As independent broker-dealers race to boost their fintech, Ladenburg Thalmann bets that impact investing could play an outsize role in the competition.

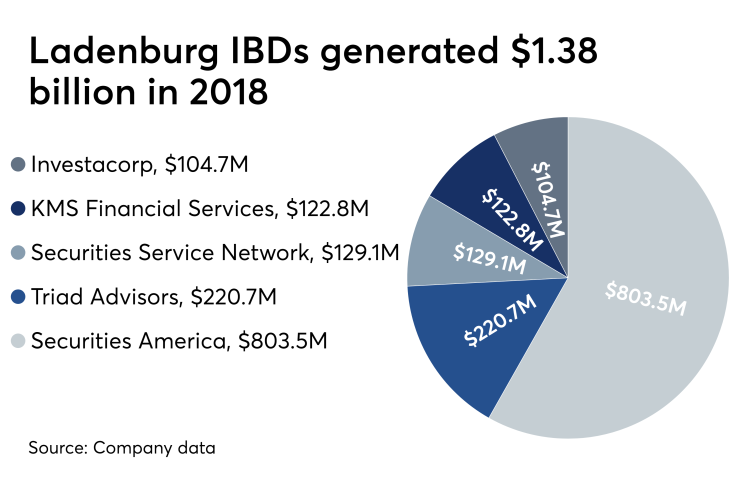

The parent of the five-IBD network

Some 4,400 financial advisors affiliated with Ladenburg IBDs like Securities America and Triad Advisors will eventually be able to offer Newday’s funds and other products while getting referrals from its client base, according to Dan Sachar, head of Ladenburg’s innovation lab.

The equity stake in Newday — which only has about $1.7 million in AUM after launching in July 2018 — came after the startup presented at

Sustainable investments jumped by 38% to $12 trillion in the U.S. in the past two years,

For example, Pacific Life Insurance’s Swell Investing is

“There's interest, but there's not as much adoption as there is interest,” says Dreizler, whose firm Solutions with Sonya works with RIAs and IBDs on impact investing, ESG and SRI tools but doesn’t work with Ladenburg.

“I don’t see this as much of an investment from Ladenburg into Newday for return,” Dreizler continues. “They are bringing this resource and technology to advisors so that advisors can really capitalize on the growing interest in values-aligned investing.”

Dreizler says she recommends engaging in client activities like Newday’s ocean cleanup events, in addition to the available data tools and funds. Newday currently manages seven funds around United Nations sustainable development goals like climate action and gender equality.

-

The two firms' boosts came amid equity headwinds — and both wealth management units now have nearly 4,400 financial advisors.

May 13 -

Ladenburg Thalmann's largest firm has added at least five teams in the wake of recent acquisitions by rivals.

August 1 -

The firm has a particular focus on female clients and empowering women to better control their finances.

May 22

Although many underperformed the broader market, just over half posted double-digit gains.

With an account minimum of only $5, Newday charges clients using its app 100 basis points on assets in equities and 60 for mutual funds, according to its SEC Form ADV brochure. The asset manager creates portfolios based on clients' answers to questions, like one identifying their preferred impact area.

Newday also plans to launch impact banking services by next year, including a compostable, corn-based debit card, according to CEO Doug Heske. The firm is weighing subscription pricing, and its current fund lineup could expand into other values-based investing.

“When somebody comes into the app, they understand every company that's in the portfolio, why it's in the portfolio and the association with a particular theme,” Heske says. “We're approaching people in a really different way than what a traditional investment firm is doing.”

Clients, he adds, are now “very much thinking about, ‘Well, how do I use my money as a tool for change?' ”

Sachar declined to provide a specific timeline for enabling advisors to put Newday’s tools to use, though he says those in attendance at the tech symposium in San Francisco expressed interest. He also sees potential in Newday’s service events and issue-specific content.

“We're making a bet on the importance of impact investing, especially for the younger investor. It’s a macro trend that can pull in a new generation of clients into the financial services,” Sachar says. “They could be at the beginning stages of a lifelong journey of investing.”

Miami-based Ladenburg’s IBDs have been adding to their base of clients and advisors. Their client assets rose by 12% year-over-year to $177.7 billion in the second quarter, and advisory AUM jumped by 14% to $85.7 billion. Headcount at the IBDs increased by 8% from the year-ago period.

A spokesman for Ladenburg declined to provide any more detailed information on metrics like specific advisor headcounts at the IBD network — which

The IBD segment generated revenue of $301.8 million, just $2.3 million higher than the year-ago period but 83% of the parent’s total business. Its parent firm lost $1.2 million after paying preferred dividends, though it earned net income of $7.5 million for the quarter.

Fintech investments have reached eye-popping levels in the IBD sector. The No. 1 firm, LPL Financial, plans

Ladenburg made more modest acquisitions last year, with two smaller ones

The stake in Newday could help advisors close the gap between interest in values-based investing and actual adoption, according to Dreizler. Sometimes advisors aren’t comfortable with discussing values-based investing with clients or using the tech, she says.

“It's a totally different kind of conversation,” she says. “The conversation with clients is one that many advisors find really challenging because it feels less specific and implementable and also can feel emotional.”

Sachar’s team wants Newday to remain independent and keep going on its current path before ultimately integrating its funds, tech and other offerings across the Ladenburg IBD network. The deal falls under the same pattern as last year’s investment in Track, he says.

“We continue to invest based on macro trends that we think are going to be more and more important for advisors,” Sachar says. “This is just two; we're going to have a lot more to come.”