-

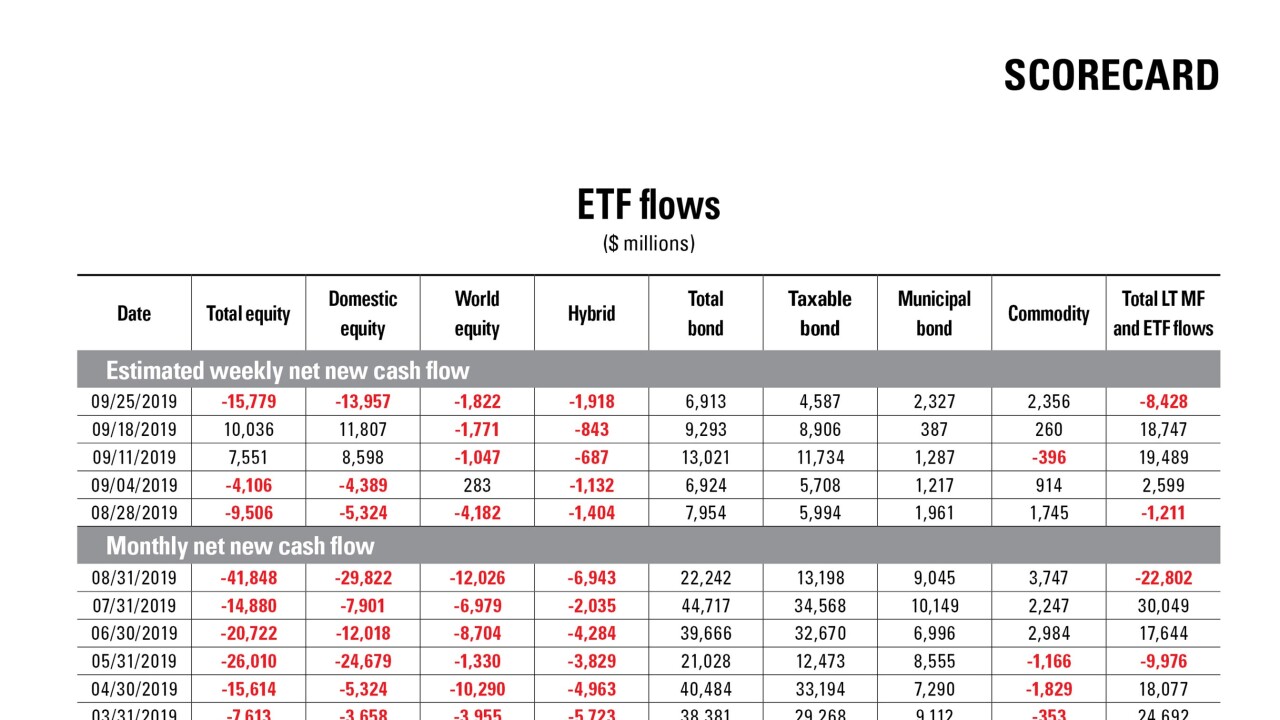

Data reported by the Investment Company Institute.

October 23 -

More than $1 trillion is invested in bond ETFs, with trading leaping 41% in 2018 from a year earlier, according to research.

October 23 -

By slashing fees, custodians are also eliminating special ETF platforms they had spent the past five years building out.

October 22 -

The move follows similar offers from other major brokerages in the last two weeks, as firms race to woo clients with the lowest-priced products possible.

October 21 -

Despite recent rebranding efforts, the EventShares fund hasn’t seen an inflow since May.

October 17 -

“Not every muni is trying to achieve the same thing,” an expert says.

October 16 -

Geopolitical friction and a slowdown in global economic growth have boosted the metal’s demand despite signs of recent wavering.

October 15 -

Clients should consider paying more deductible expenses before year-end if their total itemizable deductions will be close to their standard deduction amount.

October 15 -

The change, the regulator says, will facilitate greater competition and innovation in the ETF marketplace, leading to more choice for investors.

October 10 -

The low-cost brokerage followed its competitors for retail clients and will offer the new pricing to RIAs in November.

October 10 -

“The combination of low rates, curbs on state and local tax deductions, and consistent economic expansion have been a nice tailwind,” an analyst says.

October 9 -

More than 70% of U.S. ETF assets are in funds that charge 2 basis points or less, data show. But free isn’t an automatic ticket to success.

October 8 -

At more than twice the price of the average fund, many with the even biggest gains still underperformed the broader market over the last decade.

October 2 -

A patented structure allows ETFs to report once a quarter in an effort to protect their intellectual property.

October 1 -

It's the latest move in the race to offer products at the lowest possible prices.

October 1 -

Among funds impacted so far, the Invesco China Technology ETF fell 2.8%, while the KraneShares CSI China Internet Fund lost 3.8%.

September 30 -

The regulator says it eliminated the need for providers to seek a special order from the agency before funds can be sold to investors.

September 26 -

Under the proposed structure, the funds will conceal a portion of their assets and instead publish a list of securities that’s highly correlated to the performance of the portfolio.

September 26 -

Cash flow has subsided and market conditions have changed since the fund was closed to most new accounts in 2016.

September 25 -

The five-month-old fund from Tabula Investment Management just became one of the largest of its kind after taking in $68 million last week.

September 24