-

FNG is one of a growing number of actively managed ETFs that have the freedom to tune their exposure whenever they want.

August 2 -

Managers will actively evaluate an asset’s characteristics — its value or momentum, for example — to determine what to buy.

August 1 -

The revamped fund from BP Capital will now track an index of companies that derive “significant revenue” from sustainable energy.

July 30 -

Clients often underutilize deductions for work-related technology purchases and travel expenses.

July 30 -

ESG-focused Swell Investing wasn’t able to gain “necessary scale,” according to the firm.

July 26 -

The IBD network joins asset managers and other companies developing new methods to display how the products integrate into client portfolios.

July 26 -

On the surface, ETFs seem like a natural fit for ESG investors, but there’s an key difference between the two.

July 25 -

370 U.S equity smart beta ETFs on the market mean advisors can pick and choose when fine-tuning clients’ portfolios.

July 25 -

It's important to categorize necessary and discretionary expenses, but advisors need to know how clients are defining them.

July 23 -

The independent broker-dealer differentiates itself from competitors by offering an active portfolio and by giving access to advisors rather than clients.

July 15 -

This basketball analogy can help you explain how portfolio diversification works across multiple asset classes.

July 12 -

The firm has shed fund holdings in defensive sectors such as health care and consumer staples.

July 11 -

The deal underscores an industry trend combining planning with portfolio management.

July 11 -

The new digital products are a significant opportunity for the bank, experts say.

July 10 -

For clients’ portfolios that need international diversity, these funds focus on the region.

July 9 -

The app allows wealthy investors to get quick answers to complex questions, CEO Eric Poirier says.

June 19 -

A team of Bank of America specialists help the superrich diversify with farms, ranches and other alternative investments.

June 17 -

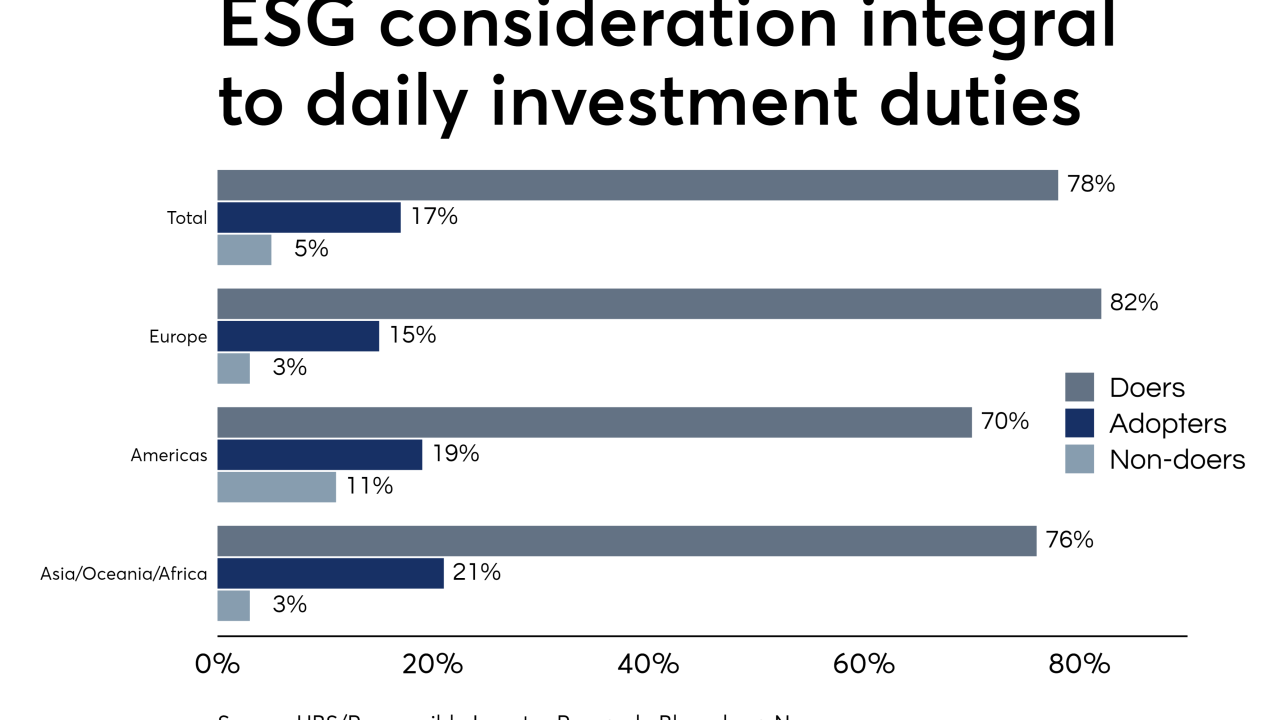

The “materiality of risks with not considering" the strategy is the primary consideration for its implementation, a UBS survey finds.

June 17 -

The losers “offer exposure to extremely narrow and volatile segments of the market,” an expert says.

June 13 -

The firm hopes to follow advisors' lead on what's best for their business in its outsourced advisory models, says CIO Burt White.

June 12