Toby is a veteran journalist with more than a dozen years of experience in the field who joined Financial Planning in 2017 after prior tenures with the New York Daily News, Commercial Observer and City Limits. He earned an undergraduate degree in the humanities from the University of Texas at Austin and a master's degree in journalism from the Craig Newmark Graduate School of Journalism at the City University of New York. He has won a dozen business journalism awards during his time with Financial Planning, including those received for the 2020 podcast series "

-

The Ladenburg IBD failed to spot the red flags of a barred ex-advisor who later pleaded guilty to fraud, former clients say.

April 3 -

Dan Arnold received $7.1 million in 2018, far below the longer-tenured chiefs of rival firms Ameriprise and Raymond James.

April 1 -

Nina O’Neal is set to launch the Female Advisor Network, joining a number of planners taking diversity matters into their own hands.

April 1 -

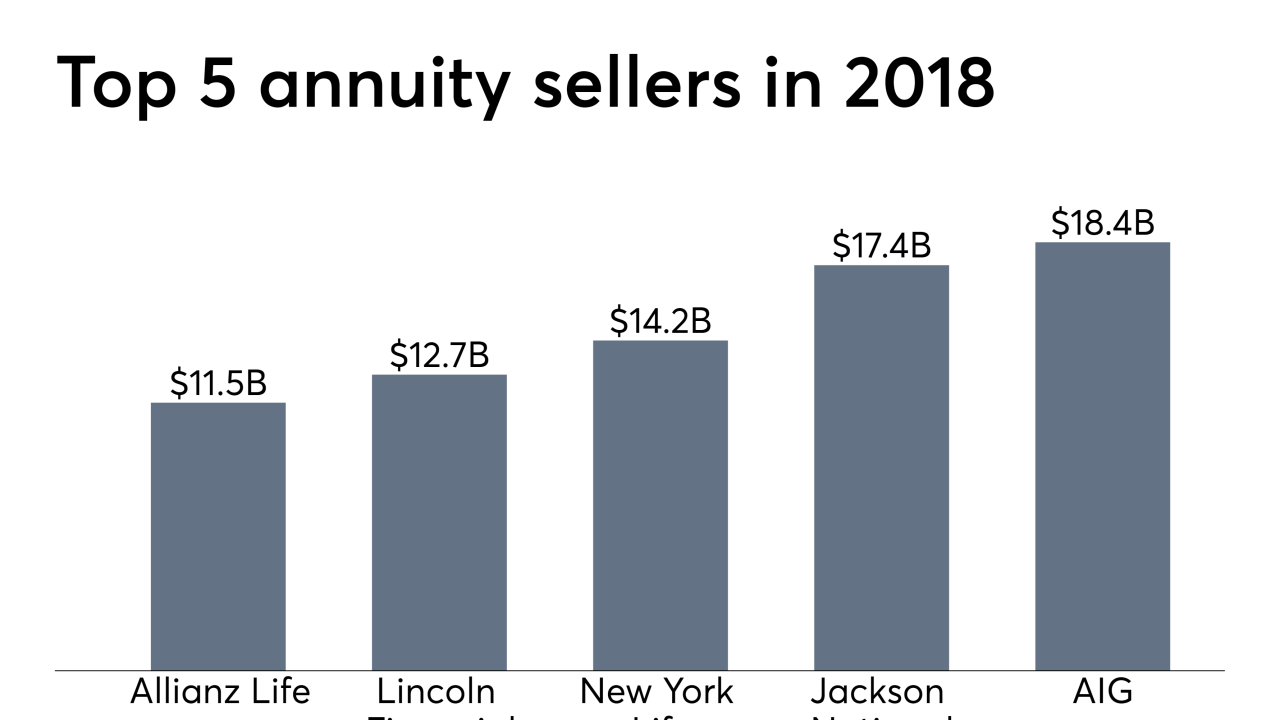

Growing fixed products, along with new fee-only offerings, are changing the shelf and the carrier rankings.

March 28 -

Arkadios Capital poached three advisors from its founders’ former firm after its revenue more than tripled in 2018.

March 27 -

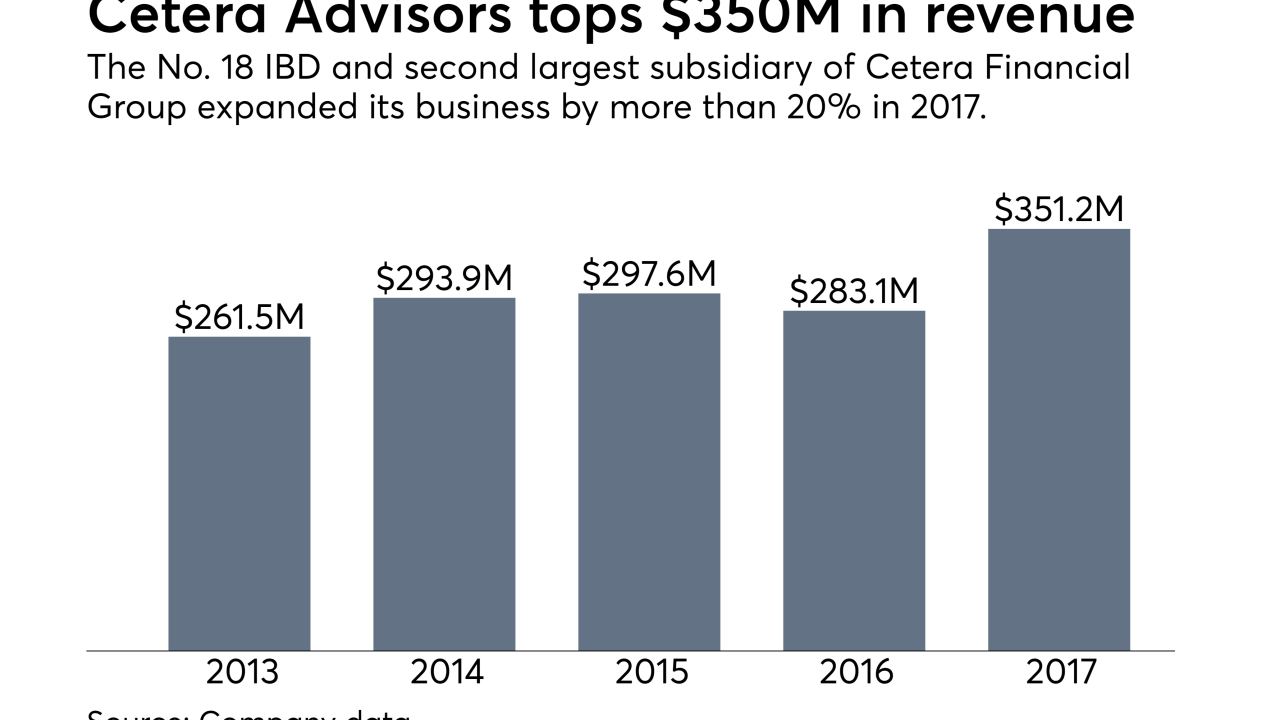

Ladenburg Thalmann’s largest IBD also says it recruited more than 300 advisors with $2 billion in AUM in 2018.

March 21 -

The advisor trio joined the firm after its best recruiting year ever.

March 20 -

Should advisor retention go as planned, Blucora's agreement to purchase the firm would boost its IBD headcount to 4,500 reps.

March 19 -

Commissions and cash-sweep revenue jumped by more than a combined $100 million in 2018 — even as the parent firm’s longtime chairman left the company.

March 15 -

The group with $175 million in client assets opted for a Ladenburg IBD they think is less likely to change hands in the future, the OSJ manager says.

March 14 -

Fourth-quarter volatility wrought negative year-over-year results for two-thirds of firms in J.D. Power’s annual survey.

March 14 -

The 12-advisor practice serves clients in a group often neglected by the industry, its managing directors say.

March 13 -

Bleakley Financial has launched its eighth office under its affiliation with LPL and Private Advisor Group.

March 12 -

The RIA divisions of Raymond James and RBC are also among the companies that self-reported.

By Ann MarshMarch 11 -

Fourth-quarter equity losses stanched client assets at wirehouses, indies and other brokerages — but their stocks are regaining ground after reporting earnings.

March 11 -

The network’s parent disclosed the results of its first year under a new accounting standard affecting the top line at many large U.S. businesses.

March 8 -

The six-IBD network lost advisors during a capital structure change, but its new majority owner says the predicted expansion is still on track.

March 7 -

Woodbury Financial Services has added 572 advisors with $22 billion in client assets since the fall of 2017, CEO Rick Fergesen says.

March 5 -

The firm aims to avoid disruptions for its 2,300 advisors — but the pending recapitalization comes as the space consolidates amid shrinking margins.

March 1 -

The husband-wife team left LPL after 11 years with an eye toward its rival’s tech and service offerings.

February 27