Regulation and compliance

Regulation and compliance

-

The SEC and FINRA have launched groups focused on better understanding this growing area of the industry.

April 29 -

An advisor was terminated after accepting money from a brother, who was also a client. Is such a loan allowed?

April 29 -

The allegation was laid out in an SEC order, which hit a U.S. unit of the firm with a $500,000 penalty.

April 26 -

Previous Republican and Democratic presidents have declined to assert authority over independent agencies, partly because the legal issue isn’t simple.

April 25 -

Increased captive insurance coverage due to expanded business in 2018 was a primary driver of a three-year high in regulatory spending, the firm says.

April 24 -

The earlier they begin planning, the easier it'll be to avoid a big tax hit.

April 23 -

The fintech company, which was forced to rebrand its cash management product last year after misleading marketing caused a backlash, is seeking a national bank charter.

April 22 -

The proposed rule will need substantial revisions before it wins the support of the commission's sole Democrat.

April 22 -

Frederick McDonald Jr. is accused of failing to disclose key risk factors regarding the complex world of the cannabis manufacturing industry.

April 18 -

The change will boost the firm’s “ability to reach a dramatically larger audience,” said CEO Stephen Schwarzman.

April 18 -

Capital gains tax rates are not just taxed at a single, more favorable, rate anymore.

April 17 -

While seeking input on how to better nationally integrate operations, the FPA has scrapped the idea of wrapping all chapters into a single legal entity — for now.

April 17 -

The move suggests that the SEC’s proposed Regulation Best Interest isn’t strong enough for some.

April 16 -

The regulator is on high alert as more than 10% of new launches last year targeted a theme.

April 15 -

PR campaigns won’t be enough to salvage the bank’s reputation after a series of scandals. Instead, it should look into adopting a new name, among other crucial steps.

April 10 -

FINRA, Morningstar and Nasdaq have already migrated to the cloud. Should RIAs follow?

April 9 -

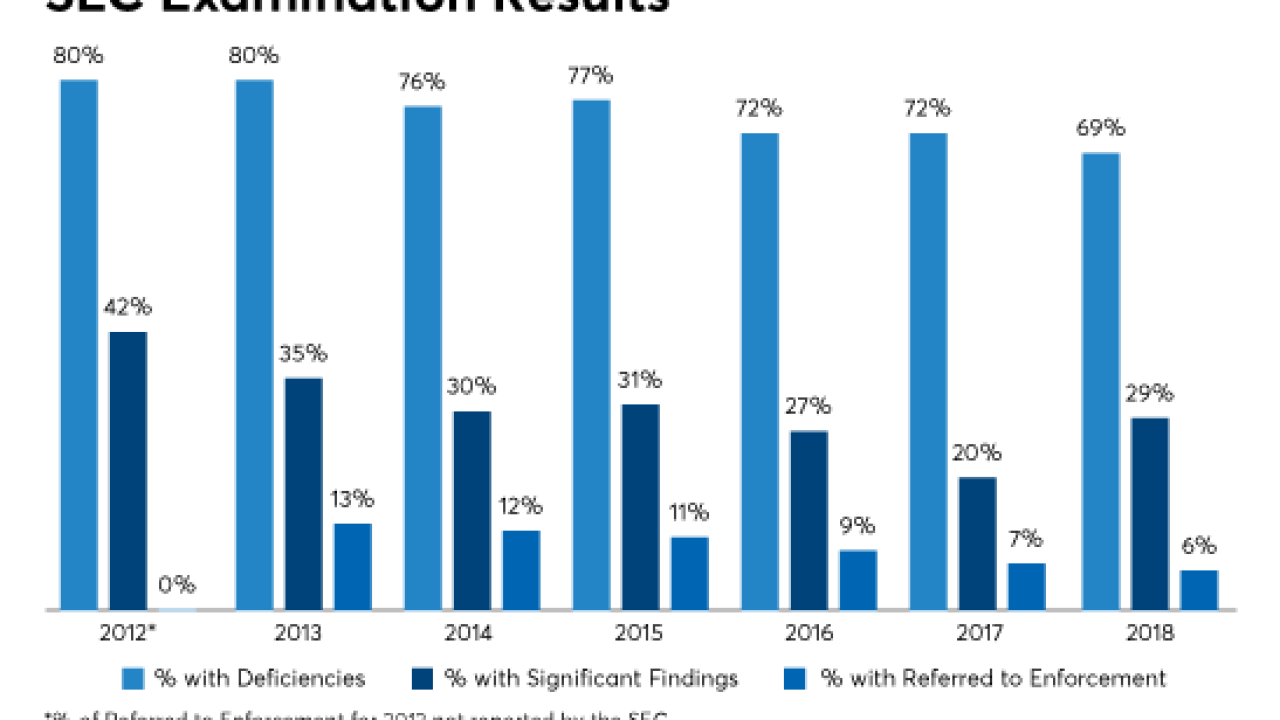

Audit volume is up but compliance issues are down — with cybersecurity as the wild card.

April 9 -

Andreessen Horowitz — one of the richest and most famous firms on Sand Hill Road — is giving up its VC designation.

April 8 -

Having ‘fessed up to improper 12b-1 fee disclosures, dually registered advisors might still be excluded by FINRA.

April 8 -

Since Wells Fargo’s phony-accounts scandal broke in 2016, the bank has appeared contrite in public. In private, it’s a different story.

April 7