-

Steady inflows showcase the buy-and-hold ethos of the typical Vanguard investor — financial advisors and wealth managers, an expert says.

December 28 -

Without market-leading, high-yield savings accounts, cash management at Betterment and Wealthfront isn’t as attractive as it was in 2019.

December 23 -

The firm, which has more than $3 trillion under management, runs dozens of mutual funds and was a pioneer in index investing.

December 11 -

There are still plenty of challenges and potential changes on the horizon. Here’s what to watch for.

December 10 Baird

Baird -

Waddell & Reed had been working in recent years to transform its “proprietary broker-dealer into a fully competitive independent wealth manager.”

December 10 -

Potential customers include hedge funds, crypto miners and over-the-counter trading desks

December 10 -

The scale of the withdrawal indicates that the ETF is both being used by large institutions and a favorite with retail investors, an expert says.

December 4 -

As part of a two-step deal involving Australian investment bank Macquarie Group, LPL will pick up 900 advisors and $63 billion in assets.

December 2 -

The low interest rates pushing down sales across most fixed and variable lines are also boosting certain products.

November 25 -

Once a laggard, the index and its cyclical components have shot up 13% since Halloween, putting it on track for the best month since 1987.

November 24 -

Two women employees at the firm’s Newport Beach, California office say they were demoted after reporting instances of bias and harassment.

November 19 -

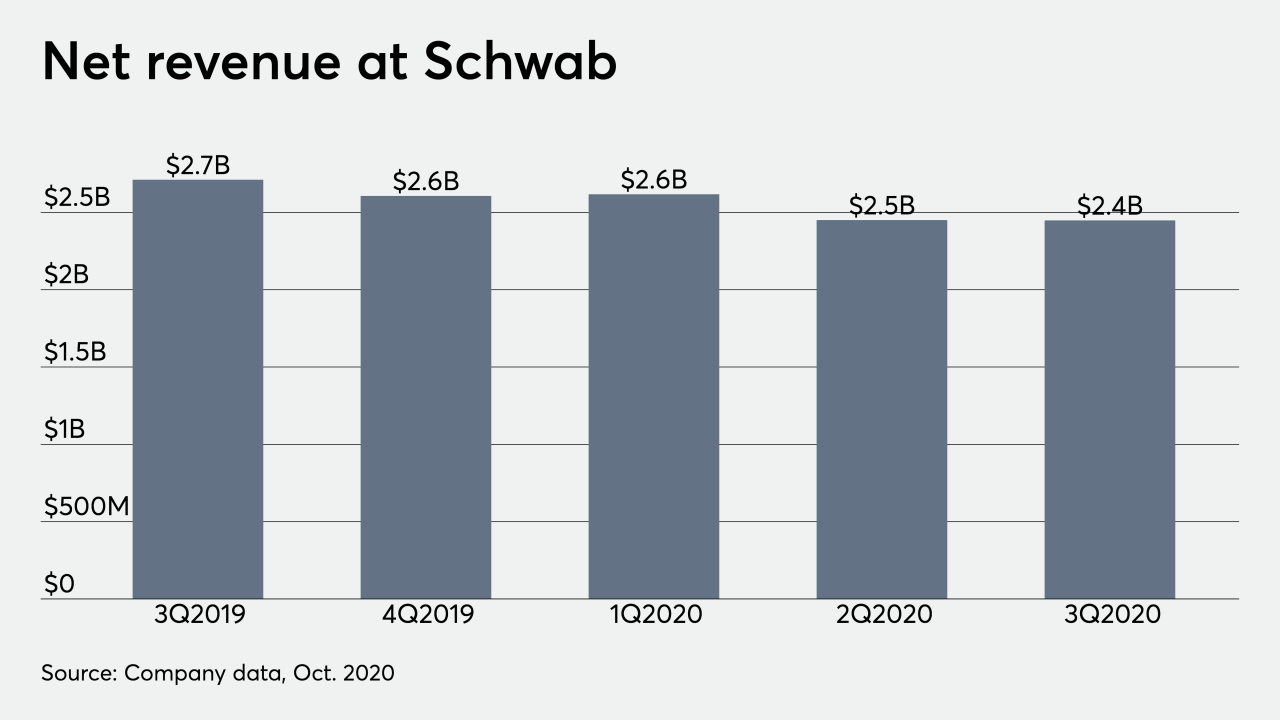

As the Federal Reserve strives to help the economy, wealth managers’ revenue takes a hit.

November 18 -

The $527 billion manager released two actively-managed products, one focused on U.S. equities and the other on international stocks.

November 18 -

The more out-of-left-field the change, the more profound the lesson learned, our columnist has found in the corporate and individual practice realms.

November 13 Wealth Logic

Wealth Logic -

Funding for wealthtech is also picking up, with firms attracting $1.5 billion across 62 deals in the third quarter.

November 10 -

A 50% allocation to equities for someone in their 60s still leaves someone with a lot of risk right before retirement, writes Jared Dillian.

November 9 -

The uncertainty could lead to market volatility, delayed stimulus negotiations and complicate planning for a potentially new regulatory environment.

November 4 -

CEO Dan Arnold cites growth in traditional channels and in recently launched models that could bring even more opportunities.

November 3 -

Wealthy clients are the fastest growing segment of the company’s retail division.

November 2 -

Even with those challenges, rep productivity and client cash balances expanded in the third quarter.

October 30