The pressure on fees collected by custodians, broker-dealers, asset managers and technology vendors has not extended to financial advisors — but they’d be wise to prepare for it.

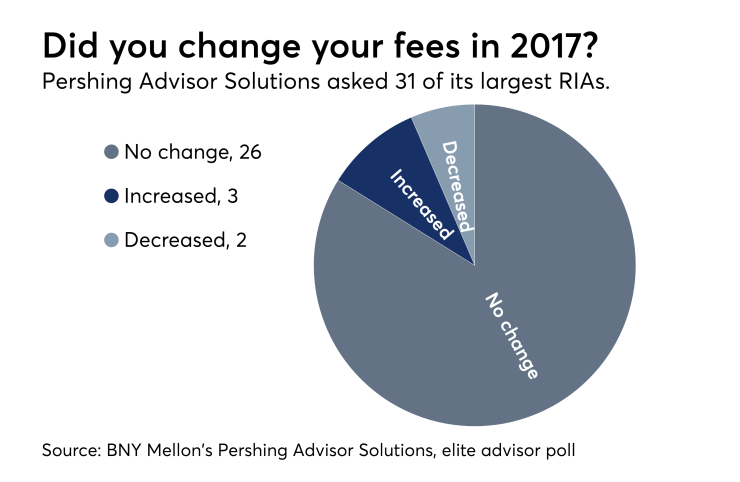

At Pershing Advisor Solutions’ conference in March for its major RIA and institutional firms, nearly all of the 31 advisors polled on practice management issues reported that their fees on clients remained level throughout 2017. More than half also said they don’t feel pressure from clients to cut them.

While the results come from a small sample of large advisory firms, they match the conclusions of a study also

The squeeze is already shaping advisors’ supply chain, Pershing Managing Director Gabriel Garcia points out. The downward momentum extends from the race to slash

The “headline of price compression in the industry is accurate, but it’s misrepresented,” when connected to advisors, Garcia says.

“There’s certainly a tailwind right now. You always have to look out for the gray clouds on the horizon,” Garcia says, noting advisors are already boosting their value by offering a wider array of services. “The concern is not so much of a price drop, but of margin compression as opposed to price compression.”

-

The firm’s 20-basis-point take will drop, says CEO Walt Bettinger.

September 28 -

An abundance of software and practice tools has planners and firms overwhelmed. Here’s what it means for the industry.

November 1 -

In price wars wars, the firm bolts ahead in the race to zero by nearly tripling its roster of commission-free funds.

October 19

Addressing the subject of mortality can be tough — but advisors can help make the conversation less painful.

The clearing firm and custodian’s clients include about 500 RIAs and 800 BDs,

The advisors rated tax planning, philanthropy, alternative investments and private banking solutions as the four areas of advisory services most important to their growth.

The downward pressure in other parts of the space should prompt advisors to increase their planning services and speed up their tech integrations, says John Anderson, managing director of the practice management solutions team at SEI Advisor Network.

“If there’s no value perceived, there’s going to be a lot of pressure on fees,” Anderson says. “What you’re seeing today is people who are starting to address the fees by product, but, sooner or later, the consumer is going to come back and say, ‘OK, well you’ve reduced the product fees, let’s reduce your fees,’ because there’s not a lot of value-add being added by a lot of these advisors today.”

Fee pressures also portend a crunch on advisors’ time, according to Cerulli. Clients “often have limited awareness of fee types — let alone benchmarks to compare options,” but the growth of robo advisors could bring a new, more cost-conscious generation into the market, the consulting firm warns.

Fixed planning fees, which are only collected by

The question remains when, or if, the supply chain will pass on the lost fees to advisors. Passive and ETF strategies have forced down revenue-sharing for BDs, while regulation and greater payouts in the RIA space are boosting their spending, says Kenton Shirk, the director of Cerulli’s intermediary practice.

“Asset managers have felt fee compression. Broker-dealers are feeling pressure on their margins,” Shirk says. “Advisors so far have not felt the pressure to the same extent.”