-

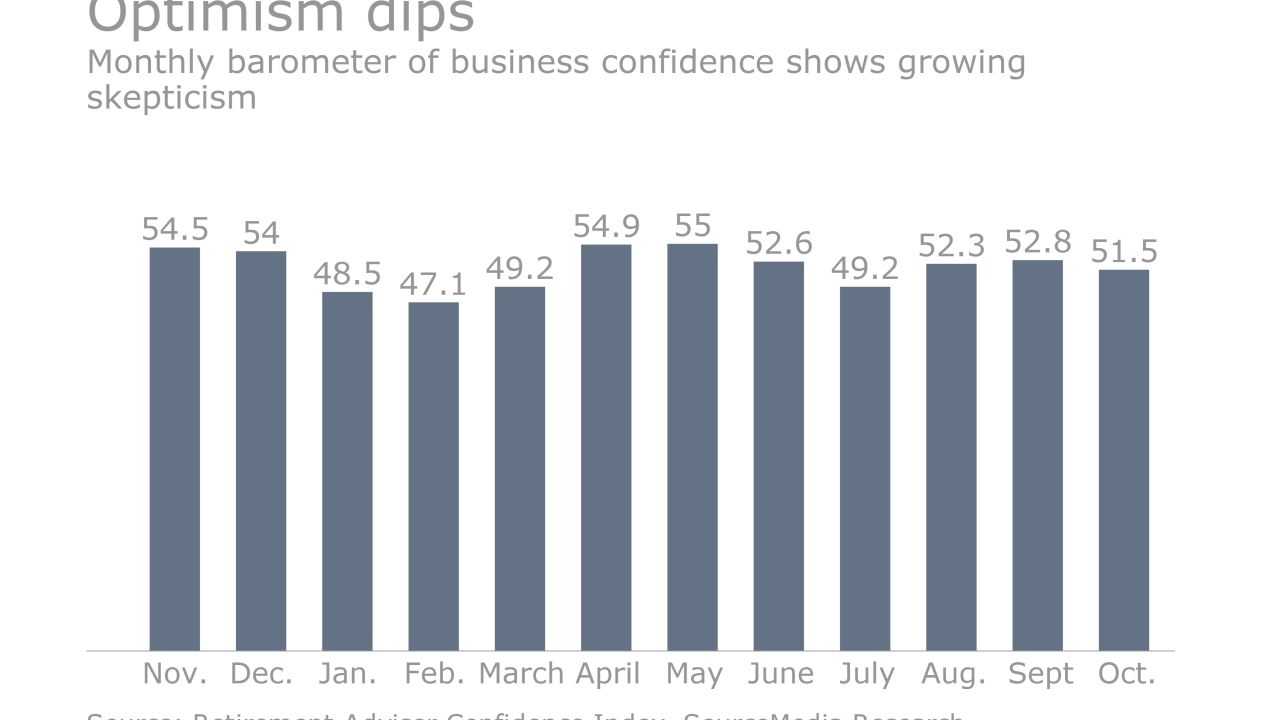

The quant crowd is justifiably concerned by the lack of objective statistics available.

June 6 -

-

Investors in higher-beta credit funds are shunning longer-duration debt following recent equity turmoil.

February 15 -

It’s time to broaden our understanding — and assessment — of risk composure.

February 2 -

-

-

The Roth 401(k) is more flexible than a Roth IRA, and it is funded with after-tax dollars, which can help "diffuse the potential tax bomb."

November 6 -

-

Fintech entrepreneurs with a common mission: to help planners, not disrupt them.

August 30 -

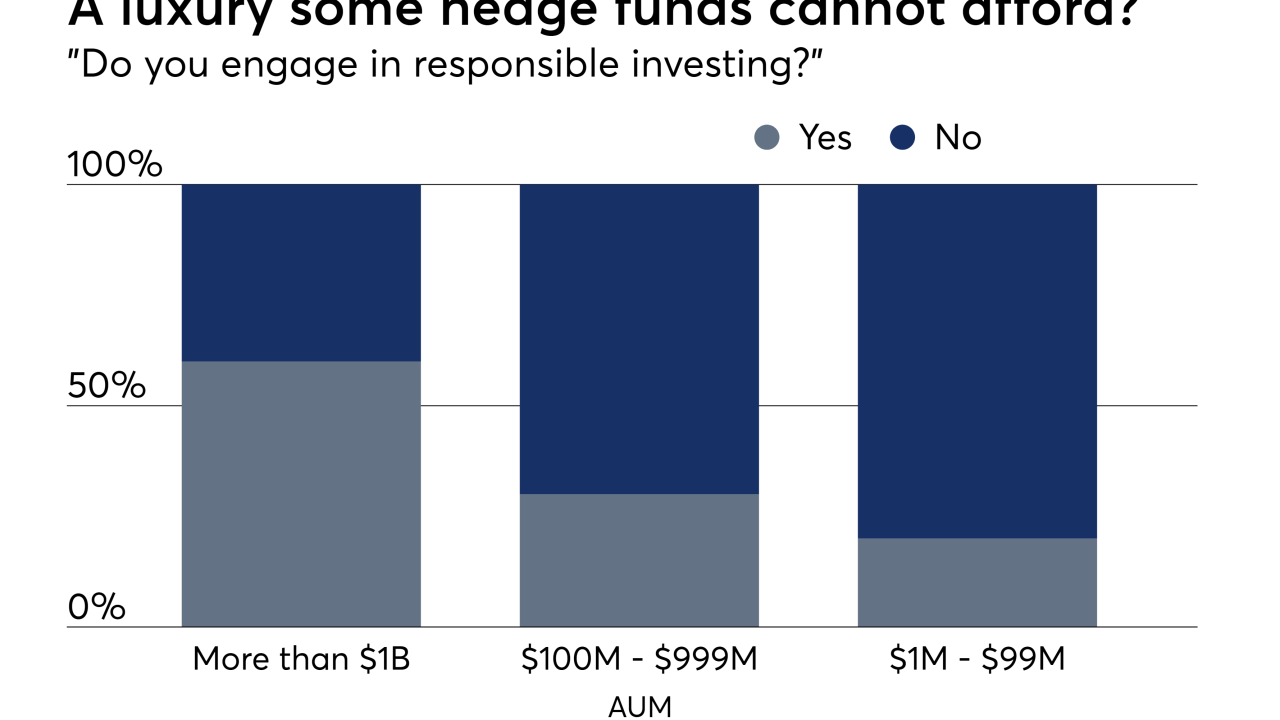

Some platforms are promoting their approaches to attract more sophisticated young investors.

August 9 -

-

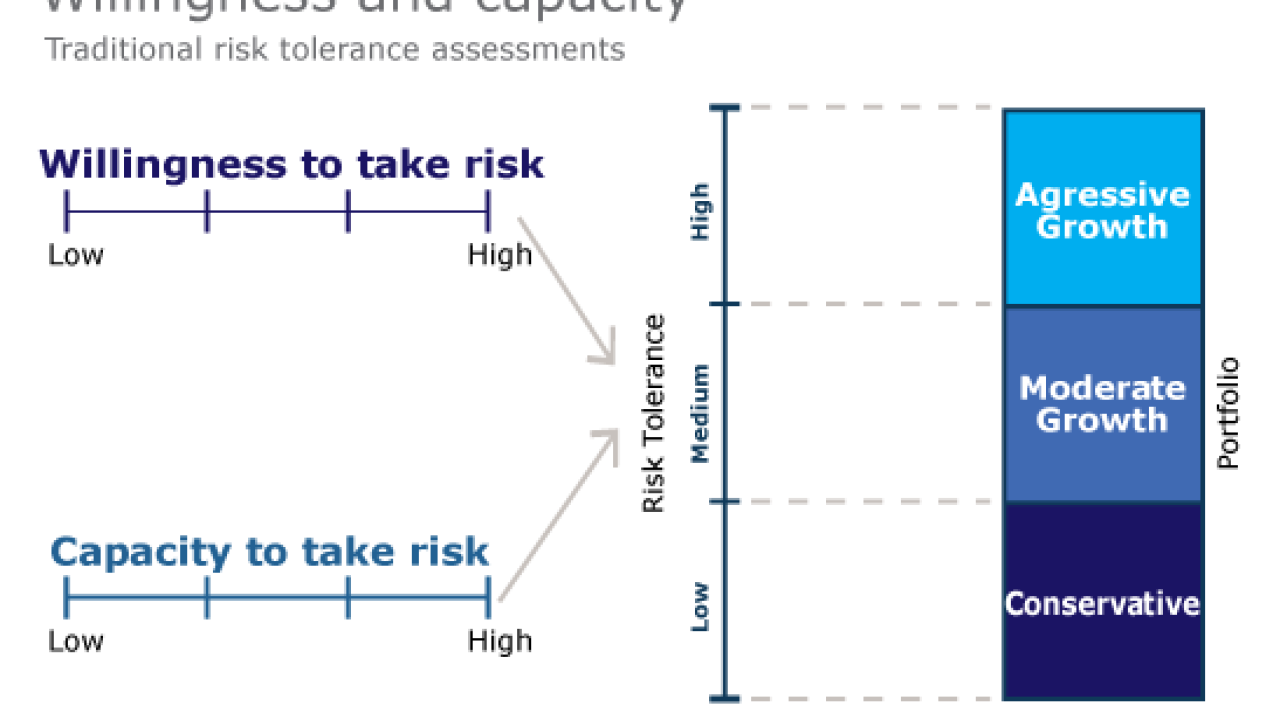

Advisers often use one number to determine a client’s appetite for — and ability to absorb — market risk. And that’s a problem, Michael Kitces writes.

March 19 -

-

Everyone knows the mantra buy low, sell high, but they do the exact opposite because they don’t know their own risk tolerance.

February 14 -

-

-

Flawed questionnaires, conflicting interests, unclear regulatory stances — it’s a mess, but it can only get better.

October 11 -

Use upside and downside capture ratios to analyze potential investment products, as well as help those who are nervous feel calmer about their portfolio.

September 29 -

Advisers must be creative and persistent in figuring out risk tolerance levels.

June 3 -

Even after Congress phased out two popular claiming strategies, you should remind clients they can increase their benefits simply by being patient.

May 17