-

Looking for a new challenge, Mark Seither found the complexities of pilot compensation and tax planning to be a niche that energizes him.

January 23 -

Brokers were worried a new rule intended to lighten their responsibility to monitor advisors' side hustles would ironically mean greater supervision duties with RIAs.

January 22 -

The results of Morningstar's latest study tracking fees and performance finds accelerating consolidation and commodification that makes advice more valuable.

January 22 -

A Ninth Circuit appellate panel ruled that10 advisors recruited to LPL from Ameriprise have the right to resist turning over their personal devices to a forensic examiner to be searched for evidence of misappropriated client data.

January 21 -

Even as crypto prices slide, a growing share of financial advisors are adding digital assets to client portfolios, with firm policies slowly catching up.

January 21 -

An internal successor, a seller and an acquirer dish out the most common mistakes they say advisory firms must avoid to address the challenge.

January 21 -

As adoption of the dual-wrapper products accelerates, so will questions about timing, pricing and residual balances.

January 21 Nottingham

Nottingham -

Roughly 100 employees — mostly in management — are expected to move to the wealth management unit's new headquarters in booming South Florida.

January 20 -

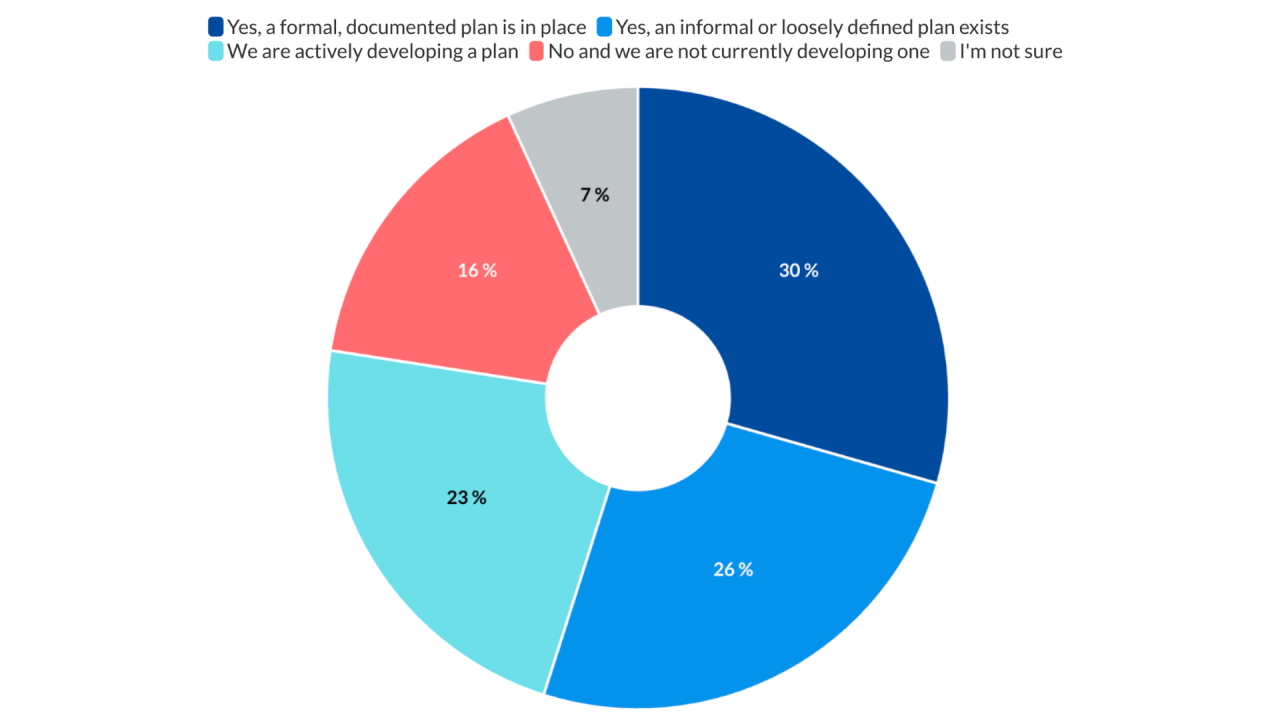

Many owners of privately held businesses are planning to sell at least part of their interests in the firm in the next five to 10 years, a Raymond James study found.

January 20 -

Plus, Wells Fargo and Raymond James pull more teams from Commonwealth/LPL, and Elevation Point takes a stake in a UBS breakaway.

January 16 -

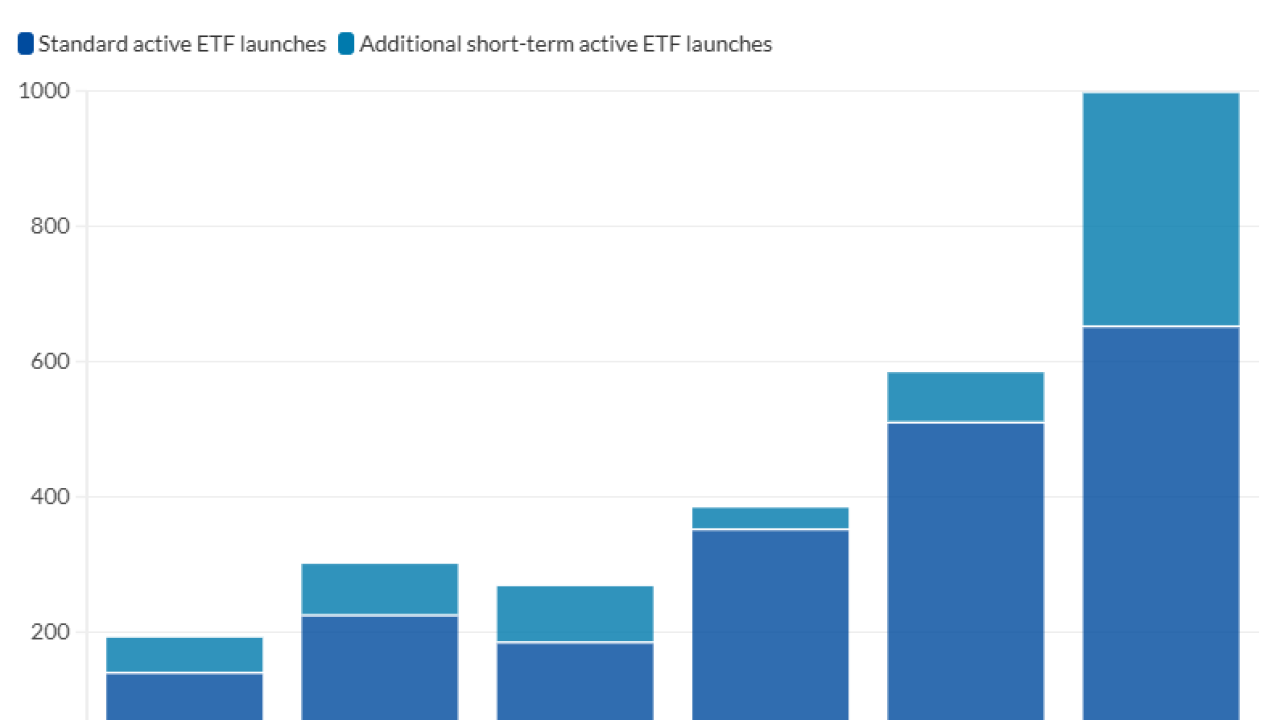

Regulators officially approved 30 more funds last month, with more expected authorizations in 2026. Will financial advisors and their clients bite?

January 15 -

The wealth management giant capped off 2025 by pressing ever closer to the asset and wealth management target set by former CEO James Gorman.

January 15 -

Clear and early communication, with coworkers as well as clients, is key when planning for a long leave.

January 15 -

Once rare, the same kind of permissive terms that are widespread on leveraged loans are becoming increasingly common in the $1.7 trillion private credit market.

January 15 -

Philadelphia-based Clark Capital will be one of several "boutique" firms in Raymond James' global asset management division.

January 15 -

An organic growth technology firm launched out of Fidelity Investment's incubator spoke with 18 big RIAs about their marketing. The results speak for themselves.

January 14 -

A sharp fourth-quarter decline in net new investment assets weighed on Citi's wealth division, tempering full-year growth despite revenue gains.

January 14 -

Bank of America's wealth management businesses suffered a blow last year when principals of a team that managed $130 billion in AUM left for independence. Merrill executives are now looking to the future with ambitious recruiting and cross-selling plans.

January 14 -

Tax-loss harvesting's overlooked cousin can pay off for clients with low-earning years, concentrated positions or UTMA accounts.

January 14 Natixis Investment Managers Solutions

Natixis Investment Managers Solutions -

The massive intake preceded the BNY-owned custodian's rollout of a new financial advisor matchmaking service aimed at conversions from institutional clients.

January 13