The ETF issuer behind funds tracking robotics and social media is now looking to cash in on the spotlight on China amid escalating trade tensions with the U.S.

-

Investors have grown cautious following October’s rout in global markets.

November 21 -

Fed Chairman Jerome Powell's dovish comments revived global demand for riskier assets.

November 29 -

The actively managed offering aims to invest in corporate and non-corporate obligations, excluding government-guaranteed issues.

August 15

Global X Management has launched six new China-focused ETFs, a broad-market large-cap fund and five tracking Chinese stock market sectors. They join Global X’s existing group of six other China sector funds to correspond with each of the eleven major economic sectors identified by the Global Industry Classification Standard, according to a statement from Global X.

U.S. investors normally do a very superficial analysis when considering exposure to China, said Jay Jacobs, Global X’s head of research and strategy. But trade war tensions have driven a wedge between the performance of different sectors, pushing investors to want to be more targeted, he said.

“There are a lot of different policies and geographic trends developing within the Chinese economy that we think just requires a more precise approach to China, rather than just saying, ‘I’m going to buy a broad benchmark,’” Jacobs said.

Many U.S. stock funds posted double-digit percentage gains, but international equities fared even better. Which were the biggest winners?

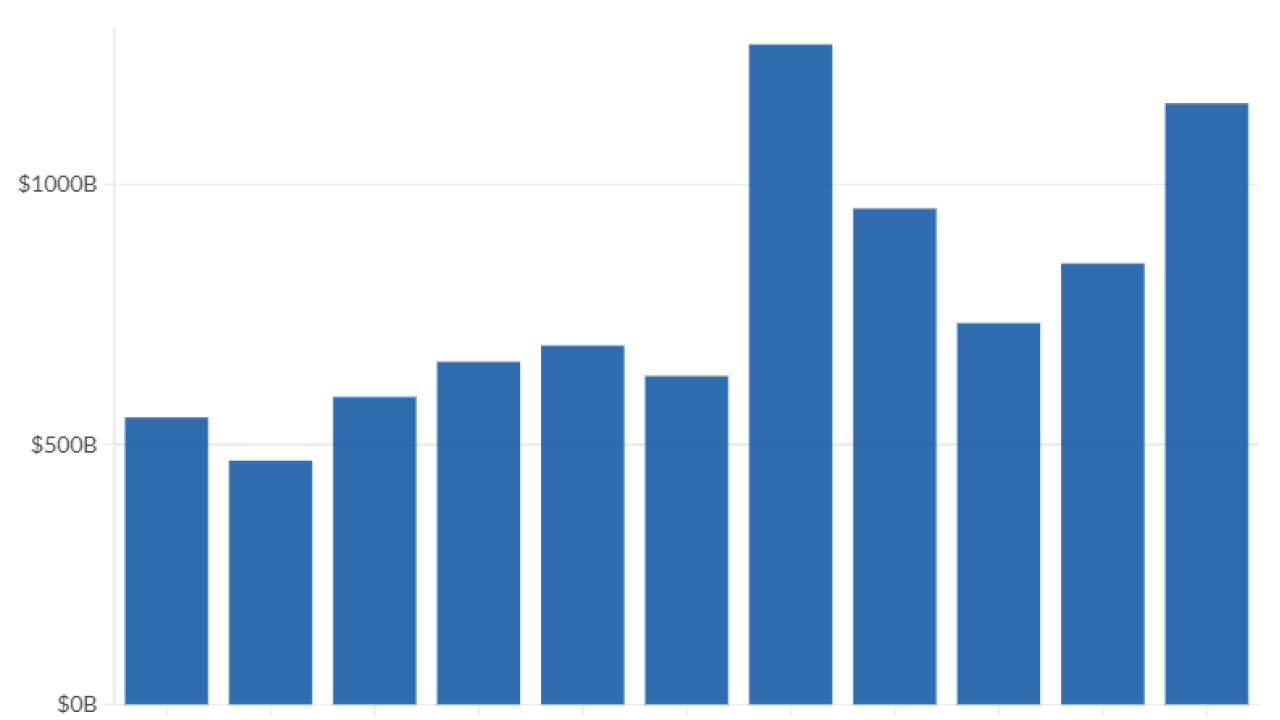

Chinese stocks have been battered this year, pressured by the rising dollar, U.S. yields and trade tensions with the U.S. that have weighed on emerging markets since March. The MSCI China Index is down around 18% this year and had fallen for five straight days before rising slightly Tuesday, but the performance among sectors within the index has diverged considerably. Utilities are the top performing sector, up 8%. The leading decliner, the consumer discretionary group, is down around 35%.

“Let’s say I wouldn’t want to invest in Chinese energy companies because they do business with sanctioned countries and there’s a risk that they could be sanctioned by the U.N.,” said Andy Wester, a senior investment analyst at Proficio Capital Partners. “I could avoid that exposure, if I didn’t want it, by not investing in a China Energy ETF, and maybe choosing something that’s Internet-focused, given the eye-popping revenue and earnings numbers.”

Information technology stocks have also been a heavy drag on benchmarks, after rallying for six straight years. Following the slump, some investors think valuations are attractive — Goldman Sachs is overweight in China’s A- and H-shares, even as it sees the country’s growth slowing down next year.