-

The advisors joined the firm’s employee and independent broker-dealer units.

December 24 -

In an internal memo, CEO James Poer pledges that any change to the firm’s capital structure "would be made with your business in mind first."

December 21 -

“I don’t want to call a helpline, I want a partnership,” the advisor says of her move to the firm, which expects to hit record gross recruited production.

December 21 -

The program could connect 4.9 million brokerage accounts to firms selected for the advisor network.

December 20 -

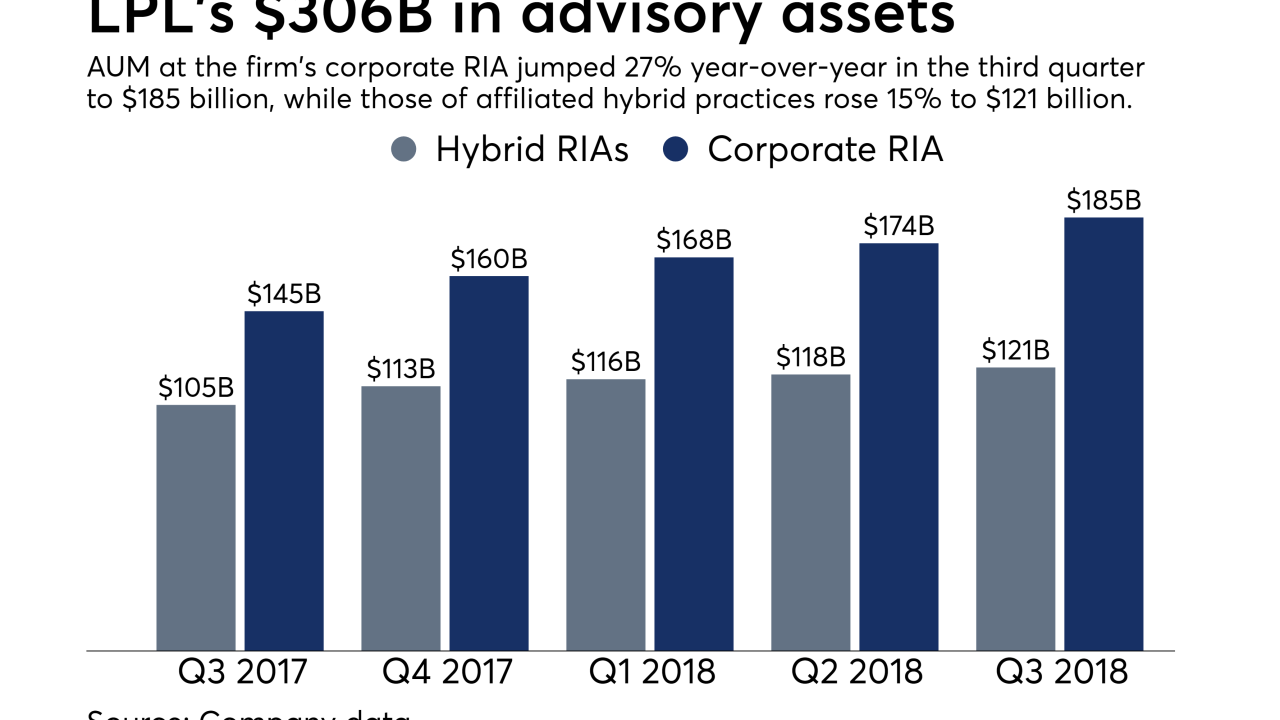

The No. 1 IBD’s advisory AUM flows show results from the company’s efforts to reward advisors for choosing its custody instead of outside firms.

December 19 -

Former Securities America rep Hector May carried out a 20-year scam through his outside RIA, according to prosecutors

December 17 -

The 50 largest teams and OSJs to change their affiliations show both the threat to incumbent firms posed by RIAs and the scale afforded by acquisitions.

December 17 -

The IBD and its subsidiaries’ 2,300 advisors appear to be facing a sale by its parent, with bidding reported to be starting as soon as next week.

December 14 -

Evan Guido is looking to partner more closely with CPAs.

December 13 -

Independent Advisor Alliance and Private Advisor Group — two of the firm’s largest hybrid RIAs — say they’ve added billions in clients assets from IFP.

December 13 -

Macroeconomic trends and matters of convenience will move advisors, assets and markets next year in the ever-changing wealth management space.

December 11 -

Six major trends to watch next year include M&A and the breakaway broker movement.

December 10 Diamond Consultants

Diamond Consultants -

Wealth management transaction activity will reach a record level for the sixth straight year in 2018, according to one forecast.

December 7 -

The rarely dinged firm joined peers grappling with two issues: mutual fund fees and supervision of advisors who've been sanctioned multiple times.

December 6 -

The firm will test markets in a few cities next year in a bid to keep pace with a shifting wealth management landscape.

December 4 -

The representative had already been permitted to resign and suspended by state regulators, but the firm lost its case for additional damages.

December 4 -

AdvisoryWorld will operate as an independent subsidiary under the No. 1 IBD while adding new offerings for its 30,000 advisor and institutional clients.

December 3 -

With 27,000 advisors on the move this year in wealth management, the industry remains in a period of flux.

December 3 -

B. Riley is grabbing a majority stake in National Holdings while pledging to be a passive investor in the overhauled firm.

November 30 -

The executive argues the firm’s ownership structure is giving it a leg up — rather than posing the issues for advisors decried by critics.

November 29