Matchmaker, matchmaker, make me a match: Advisors say the number one reason they don’t have a succession plan in place is that they haven’t identified a strong partner yet.

Now, Advisor Group wants to play cupid...but for financial planners. The Phoenix-based network of independent advisors recently launched My Succession Plan, a tool to help advisors prepare to hand the reins over to the next generation.

When it comes to deciding who will take over your practice, advisors must find a "like-minded cultural fit," says CEO Jamie Price.

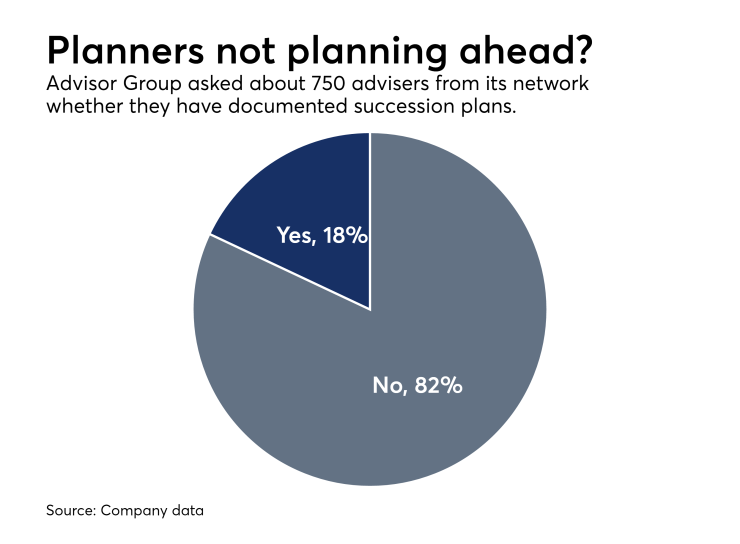

Succession planning is increasingly important. About 80% of advisors don’t have a succession strategy, even though 42% of them say they plan to retire in the next 10 years, according to an Advisor Group survey.

“Buyers and sellers of independent advisor practices continue to cite finding the right partner as the most difficult aspect of a deal,” says Todd Fulks, Advisor Group senior vice president of succession planning and business acquisition.

My Succession Plan helps advisors looking to merge, acquire or sell part of their business to source and connect with potential partners across the Advisor Group network. The program addresses the succession issue with features like valuation services, advanced search options and access to support from the platform’s consulting team.

“We saw an opportunity in the marketplace,” Price said during a media conference call. “We have lots of advisors looking to grow their business.”

As it rolls out the initiative, Advisor Group is targeting its existing members, as well as non-Advisor Group affiliated firms that are looking to build a succession strategy. A partnership with Truelytics, a business intelligence metrics provider, allows members of My Succession Plan to put together an online valuation model and obtain a fair market estimate of the value of their business.

-

Two of its Royal Alliance firms form a $2.5 billion powerhouse.

March 8 -

Whether the plan is to groom from within or look outside, keep these tips in mind.

May 23 - Senior advisors say they've discovered they can be the best recruiters for landing a younger partner, and one who might one day inherit their business.Sponsored by Quest Diagnostics

The search option enables buyers and sellers to identify potential partners by filtering through a range of factors, the same way a dating app helps users find their ideal match.

These factors include total revenue, client AUM, number of households, location, service offerings and more, the firm says.

The platform’s consulting team offers one-on-one support to advisors, while also quarterbacking introductions to external professionals with experience in areas essential to implementing a successful succession strategy.

“The succession and acquisition team was integral in helping me make my most recent acquisition,” explains Shehab Mohammad, an advisor for Royal Alliance and president of NWF Advisory Group. “They helped with deal structuring, documentation, execution and facilitated financing. They saved me at least $10,000 or more in fees from outside advisors.”

The team also helped guide Mohammed and the seller through the more emotional side of the process.

“Their bedside manner was the key to closing. Without their help, we could not have completed the deal,” Mohammed says.

My Succession Plan is available to Advisor Group members for $300 per year. Planners outside the network are also able to become members. As of October 20, 2017, 150 Advisor Group advisors have signed up for the program.