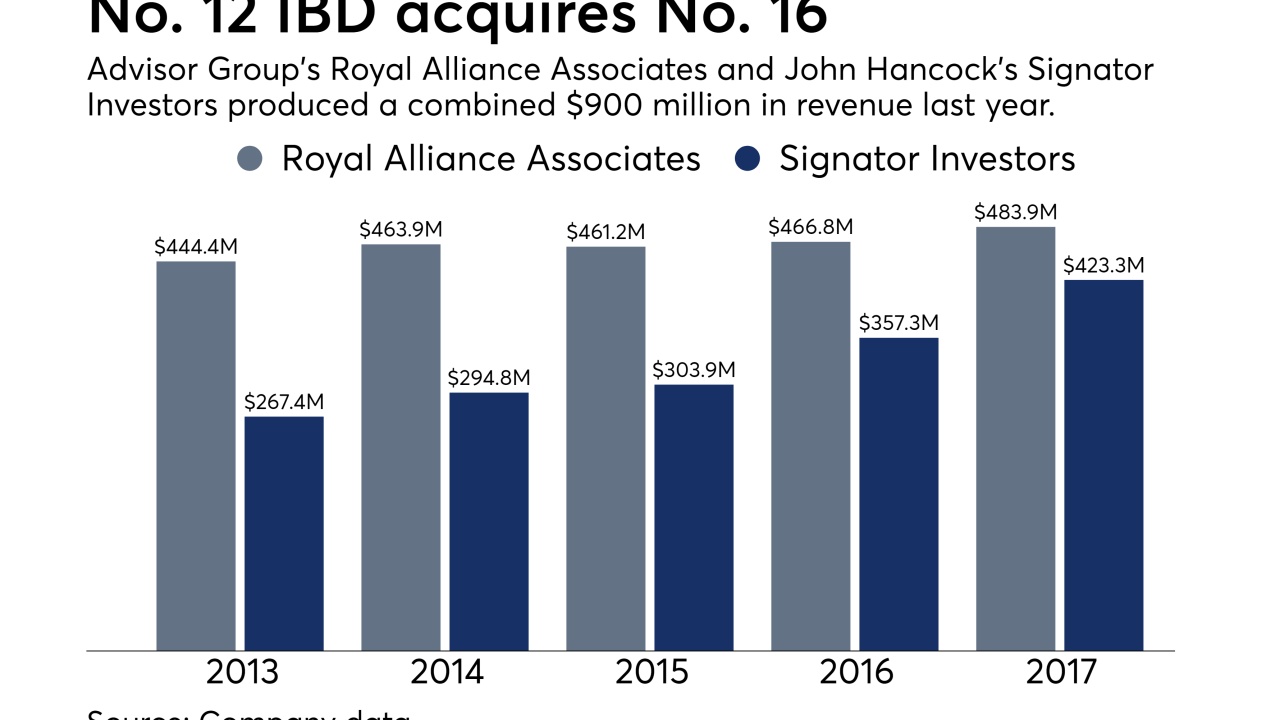

CEO Jamie Price and other executives met with some 1,000 prospective advisors after inking one of the largest M&A deals in the IBD space this year.

November 6 -

The No. 1 IBD’s major spending on recruiting, technology and organic growth is yielding big returns.

October 30 -

Seven IBDs turn 50 this year. Here's why most of them won't survive another half-century.

October 30

-

The No. 1 IBD poached two more teams from the largest firm in rival network Cetera Financial Group.

October 25 -

The No. 7 IBD expects such moves by advisors to increase in coming years, so it's ramping up offerings aimed at fee-only services.

October 12