Regulation and compliance

Regulation and compliance

-

Nov. 6: Platforms like FundKeeper are aimed at helping retirement account advisors comply with the DoL’s fiduciary rule.

November 3 -

Trump's pick might have to manage a recession, given that the current expansion would become the longest ever in the next four years.

November 2 -

Who would the changes help — and hurt? Baird’s director of advanced planning weighs in.

November 2 - Finance and investment-related court cases

Lies about being in contact with clients were the real reason the whisteblower was fired, according to a defendant and key witness for the bank.

November 2 -

The department's proposal furthers efforts to undo the controversial regulation.

November 2 -

Here’s what to tell your clients about investing in marijuana.

November 1 -

With the compliance deadline nearing, regulators have yet to make key decisions on dark pools, rules clashes with foreign markets and data collection.

November 1 -

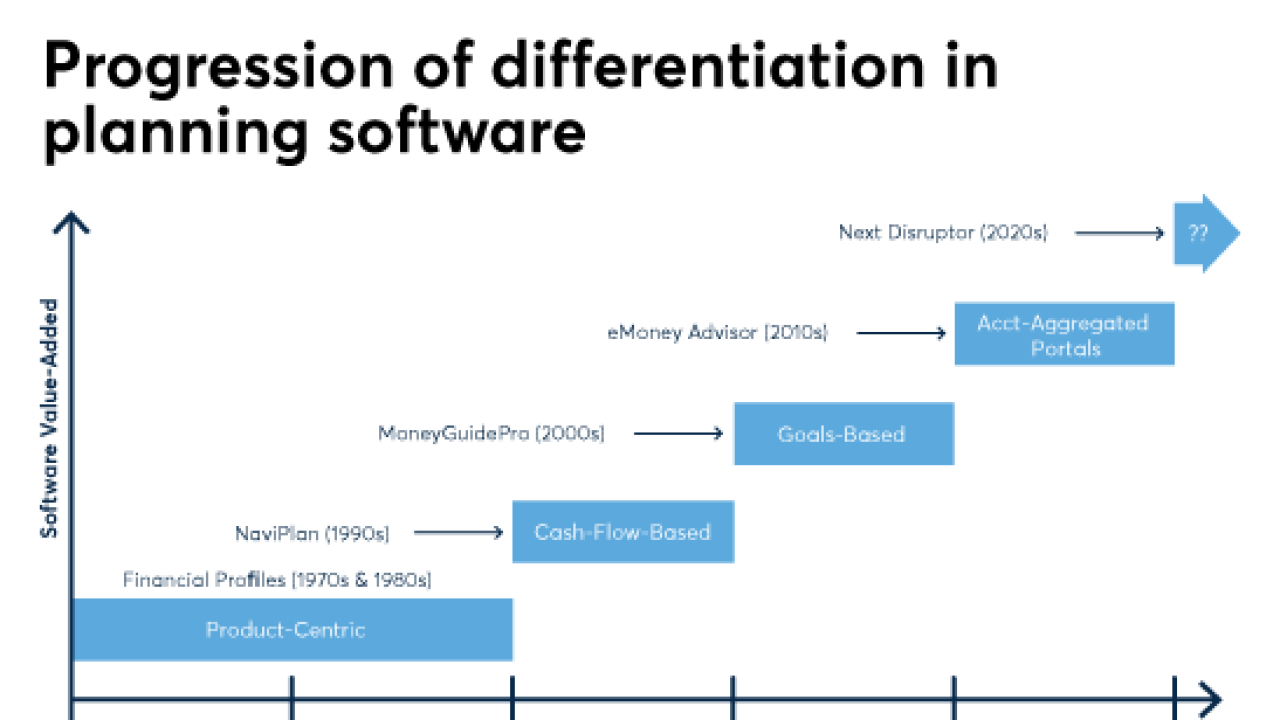

An abundance of software and practice tools has planners and firms overwhelmed. Here’s what it means for the industry.

November 1 -

Tom Buck was once a top-ranked Barron's advisor at the wirehouse, where he worked for more than 30 years.

October 31 - Finance and investment-related court cases

A former vice president in the private wealth management group claims she was fired for investigating suspicions that a client might be involved in fraud or money laundering.

October 31 -

Taxpayers face a penalty known as an individual shared responsibility payment if they do not comply, IRS says.

October 30 -

Institutions are regularly compiling large amounts of data in their quest for enhanced disclosure, an expert writes.

October 30 -

New solutions offer plenty of features but lack focus.

October 30 -

Susan Axelrod will leave the self-regulator after 28 years on the job.

October 27 -

Oct. 30: After experiencing two major bear markets, younger generations are demanding products that are easy to understand and offer transparency.

October 27 -

Speaking to hundreds of industry executives, Jay Clayton said his agency can't simply supplant the Department of Labor.

October 26 -

The advisor reportedly sold $48,500 worth of securities in a purported computer products wholesaler without disclosing the transactions to his then employer, J.P. Morgan Securities.

October 26 -

The move comes as part of a wider push to deepen the firm’s offerings across income-generating assets.

October 26 -

CEO Jim Cracchiolo reported record client assets and a sharpened focus under the fiduciary rule.

October 25 -

"This bill is a giant wet kiss to Wall Street,” Senator Elizabeth Warren says.

October 25