-

The uncertainly of regulation and their own survival is at the root of advisors’ stress, but there are also some positives of the job.

April 30 -

A massive acquisition also helped boost the No. 1 IBD’s headcount by 833 advisors year-over-year to 15,210.

April 30 -

The stresses of the job practically demand that we have people to confide in when the going gets rough, Michael Kitces writes.

April 30 -

A 41-year industry veteran says his practice was seeking “a new strategic partner to help us take the next step in our firm’s growth.”

April 26 -

The private equity-backed IBD is "very appealing to advisors in that larger independent setting," its top recruiter says.

April 26 -

The No. 1 IBD announced the new NTF offerings and additional flattened prices for its corporate RIA.

April 26 -

Whatever planners learned when they were trained for the job decades ago is most likely outdated.

April 25 -

New legal analysis suggests that the rules would add "teeth" to broker-dealer regulation.

April 24 -

The bank’s latest retreat from wealth management will move 51 advisors to the independent space under Woodbury Financial.

April 19 -

The downward trend in the supply chain is already prompting major changes, and it could soon spill over to advisors’ practices.

April 18 -

Advisors may be upset due to the high-handed attitudes of the larger firms, but pulling down six zeroes a year can offset a lot of irritation, says On Wall Street’s annual recruiters roundtable.

April 16 -

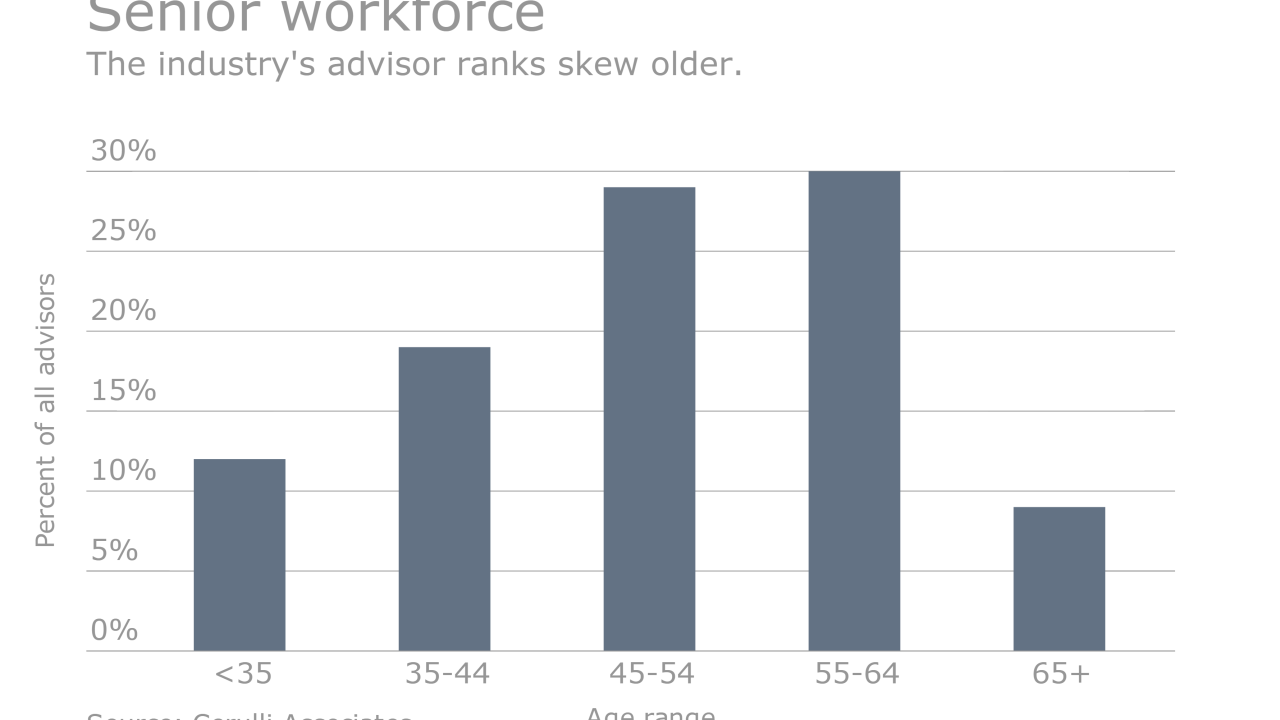

Two-thirds of firms don't know how to attract young people, a new survey reports.

April 16 -

The $263 million practice’s new IBD reported record recruiting for 2017, helped in part by the movement of advisors following LPL’s massive acquisition.

April 9 -

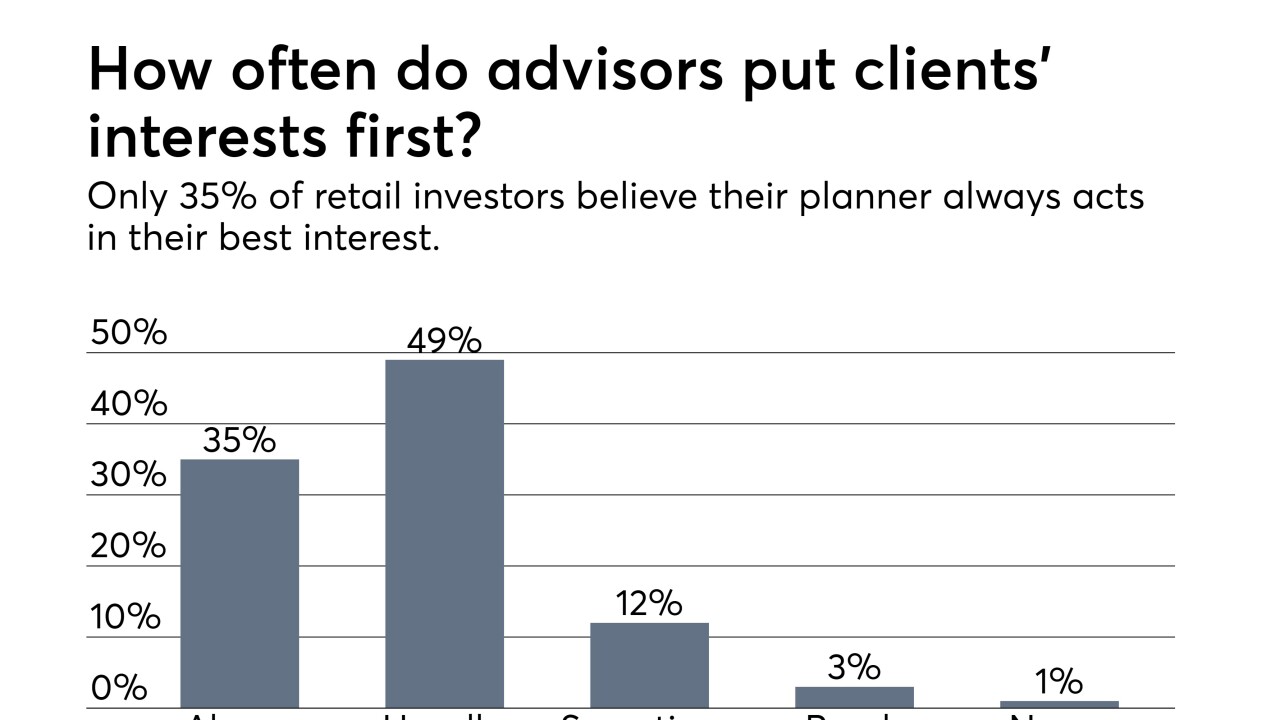

Instead of thinking about fiduciary purely as an obligation or regulation, advisors should envision it as something much bigger: a way of life.

April 6 Financial Planning

Financial Planning -

The Justice Department disclosed a felony probe the day before the broker’s termination.

April 6 -

A new survey finds that investors prize full and upfront disclosures about fees and conflicts of interest, but advisors fall short.

April 6 -

The new hires say they were drawn to the firm’s investment platform, product offerings and investment diversification.

April 4 -

Being raised by a single mother and going through two divorces taught Loreen Gilbert how to be a better planner, she writes.

April 4 -

Need a gut check on your career? Read what top recruiters have to say about the big and small firms in the industry.

April 3 -

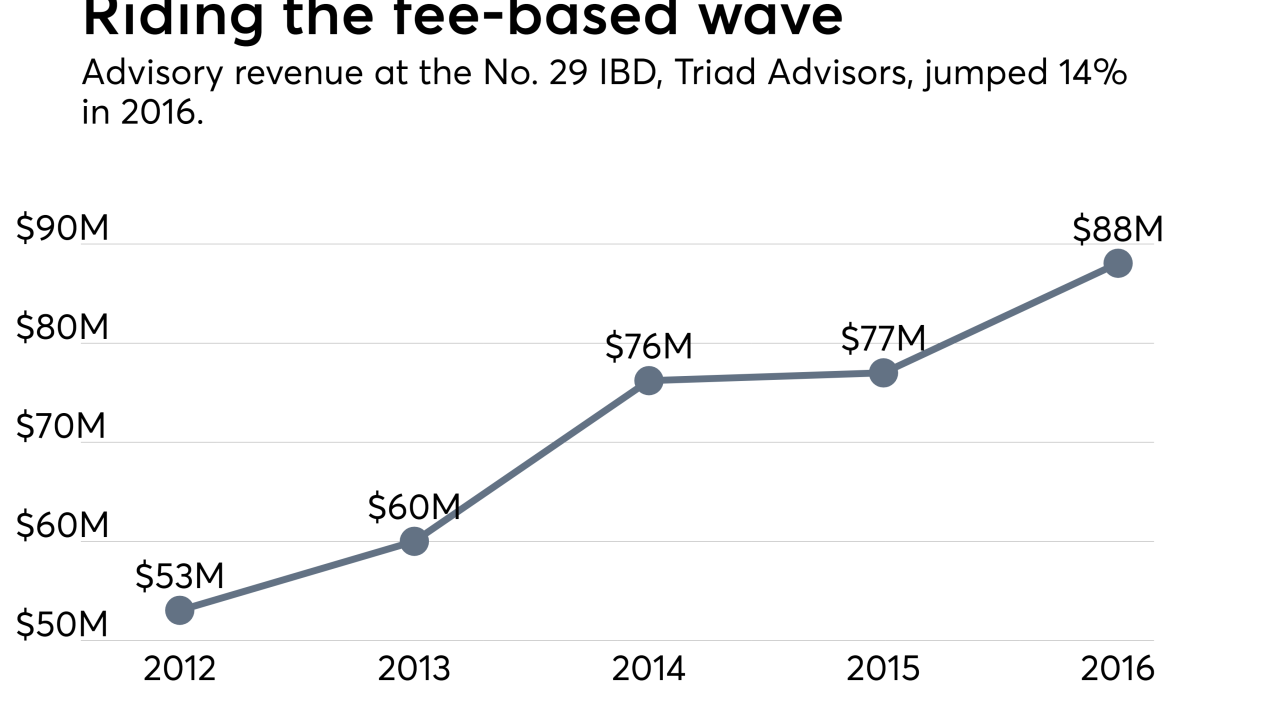

As the financial planning industry nears a fee-only, fiduciary world, independent broker-dealers will face some important choices about their future business models.

April 2 Financial Planning

Financial Planning