-

Startup Breakaway Bookkeeping & Advising is building a network of finance professionals to act as virtual CFOs for small-business clients.

July 13 -

The manager joins firms including JPMorgan and Arena Investors in seeking opportunities in the sector, particularly in the wake of the coronavirus pandemic.

July 13 -

Almost 90% of smaller fund managers would no longer have to report their investments and their firms would save $136 million a year, the agency estimates.

July 13 -

Investment advice firms netted hundreds of millions of dollars. Here’s where they’re based, what lenders they turned to, and more.

July 9 -

Mass exodus from the market has forced managers to dump securities to raise cash, sending prices tumbling the most in at least four decades.

July 9 -

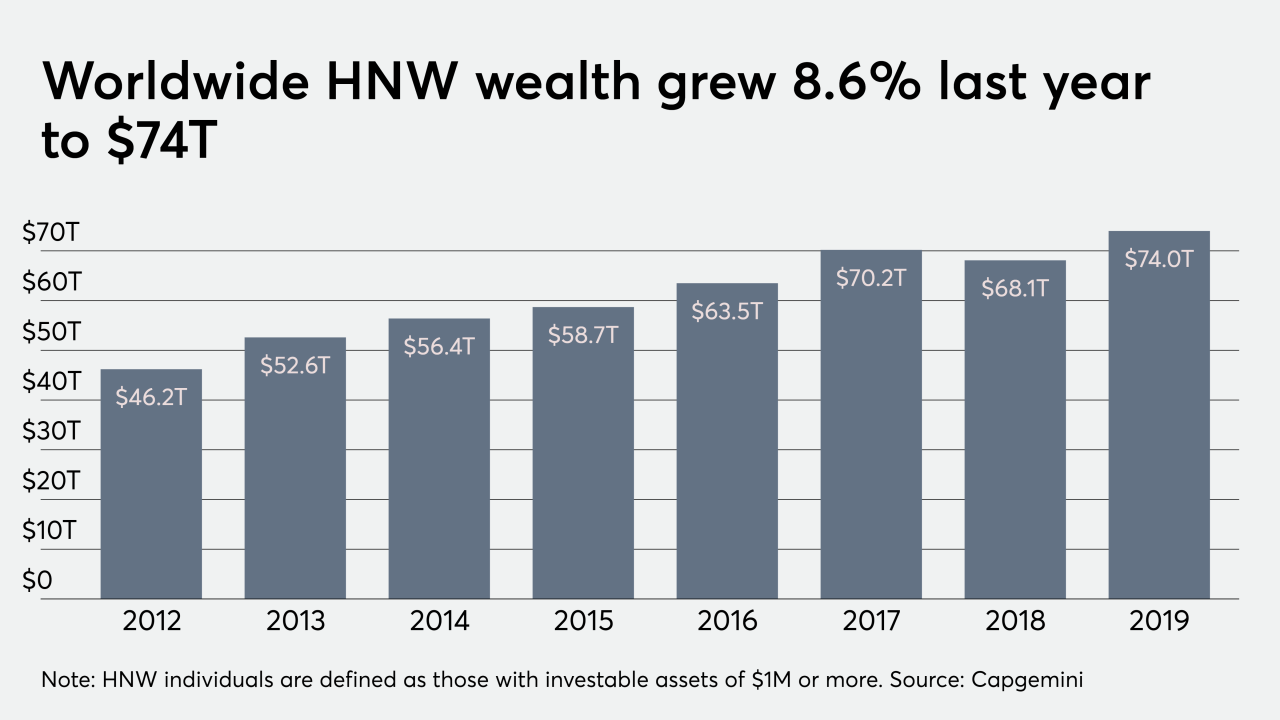

Affluent investors are concerned about transparency, performance and value, according to a new report by Capgemini.

July 9 -

Its rivals have been building out their own insurance arms in recent years and have brought on executives who can help them attract more business.

July 9 -

The firm announced plans in March to acquire $200 million of its stock and has been in the market on average once every three trading days since.

July 9 -

The leaders raked in a combined $949 billion over the past decade.

July 7 -

A “distribution bump” from the commission-free trading trend that took hold late last year may be behind the surge, analysts say.

July 7 -

Jacob Gottlieb, whose $8 billion fund shuttered amid an insider trading scandal two years ago, received a $150,000 to $350,000 loan for his new shop.

July 7 -

Instead of a sale, Orion’s private equity backers are reinvesting to help grow the company’s presence in the TAMP marketplace.

July 2 -

The manager is still recovering from losses that started in 2015, when his main fund fell 20%, and deepened with a record 34% decline three years later.

July 1 -

The industry outranked asset classes including private equity and venture capital, which have historically ranked higher in a Credit Suisse survey.

June 30 -

As more active strategies embrace the exchange-traded model, the landscape may be shifting.

June 29 -

The privileged realms of American finance still look much the way they did a decade ago, or even two or three decades ago.

June 29 -

Speculative investors bought a net 206,227 S&P 500 E-mini contracts in the week to June 23, the most since 2007.

June 29 -

As much as $16 trillion of global wealth may be wiped away this year as a result of volatility and economic fallout from the pandemic.

June 25 -

Secretary of Labor Eugene Scalia said retirement plans aren’t for “furthering social goals or policy objectives that are not in the financial interest of the plan.”

June 25 -

A new book could help advisors better grasp the difficulty with the topic of money among underserved client groups.

June 25