A mutual fund’s returns represent just one factor out of many considered by financial advisors when making recommendations.

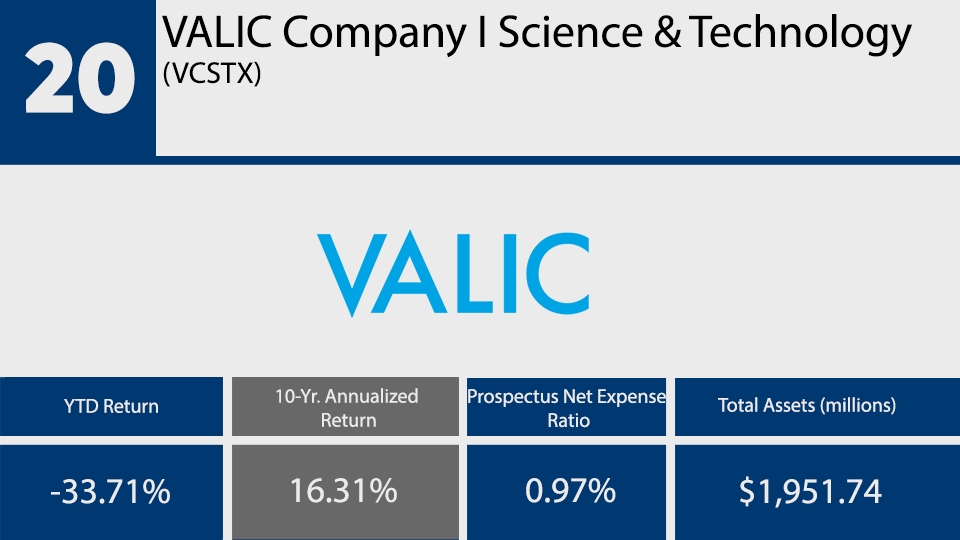

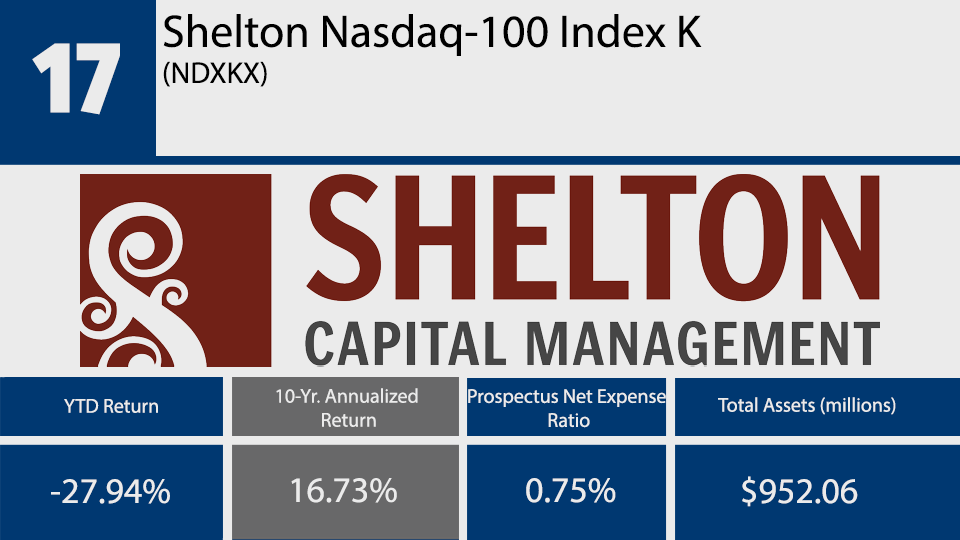

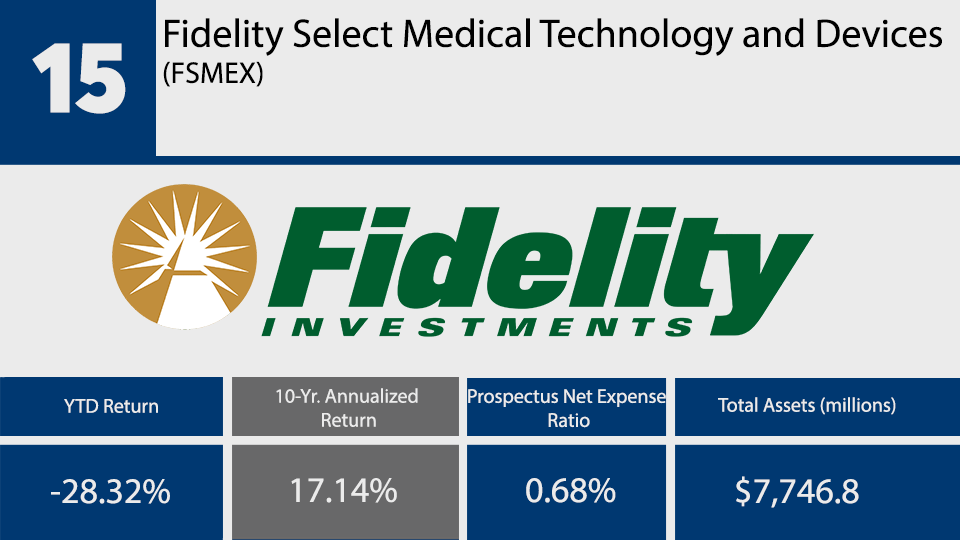

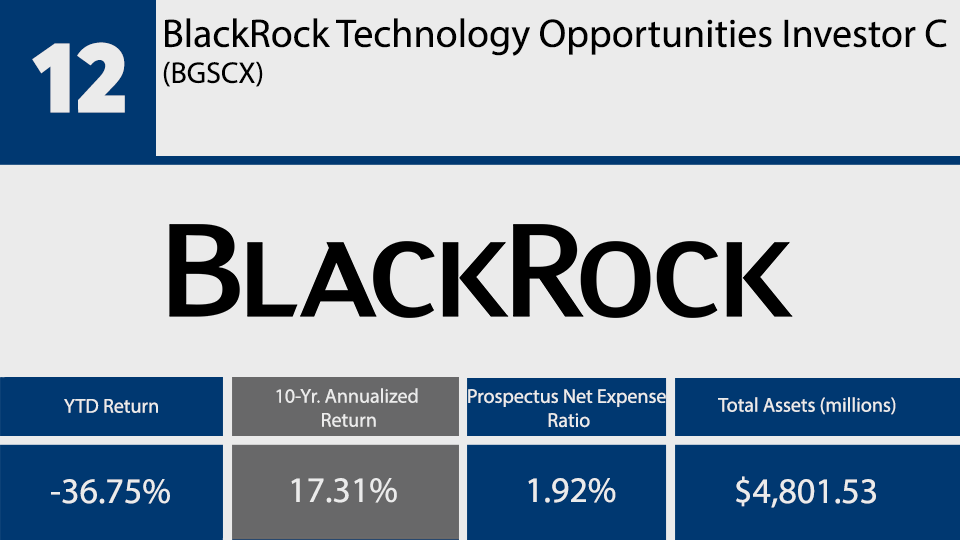

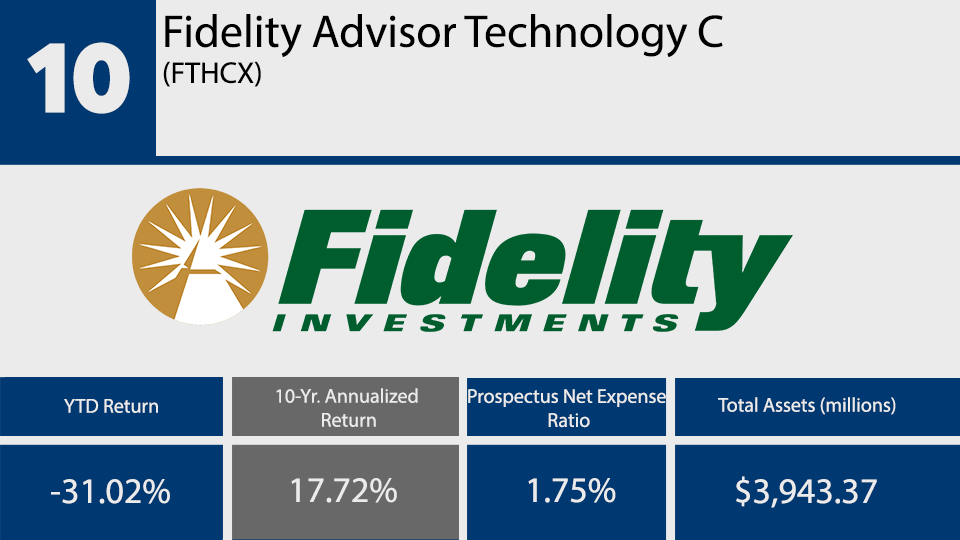

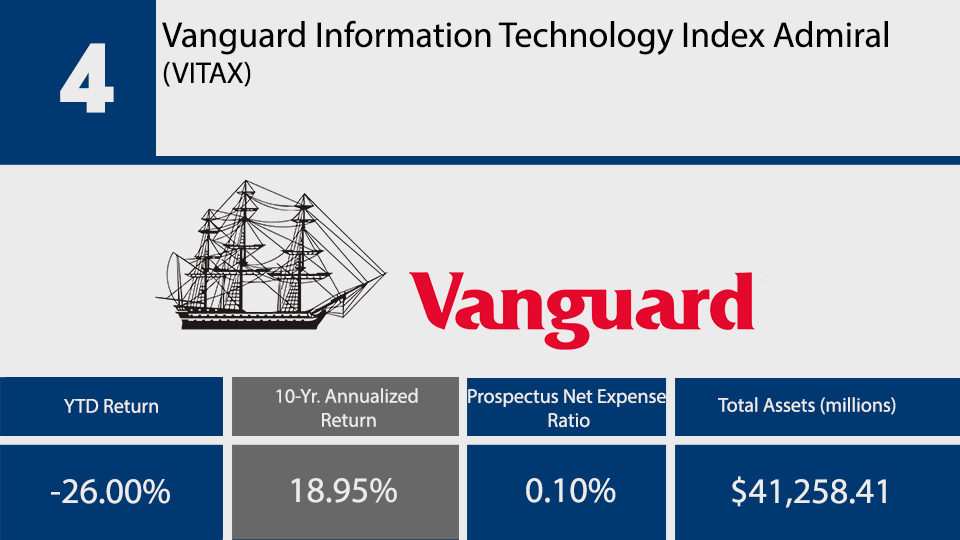

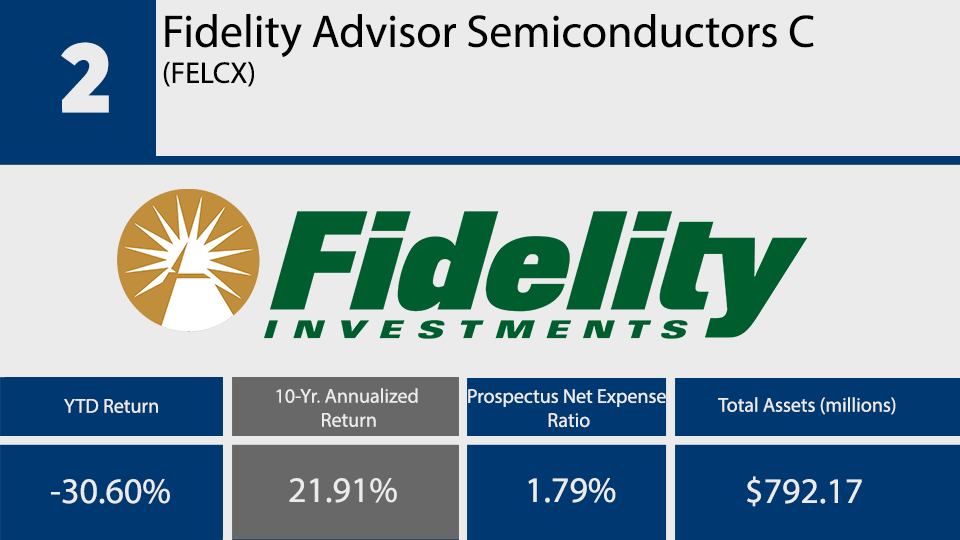

That’s the consensus of a half dozen advisors who responded to questions that Financial Planning sent to members of the Financial Planning Association and the XY Planning Network about how they weigh performance against cost and what to do when a client asks about a specific fund. Using Morningstar Direct data, FP compiled the below ranking of the mutual funds with the best 10-year returns as of May 25.

“Thinking about fund returns and costs, it's always my first instinct to take a step back and paint a picture for clients that acknowledges their emotions around investing but also anchors these ideas in the reality of the data. I think it's so important to educate clients early and often about how markets work so they feel empowered around the decisions we're making for their investment portfolio and so they're prepared when volatility inevitably rocks their short-term performance,” Kelly Klingaman said in an email. Klingaman launched Austin, Texas-based Kelly Klingaman Financial Planning earlier this year after spending more than a decade with Dimensional Fund Advisors.

“There's so much noise in the information they consume via the media, and in reality, I only get a chance to speak with them on these topics for mere hours in the span of any given year,” she continued. “When it comes to fund performance, I think it's natural for clients to want to chase high returns in the hopes of experiencing that performance within their own portfolios, to somehow isolate themselves from the overall shaky experience of the markets at large.”

Many financial advisors go through a similar process with their recommendations, they said.

“Performance (against appropriate peer sets) is only one piece of the puzzle when selecting mutual funds,” Jarrod Sandra of Crowley, Texas-based Chisholm Wealth Management said in an email. “And even then, I’m most interested in longer-term performance versus shorter. I’m interested in reviewing costs, number of holdings and weightings, manager tenure, turnover, style consistency, and risk-return ratios as primary data points. So, when we talk about the latest and greatest hot performing fund, I run it through those lenses to understand what’s going on. That small set of variables can tell you a lot about a fund and perhaps figure out what attributed to the outperformance.”

Other planners specifically steer clear from the funds with the best numbers for the past 12 months.

“I would never buy a fund that is a top performer over the last year, because there is such overwhelming evidence of reversion to the mean,” Kevin Shuller of Denver-based Cedar Peak Wealth Advisors said in an email. “It happens every generation. A star manager shows up, has great returns, makes a name, gets press, gathers assets and fades into the annals of history.”

Clients hire a planner to help them navigate such decisions, according to Aaron Clarke of financial education service Gig Wealthy.

“We're going to screen through all our normal screens and see how it stacks up,” Clarke said in an interview. “What you should be looking for is somebody who has a plan in place to get you to ‘X’ spot. The question is, how much risk do I need to take to get to that spot.”

As for clients who show up to a meeting with a particular fund product in mind like a patient asking a doctor about certain medication, advisors have grown accustomed to those queries.

“I had this question from a prospective client today,” Elliot Herman, the chief investment officer of Quincy, Massachusetts-based PRW Wealth Management, said in an email. “I shared that we are humble at our core and do not profess to know everything. We are happy to vet new ideas and sometimes find that our clients bring us good ideas that we can then use with other clients. My prospective client said she was met with such disdain by her current advisor when she brought him an idea that she has opted to leave this person and look elsewhere — hopefully us.”

It’s important to add the right context to such conversations, according to Cody Lachner, the director of financial planning with Fishers and Lafayette, Indiana-based BBK Wealth Management.

“I try to focus the discussion on educating the client about looking beyond return,” Lachner said. “We want to know the whole story of how a fund obtained that top performance standing. Typically we can tie in the client's stated goals and their financial plan to illustrate why a fund may or may not be appropriate. For example, a fund that took an above-average amount of risk to achieve the top performer status may not align with the client's plan. Many software programs can visually illustrate the impact that an inappropriate fund would have on the client's plan (like illustrating potential volatility and downside).”

To see the list of the top-performing mutual funds over the past decade, scroll down our slideshow. For a look at the real estate funds with the best 10-year returns,

Note: All data comes from Morningstar Direct and is current as of Wednesday, May 25. Funds with less than $500 million in AUM were excluded, as were institutional or leveraged products and funds with investment minimums over $100,000.