Woodbury Financial Services notched its second major recruiting grab in just two weeks, adding an SII Investments firm with $2 billion in client assets and 52 advisors to its ranks.

The move comes as Woodbury has been courting former National Planning Holdings’ advisors, ever since

Including Tenacity’s team, a total of 140 new advisors have come aboard at Woodbury this year and 440 have joined

Now, Tenacity is

-

The team marks at least the second to opt for a smaller IBD over the nation’s largest.

October 19 -

CEO Dan Arnold said the acquisition of NPH’s assets will serve as a model for the future.

October 27 -

The practice opted for USA Financial after Jackson National sold National Planning's assets.

October 26

Independent and regional firms have been maintaining strong appeal with new recruits.

Advisor Group’s four BDs, as well as

“They have the size, the scale, the quality, but they certainly have the means of supporting these OSJs,” says Barbara Herman, a senior vice president with Diamond Consultants. “There’s sort of this short list of proven winners in this space who can handle the complexity of a large OSJ move.”

Tenacity formally joined Woodbury last week, according to FINRA BrokerCheck. A spokesman for LPL declined to comment on their move, while a spokeswoman for National Planning Holdings didn’t immediately respond Wednesday to a request for comment.

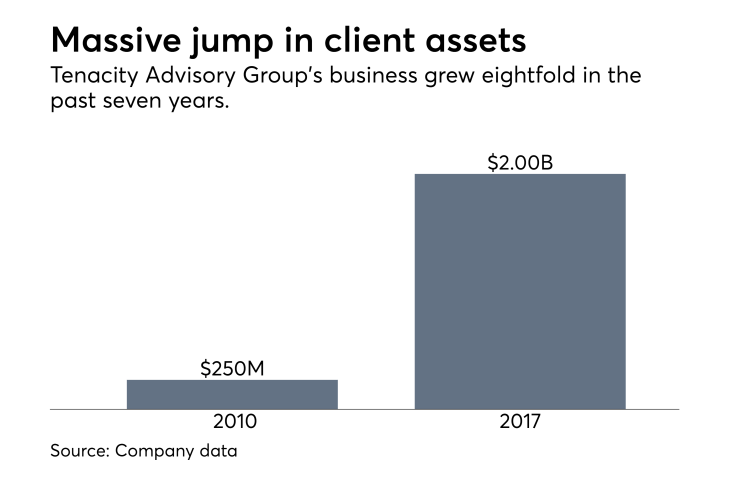

Tenacity launched in 2010 with nine advisors and $250 million in client assets, growing to its present footprint of 30 offices in Wisconsin, Michigan, Ohio and Nebraska, according to the firm. Prior to affiliating with SII, Tenacity President Mike Savolt had worked 15 years at Capital Financial Services.

“Our decision to join Woodbury was an easy one, based on the strong values the firm demonstrated,” Savolt said in a statement. “During our search process, Woodbury treated us like family, and the relationships that we've already built with them are invaluable.”

Pershing will remain Tenacity’s custodian following the move to suburban St. Paul, Minnesota-based firm, Woodbury says. Industry observers had mentioned firms on Pershing’s platform

LPL plans