-

Under the proposals, the top 0.1% of earners would be subject to a 43% tax rate on their income.

September 14 -

Clients may have an ability to increase the ratio of after-tax dollars in their account by completing one or more transactions that are exempt from the pro rata rule.

September 11 -

To protect client nest eggs, advisors must know which savings vehicles are protected — and they’re not all created equal.

September 10 -

Effective tax management can add 1% percent to a portfolio annually, and potentially more in highly volatile years

September 8 Commonwealth Financial Network.

Commonwealth Financial Network. -

Waiting until year end to factor in portfolio volatility is risky business.

September 4 Russell Investments

Russell Investments -

It may seem counterintuitive, but paying appreciably more taxes in 2020 could save families a lot of money down the road.

August 31 Proquility Private Wealth Partners

Proquility Private Wealth Partners -

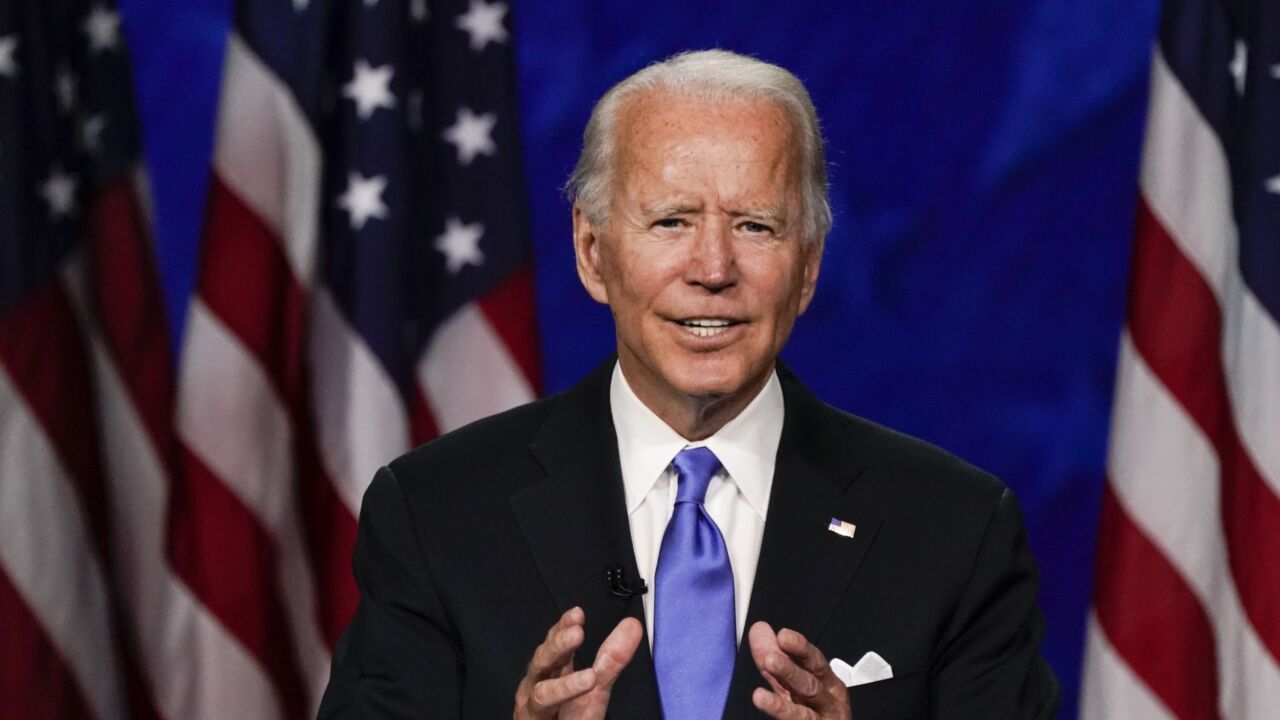

The president has deferred payroll taxes that fund the program, and says he would eliminate them if elected to a second term.

August 27 -

Depending on the economy and the election, they could be on the chopping block as soon as 2021.

August 26 Cresset Asset Management

Cresset Asset Management -

New regulations have altered advice for Social Security, Roth conversions, tax code, estate planning and much more. Financial plans must be crafted with enough flexibility to change with the times.

August 24 Commonwealth Financial Network

Commonwealth Financial Network -

Gifting embedded loss assets can avoid a step-down in basis and preserve capital losses. Here's how to go about it, under several scenarios.

August 24 -

From regulations to taxes, big changes could be in the offing.

August 20 -

The president said his action authorizes the U.S. Treasury to allow companies to defer — not suspend — payroll taxes for Americans making less than $100,000 a year from Sept. 1 through Dec. 31.

August 10 -

Here's an at-a-glance guide to the candidates' positions on individual taxes.

August 5 -

Tax-rate arbitrage is one approach, but it’s far from the only one, according to contributor Michael Kitces.

August 4 -

Any tax increases on high-income individuals and corporations would be offset by massive spending packages targeted at accelerating the country’s recovery from the coronavirus, according to the firm.

July 31 -

Educating clients with startup businesses on the new regulations can help them provide for employees without breaking the bank.

July 29 Commonwealth Financial Network

Commonwealth Financial Network -

The majority of advisors don’t understand how much of a positive difference they can make for their clients, says advisor Deborah Fox.

July 28 -

Many clients have seen the value of their investment accounts drop, making this a good time for planners to prove their value

July 27 Prudential Financial

Prudential Financial -

The COVID-19 pandemic has infected the service’s annual list of top tax scams.

July 20 -

“Time is quickly running out for these taxpayers," IRS Commissioner Chuck Rettig said in a statement.

July 6