-

CEO Jamie Price unveiled a three-part “advisor appreciation program” after Reverence Capital closed on a majority stake of the IBD network.

August 20 -

President Adam Antoniades cites record expansion for the year, but the IBD network faces challenges related to recruiting and debt levels.

August 19 -

Bleakley Financial has recruited advisors with $750 million in client assets since January 2018 alongside LPL’s substantial recent grabs.

August 15 -

The new recruits come from Merrill Lynch and Stifel, with $165 million in total client assets.

August 14 -

Newday’s tools include content centered around clients’ issues of focus and, soon, a corn-based compostable debit card.

August 13 -

The firm has made formal hiring offers totaling approximately $214 million as of June 30.

August 13 -

Critics reject the notion that disclosure alone is sufficient for reigning in conflicts — but the charges against Commonwealth have put BDs on notice.

August 12 -

HD Vest's parent displayed the growth coming from the acquisition of its former rival.

August 9 -

A barred and terminated former Securities America advisor’s conduct was “appalling, reprehensible and evil,” according to a federal judge.

August 8 -

One team wanted more flexibility and time to manage their clients’ financial needs.

August 5 -

CEO Philip Sanders admits the past two years of the segment’s overhaul have been “a grind,” but he says it’s now ready to grow.

August 5 -

The stark figures show that only about one-sixth or fewer of the sector’s financial advisors are women.

August 5 -

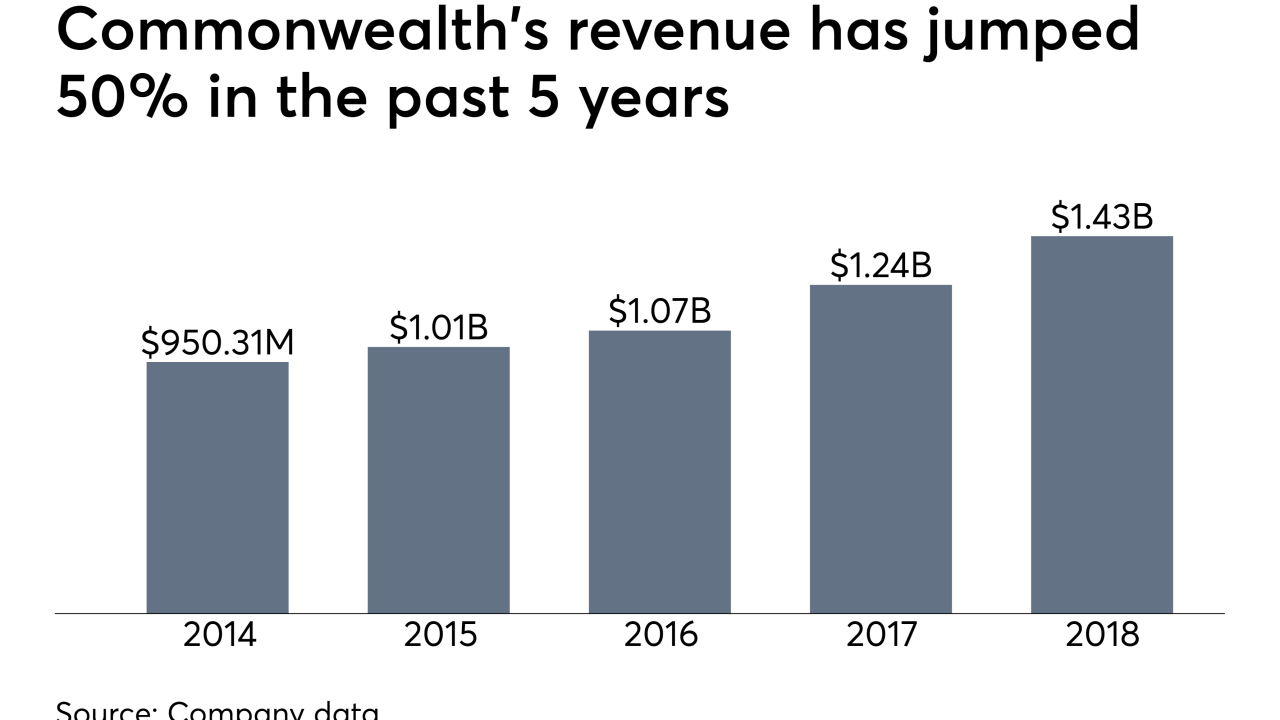

The firm didn't disclose its conflicts of interest in receiving over $100 million in revenue sharing from mutual funds over nearly five years, the SEC says.

August 1 -

Ladenburg Thalmann's largest firm has added at least five teams in the wake of recent acquisitions by rivals.

August 1 -

The freshly recapitalized firm is offering succession services without any custodial or affiliation requirements.

July 30 -

There are red flags that may be pointing to elder fraud in a client account.

July 30 -

After affiliating with Advisor Group following its acquisition, Signature Estate & Investment Advisors aims to offer its TAMP across the network.

July 29 -

The IBD network joins asset managers and other companies developing new methods to display how the products integrate into client portfolios.

July 26 -

Dan Arnold deployed a five-pronged argument for why consolidation is a recruiting boon for the No. 1 IBD.

July 26 -

The new recruits came at the expense of wirehouse rivals Merrill Lynch and Wells Fargo.

July 25