M&A

M&A

-

Pete Dorsey is the latest member of TD Ameritrade’s leadership team to part ways with the company after it was acquired by Charles Schwab.

February 23 -

The unit has $603 billion of assets under management and employs more than 450 investment professionals.

February 23 -

The agreement will expand the companies’ recruiting efforts in the bank and wirehouse channels.

February 17 -

A merger would value Apex and Northern Star Investment Corp. II at as much as $5 billion, a personal familiar with the matter said.

February 12 -

With few areas of growth in 2020, insurers are focusing on burgeoning RILAs and finding more distribution channels, experts say.

February 11 -

-

The company, which has seen headcount increase 45% since closing the deal, has eliminated more than 1,000 positions in recent months.

February 9 -

The private equity-backed firm’s deal could tack on some 900 advisors to its ranks.

February 8 -

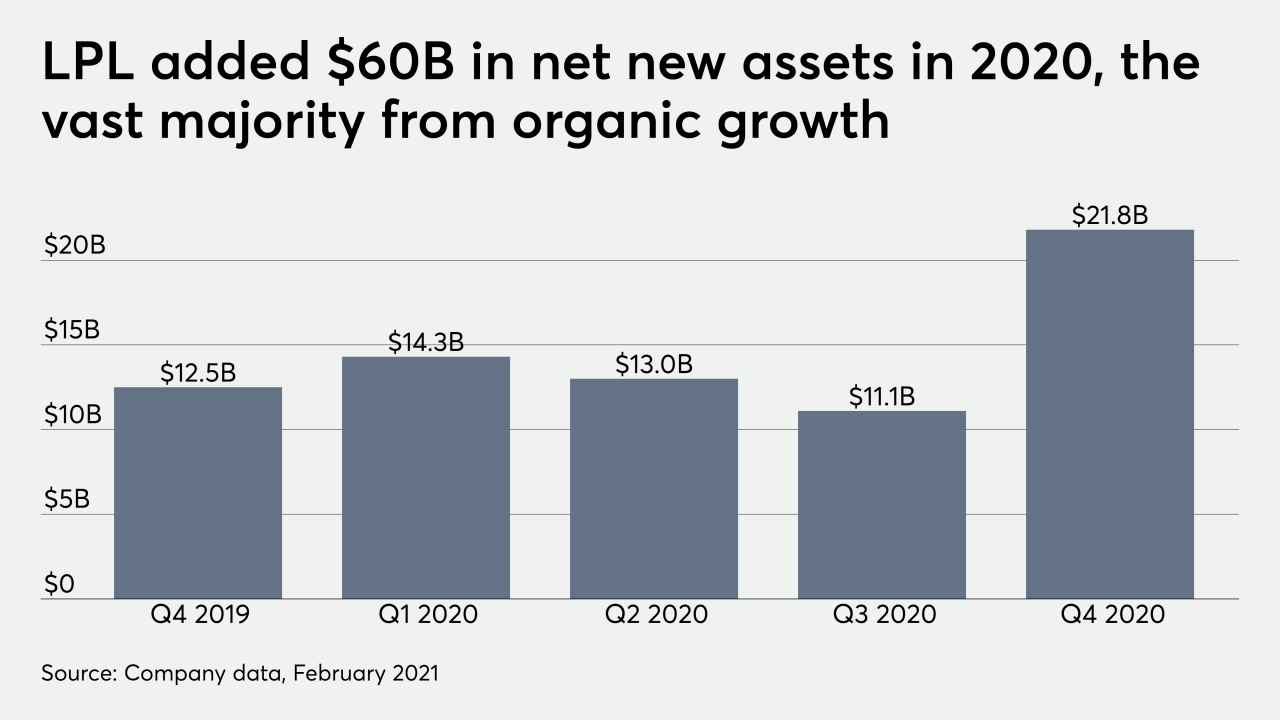

As the No. 1 IBD rolls out M&A services to advisors this quarter and reels in record recruits, Dan Arnold says the firm is experimenting.

February 5 -

The practice received a recommendation from a surprising source and wound up picking its suitor after only a three-month search.

February 5 -

The acquisition of another midsize wealth manager will boost the holding company above 2,500 reps with nearly $95 billion in AUA.

February 3 -

The combined company will service $4 trillion in assets and is valued at $1 billion.

February 3 -

Despite the credit-positive reading by one agency, the IBDs are competing against less leveraged rivals.

February 1 -

Sammons is trying to solve the longtime question of how best to combine planning with certain products through technology.

February 1 -

CI Financial has inked 14 deals for RIAs in less than a year — taking the lead in a hot M&A market.

January 28 -

Acquisitions of wealth management, insurance, fintech and other firms are expected to pick up as banks seek new sources of fee income and look to improve digital capabilities.

January 27 -

Among the new hires is Scott Collins, former head of brokerage independence and institutional sales consulting. He is one of many ex-TD Ameritrade alums seeking new employment after Charles Schwab acquisition’s of the firm.

January 26 -

Arete Wealth’s niche focus on alts for HNW and UHNW clients has given it a strong foothold in a fractured sector, experts say.

January 22 -

To streamline the company, CEO Charlie Scharf has been looking to sell certain businesses since taking over in 2019.

January 15 -

The founding partners of the 300-advisor OSJ will remain in their current roles for three years under the same structure as before the deal.

January 13