Toby is a veteran journalist with more than a dozen years of experience in the field who joined Financial Planning in 2017 after prior tenures with the New York Daily News, Commercial Observer and City Limits. He earned an undergraduate degree in the humanities from the University of Texas at Austin and a master's degree in journalism from the Craig Newmark Graduate School of Journalism at the City University of New York. He has won a dozen business journalism awards during his time with Financial Planning, including those received for the 2020 podcast series "

-

Financial advisors, asset managers and researchers are racing to fill in the information gaps Americans reported in a new J.D. Power survey.

May 21 -

FINRA arbitrators ordered the wealth manager and closed-end funds manager to pay damages as it resolves outstanding claims stemming from the island’s fiscal crisis.

May 21 -

The advisor, who is Egyptian American, lost most of his client accounts to a white rep who poached them with support from management, a new lawsuit claims.

May 20 -

After Brooklynn Chandler Willy recommended that the clients invest $100,000 into an LLC, its principals were arrested on federal fraud charges, the filing says.

May 20 -

In a panel discussion, three financial advisors explained why the products are often misunderstood and how to assist clients in evaluating their policies.

May 19 -

The Connecticut Democrat has introduced comprehensive legislation in each Congress since 2014. What are its prospects in this session?

May 19 -

Two advisors left their prior firm of 10 years after the bank’s wealth and asset management unit generated record net income in the first quarter.

May 18 -

The giant retirement plan recordkeeper’s BD didn’t adequately file suspicious activity reports for more than three years, according to investigators.

May 18 -

The quartet of financial advisors leaving UBS after a decade also has an advisor with an equestrian specialty.

May 14 -

Financial advisors and even competitors to Robinhood say the self-directed service has opened the door to new potential clients.

May 13 -

A barred broker’s alleged version of the “infinite banking” strategy recommended that clients liquidate their 401(k)s or IRAs to buy variable annuities.

May 13 -

At FP’s INVEST conference, executives from major firms explained how the coronavirus has altered the advisor and client experience for the long term.

May 12 -

With Edward Jones poised to settle a racial discrimination class action for $34 million, what does the case say about the state of diversity and inclusion in wealth management?

May 12 -

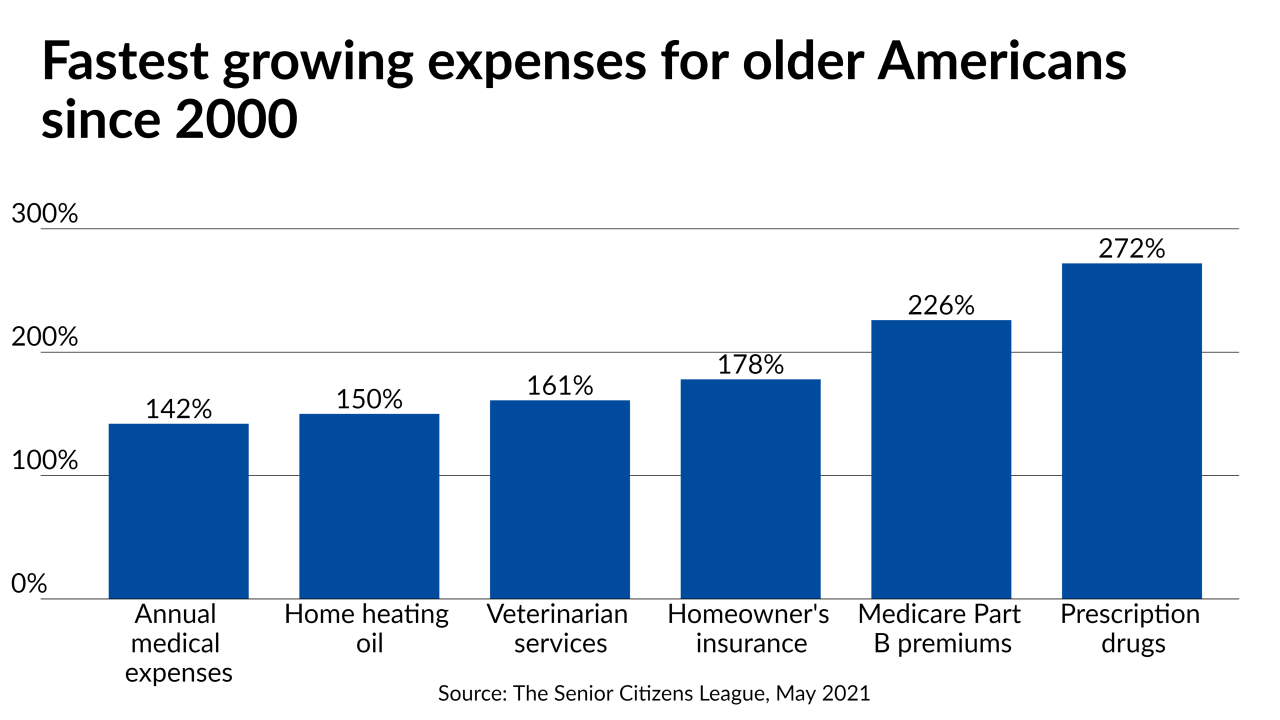

The Senior Citizens League made its forecast amid inflation fears and as advocates criticize the formula for calculating the annual adjustment.

May 12 -

After its industry-leading headcount dipped slightly during the temporary ban, the wealth manager plans to offer more resources for incoming recruits.

May 10 -

The RIA completed seven transactions in the first quarter, along with starting a new international venture in partnership with the billionaire Hinduja family.

May 10 -

The team managed $1.5 billion in client assets with Merrill Lynch, and they chose an RIA with ties to the wirehouse working in its favor.

May 7 -

The tax-focused wealth manager’s parent disclosed lower first-quarter earnings after an eventful period marked by a proxy fight and a reported acquisition offer.

May 7 -

The enterprise could reach more than 50 registered representatives in the next couple of months, depending on how many of them leave MassMutual.

May 6 -

As its advisor headcounts in the W-2 channel have stagnated, Raymond James Advisor Select added a major former UBS quartet.

May 6