-

Some advisors say they’re busier than ever in the last weeks of 2020.

December 22 -

The potential for higher rates in 2021 is real, but exactly what the rate would be, and who would pay those rates, is far from certain.

December 10 -

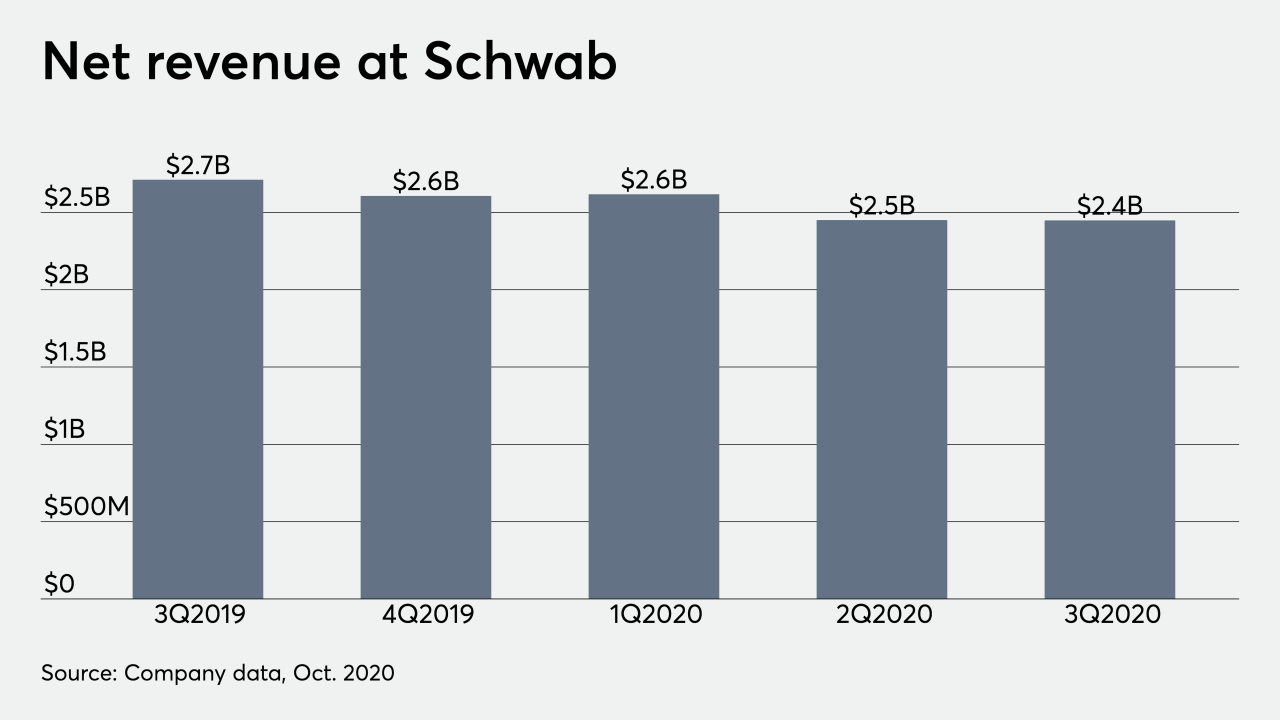

The firm has sought to broaden the range of clients it targets with its wealth-advisory services.

December 4 -

The advisors know RBC’s Pittsburgh complex director from earlier in their careers, when all three men worked at Smith Barney.

November 30 -

Wealthy clients are the fastest growing segment of the company’s retail division.

November 2 -

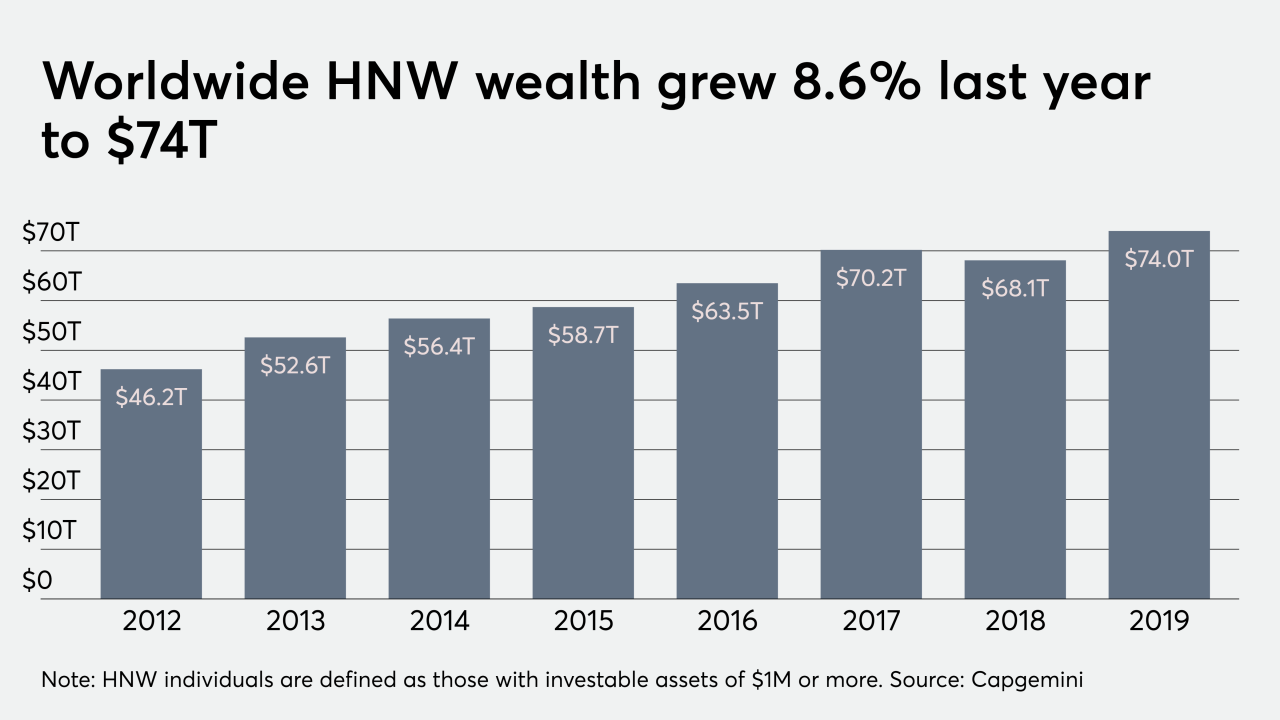

Fortunes in the tech and health care sectors jumped by 43% and 50%, respectively.

October 7 -

The company plans to expand services to the high-net-worth by doubling the number of its advisors, its wealth management head says.

October 6 -

“I would not be doing my job as somebody that is totally committed to making our Americas’ business a top competitive business for Julius Baer if I wasn’t seriously looking at a U.S. platform,” said Beatriz Sanchez, the bank’s head of the Americas.

September 28 -

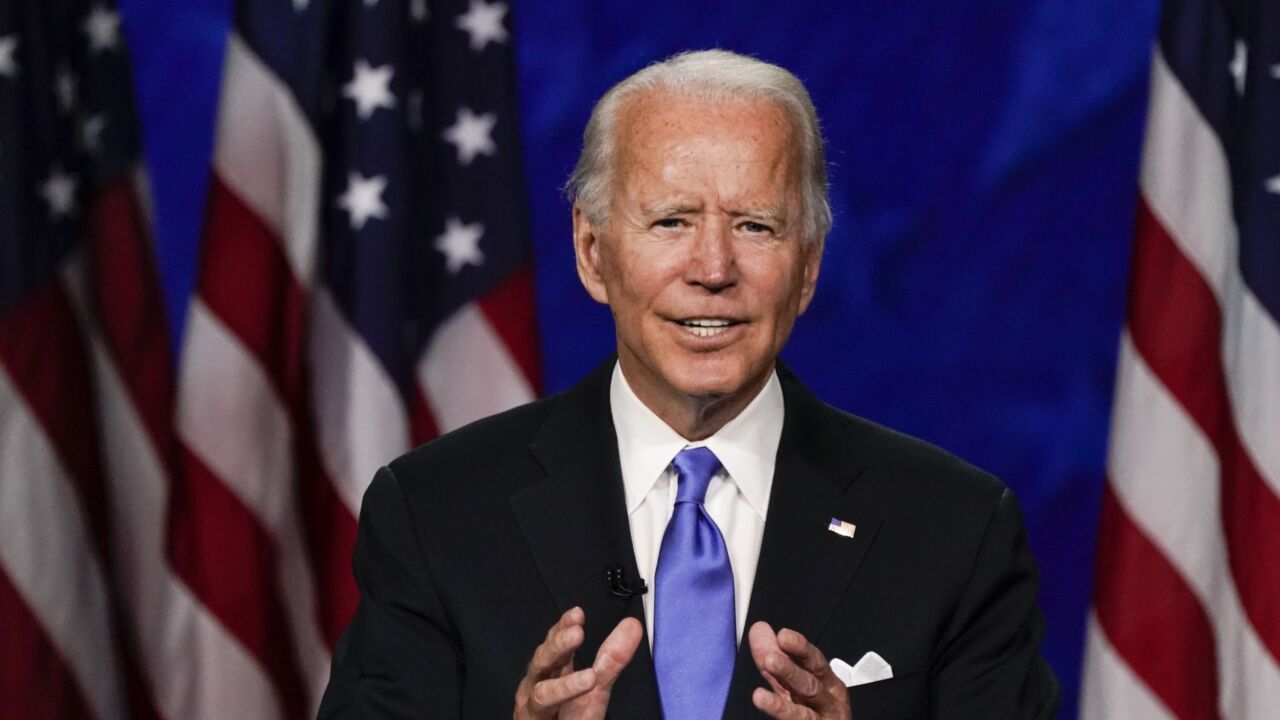

Under the proposals, the top 0.1% of earners would be subject to a 43% tax rate on their income.

September 14 -

“Everyone is looking ahead to the elections and what tax policy could look like in various administrations," says Ben Huneke, head of investment solutions in the firm's wealth management division.

September 10 -

The firm expands on both coasts with Glasband Stempel Wealth Management in Florida and Carol Wilshire in California.

September 4 -

Credit Suisse has discovered fraud at its international wealth management business, two years after it was criticized by a regulator in a similar case that rattled the bank and raised questions about controls.

August 28 -

Gifting embedded loss assets can avoid a step-down in basis and preserve capital losses. Here's how to go about it, under several scenarios.

August 24 -

Tax-rate arbitrage is one approach, but it’s far from the only one, according to contributor Michael Kitces.

August 4 -

Any tax increases on high-income individuals and corporations would be offset by massive spending packages targeted at accelerating the country’s recovery from the coronavirus, according to the firm.

July 31 -

Perceptions on relationships, health, and lifestyle have also changed.

July 28 -

The move follows efforts to reduce expenses in the company’s global wealth management business.

July 23 -

“They’re now realizing: Let’s actually get the contingency plan in place,” said Dominic Volek, head of sales at Henley & Partners, the world’s biggest citizenship and residency advisory firm.

July 20 -

Affluent investors are concerned about transparency, performance and value, according to a new report by Capgemini.

July 9 -

As much as $16 trillion of global wealth may be wiped away this year as a result of volatility and economic fallout from the pandemic.

June 25