Compensation

Compensation

-

Retirees may benefit from moving money to various locations that offer better savings rates and returns.

January 21 -

With its appointment of Martine Lellis, one of the largest and most-acquisitive RIAs ups its leadership ranks to almost 40% women.

January 21 -

Investors who plan to retire early are advised to start saving as soon as possible and diversify their earnings with multiple sources of income.

January 17 -

The bank is an aggressive recruiter of HNW and UHNW talent.

January 17 -

The 17-member team is one of the largest to switch employers in recent years.

January 17 -

A recent study found American workers would face better retirement prospects if the federal government adopts certain public policy changes.

January 16 -

The firm typically trains its own advisors in lieu of recruiting talent from the competition.

January 16 -

“The advice I give is to calculate the financial impact for each option,” an expert says.

January 15 -

Along with other decisions, dating the amount of money they need to withdraw would help them in retirement planning and spending.

January 14 -

The recruits include a father-son duo from UBS.

January 14 -

The bank continues to struggle with attrition due to scandals, regulatory scrutiny and a graying workforce.

January 14 -

Failing to pay taxes on side-gig earnings and keeping faulty records of business-related expenses must avoided to prevent an excessive tax burden.

January 14 -

This rise of the so-called grey divorce has created a number of uncommon and complex issues for retirement accounts.

January 14 -

Seniors can claim tax deductions for payments made on their homes, allowing them to reduce their tax burden when they retire.

January 13 -

The advisor switched firms only to see his new employer close shop 18 months later.

January 13 -

Similar products are stockpiling unprecedented levels of new cash as investors look to alternative assets for growth and income.

January 13 -

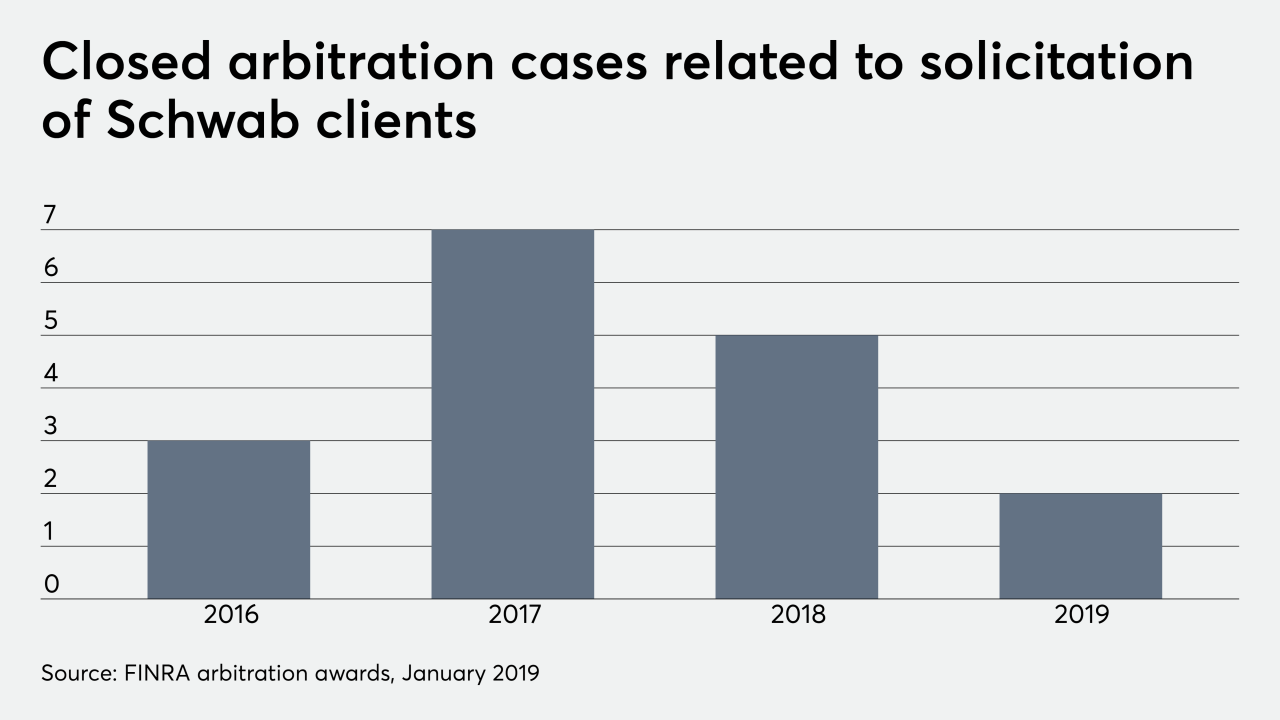

Planners — and RIAs that want to hire them — have faced hurdles tied to client solicitation rules.

January 13 -

It is important for entrepreneurs to have an exit strategy and to take control of their debt.

January 10 -

The regional broker-dealer is among the industry’s most aggressive recruiters.

January 10 -

Our industry is one of the few that’s barely experienced pricing pressure ... so far. Here's how to assure you keep providing value to clients.

January 10