-

Risky assets outside the U.S. are seeing fresh flows as a potential trade deal with China buoys expectations for global growth.

November 20 -

A quarter of wealthy investors' average assets are currently in cash, according to a new survey.

November 13 -

-

Many lenders have started to scale back as the fund industry copes with reduced demand for research following MiFID II.

October 29 -

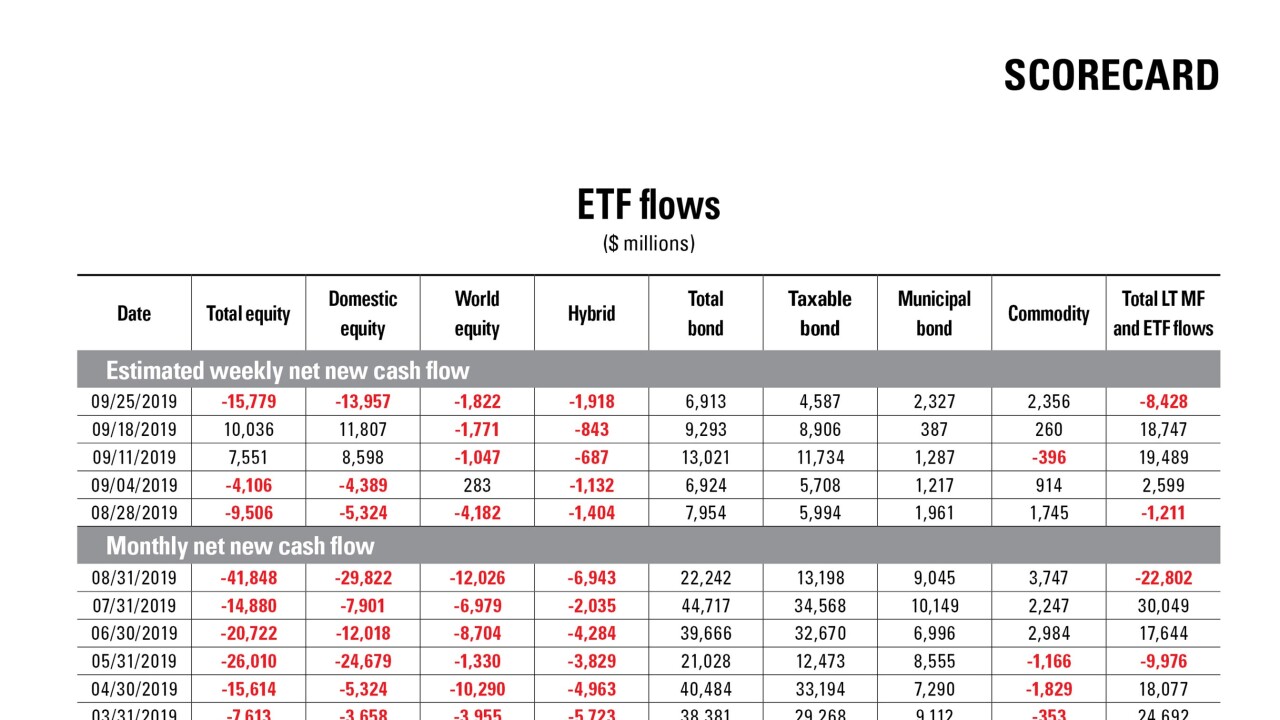

Data reported by the Investment Company Institute.

October 23 -

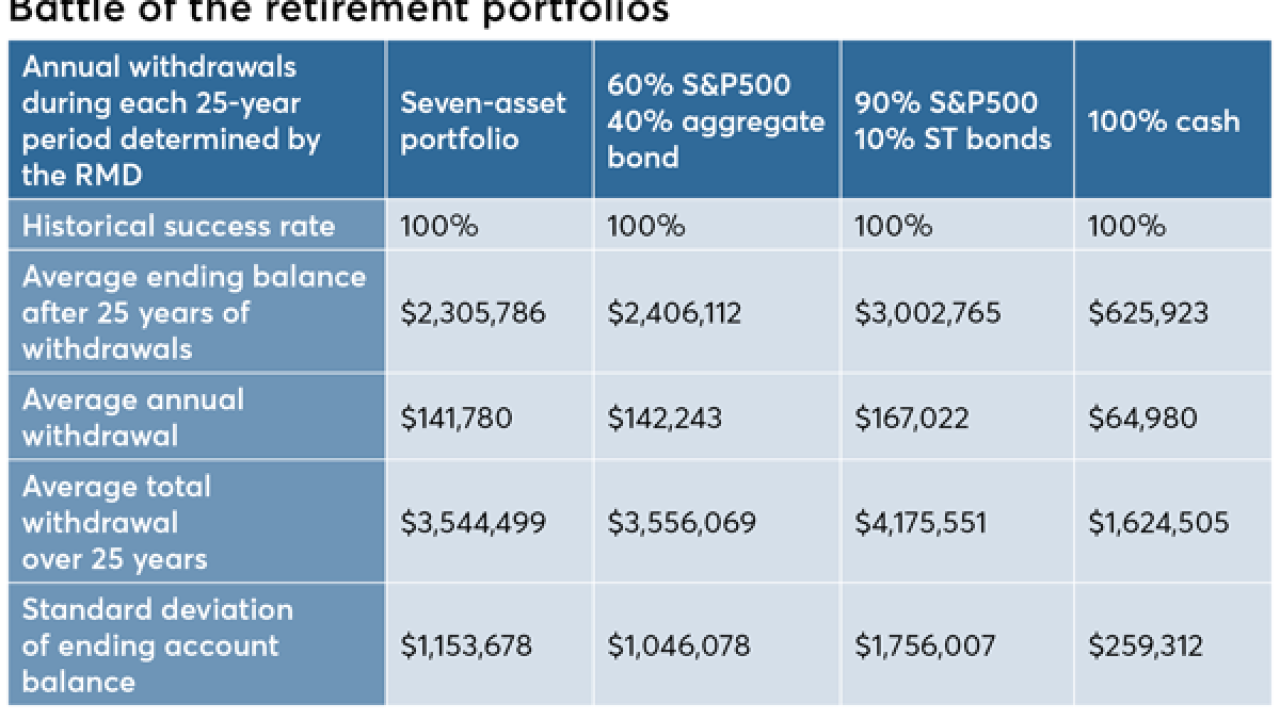

Someone with a long-term investing horizon is generally not helped by bailing out of a well-diversified, multi-asset portfolio. Here are some options for them, and some talking points for you.

October 1 -

Roughly 45% of Berkshire’s stock portfolio is allocated to the financial sector, and eight of the portfolio’s top 12 holdings are financial stocks — a deeply contrarian bet.

August 27 -

UBS Global Wealth Management, which oversees more than $2.48 trillion in invested assets, has gone underweight on equities for the first time since the euro-zone crisis.

August 26 -

The firm added an experienced advisor from Wells Fargo after recruiting 72 other tenured reps in the second quarter.

August 21 -

Anticipation of a prolonged U.S.-China conflict is mounting, and “it’s possible that a currency war will start as well,” an executive says.

August 5 -

Managers will actively evaluate an asset’s characteristics — its value or momentum, for example — to determine what to buy.

August 1 -

The activity began last Friday when 6.4 million shares hit the tape, fueling a record daily inflow for the fund.

July 29 -

The famed investor recommends 90% large-cap U.S. stock and 10% short-term government bonds. Is it a crazy idea?

April 3 -

Home to more than $249 billion, these funds have expense ratios more than 20 basis points higher than the industry average.

March 13 -

Although it undercuts 2,000 existing U.S. products, some analysts say the price still isn’t low enough.

March 11 -

“These products are really focusing on who’s driving advances in innovation,” the global head of its asset management arm says.

March 7 -

A member-owned market is the wrong response to rising fees.

January 8 -

By sending orders to an exchange they own, banks and brokers presumably can save money on trading costs.

January 7 -

Daily volume jumped 22% to 20 million contracts in 2018.

December 31 -

The Global Income Fund slashed its equities exposure by nearly a third in October and moved part of the proceeds into U.S. and European high-yield debt.

November 30