-

“As of today, Wells Fargo Advisors is not allowing solicitation of those two securities,” a spokesperson for the bank said Wednesday.

January 28 -

Jacob Glick is accused of breach of fiduciary duty and misappropriating client funds, among other alleged misconduct.

January 22 -

SA Stone Wealth Management representative Gregory Frank Estes had already registered as a sex offender after a 2002 conviction, records show.

January 21 -

Biden's expected nomination for chairman is known for pushing back at banks and corporations in search of greater investor protections.

January 15 -

The 25-year industry veteran of four wealth managers and a trust company faced a charge of unlawful entry on public property.

January 15 -

“The sheriff is coming to the preeminent financial regulator in the world,” said Justin Slaughter, a consultant at Mercury Strategies. “It means regulation and enforcement are about to get much tougher.”

January 14 -

Two former FINRA employees are joining the fast-growing brokerage app.

January 14 -

The firm’s use of third-party compliance vendors came under scrutiny after an ex-rep pleaded guilty to bilking clients out of $5 million.

January 5 -

Long-awaited advertising regulations allow for online testimonials but also increased risk of audits, observers and commissioners say.

December 30 -

In the first wave of cases under the regulator’s self-reporting initiative, it garnered more than $2.7 million in payments of restitution plus interest.

December 30 -

SEC cases that go beyond faulting firms for their failure to disclose conflicts of interest have drawn pushback from the industry.

December 30 -

Attorneys, compliance experts and marketers weigh in on the regulator’s first update to advertising compliance in decades.

December 24 -

The worst fiscal crisis in decades is pitting U.S. states against one another over billions in taxes from residents working from home.

December 24 -

The wealth manager whose parent firm also owns an insurer and asset manager settled its third case involving the same time period.

December 23 -

The allegations involving 12b-1 fees, cash sweeps and commissions also include violations of best execution rules.

December 23 -

“We look forward to our day in court and will not be bullied by the regulatory thugs at the SEC," the firm's co-founder says.

December 23 -

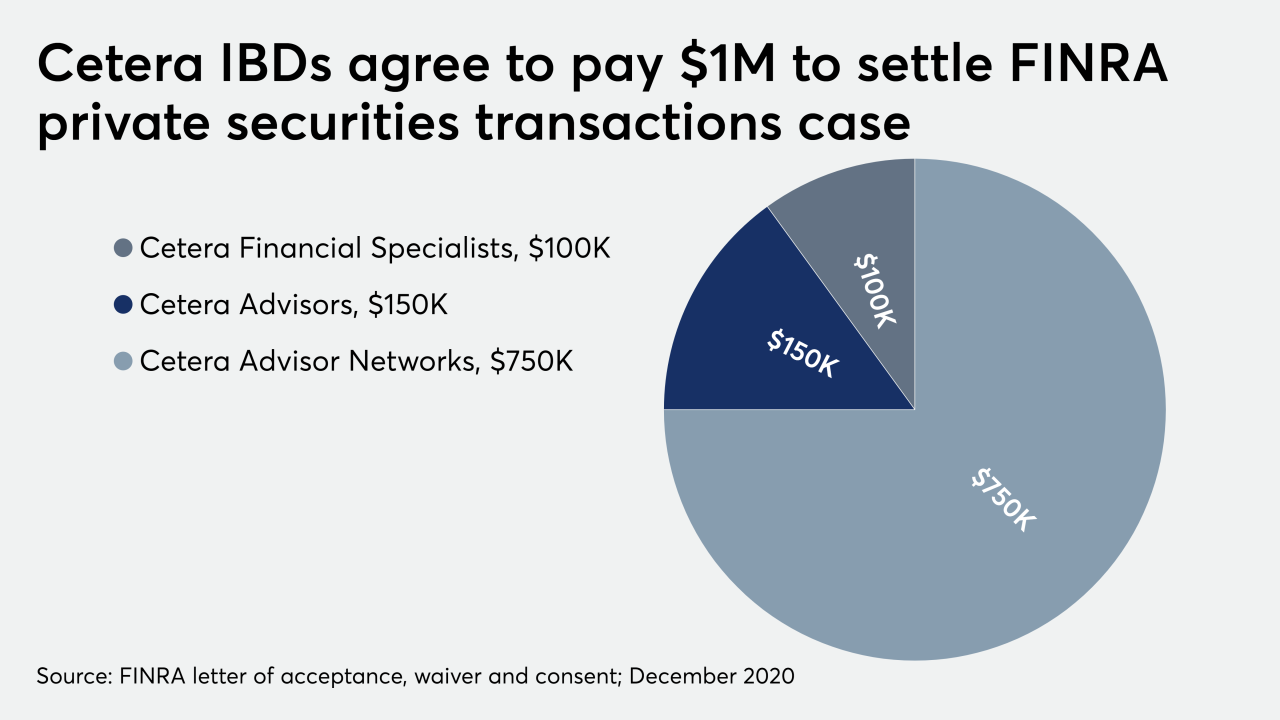

Despite pledges, the IBD network didn’t collect enough data for suitability reviews of the outside transaction for more than five years, according to the regulator.

December 22 -

Planners and experts dive into wirehouse pay, charging clients at a higher rate, emerging business models and other key issues.

December 1 -

Maybe not, says FINRA — but if you’re IM’ing, using slides during the virtual meeting, or recording it, probably yes.

November 25 -

Five firms agreed to pay $3 million to settle an SEC investigation into unsuitable sales of complex exchange-traded products.

November 16