-

Few clients think to look at the impact of capital gains on their mutual funds.

March 11 -

There is quite a bit of data indicating planners timed the markets poorly during the financial crisis. Let's not make the same mistakes again.

March 9 Wealth Logic

Wealth Logic -

-

“Stocks and bonds say we’re doomed,” said Chris Rupkey, chief financial economist for MUFG Union Bank.

February 27 -

The software giant’s offer comes as many fintech companies are becoming established enough to go public.

February 24 -

The academic duo who fueled the strategy’s boom want to know if worsening performance signifies a bout of misfortune or if something’s fundamentally broken.

February 6 -

A flight to safety that saw funds in short-term bonds and utilities add cash as coronavirus dominated headlines has given way to a vigorous rally.

February 5 -

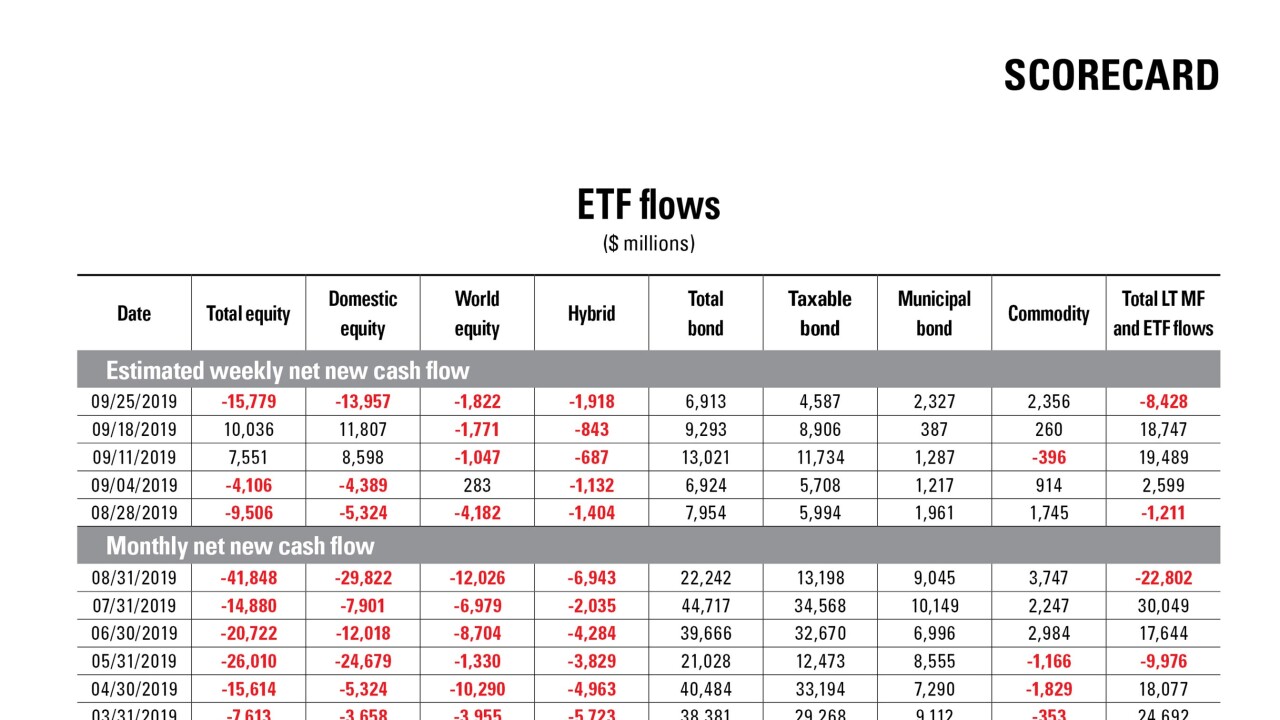

Data reported by the Investment Company Institute.

February 3 -

The move is part of a larger strategy to bring account minimums down for clients who either can't or don't want to buy entire shares of high-priced stocks.

January 30 -

Similar products are stockpiling unprecedented levels of new cash as investors look to alternative assets for growth and income.

January 13 -

Risky assets outside the U.S. are seeing fresh flows as a potential trade deal with China buoys expectations for global growth.

November 20 -

A quarter of wealthy investors' average assets are currently in cash, according to a new survey.

November 13 -

-

Many lenders have started to scale back as the fund industry copes with reduced demand for research following MiFID II.

October 29 -

Data reported by the Investment Company Institute.

October 23 -

Someone with a long-term investing horizon is generally not helped by bailing out of a well-diversified, multi-asset portfolio. Here are some options for them, and some talking points for you.

October 1 -

Roughly 45% of Berkshire’s stock portfolio is allocated to the financial sector, and eight of the portfolio’s top 12 holdings are financial stocks — a deeply contrarian bet.

August 27 -

UBS Global Wealth Management, which oversees more than $2.48 trillion in invested assets, has gone underweight on equities for the first time since the euro-zone crisis.

August 26 -

The firm added an experienced advisor from Wells Fargo after recruiting 72 other tenured reps in the second quarter.

August 21 -

Anticipation of a prolonged U.S.-China conflict is mounting, and “it’s possible that a currency war will start as well,” an executive says.

August 5