For a split second, financial advisor Jana Davis thought she and other marchers at a recent protest in support of drag queens and kings were under fire, she recalled. A loud, sudden noise turned out to be a couple of dogs near the route in the gay mecca of West Hollywood, California.

Davis has been out as a lesbian for decades and feels "110% supported with who I am" by her employer,

"Even if we come across as confident and loud about our opinions, there's a fear there, too," Davis said. "But we just can't let it silence us."

LGBTQ advisors and industry professionals are expressing concern that

The discussion is also raising questions about the political activities of donor-advised funds partnering with Kingdom Advisors and the larger Christian right. Public nonprofits aren't allowed to engage in political activities, but some donor-advised fund issuers and critics are calling for much stricter screening procedures for grant recipients and more rules governing the products.

The LGBTQ professionals

"This is money that is being funneled into building this army of people," said David Auten-Schneider, who's host of the

An

"They're making it very untransparent where this money is going," John Auten-Schneider said. "There are good Christrians out there who probably don't know that this is where their money is going."

In some ways, the couple would like to emulate what they say the Christian donor-advised funds are doing.

"We're so far behind on this because they've been working on this for years," David Auten-Schneider said. "We're so focused on reaction. We're playing defense all the time, and so we need to figure out, 'how do we start building our offense?'"

Tense political environment in business

The politics of LGBTQ rights have shifted from

The mere posting of an ad for Bud Light on Instagram led to a conservative boycott of it and its parent beer, Budweiser, because the company

State lawmakers have introduced a record 520 anti-LGBTQ bills in 2023, with a new high of 70 enacted, including 15 that banned gender-affirming care for transgender youth, four that censor school curriculum and two that put restrictions on drag performances,

"This weaponization of public policy has been driven by extremist groups that have a long history in working to oppress the existence and rights of LGBTQ+ people," the organization said in a report last month. "Several of these organizations have been deemed hate groups by the Southern Poverty Law Center, such as the

Kingdom Advisors displays links to those organizations through its founder and emeritus board member, planner Ron Blue. He's a former board member of the Family Research Council and a co-founder of the

The National Christian Foundation — which Accountable for Equality

"While we recognize that members of the Body of Christ may sincerely hold differing views on these topics, which we neither judge nor condemn, we are committed to upholding NCF's beliefs and values," the guide said.

More than 30,000 individuals and families use donor-advised funds the foundation calls Giving Funds that have provided over $16 billion in grants to 71,000 different charities that "are providing clean water to the thirsty, rescuing victims of human trafficking, translating the Bible into new languages and much more," National Christian spokesman Steve Chapman said in an email.

"Our team at NCF does not develop or implement strategies about which charities or causes to support. All grants are initiated by the recommendations of the individuals and families who have funds at NCF," he said. "NCF is not a lobbying or political organization. We decline grant recommendations to both 501(c)(4) political organizations and 501(c)(3) charities engaged in substantial lobbying or political activities."

Corporate partners

Kingdom Advisors cites the NCF on

"We are grateful that some of the largest and best respected wealth management firms in America partner with Kingdom Advisors," CEO Rob West said in an email. "Over the years they have come to recognize the quality of our professional network and our commitment to serve the entire Christian financial services industry."

The other Kingdom partners among wealth management firms and technology companies include: LPL Financial, XY Planning Network, Riskalyze (

Kingdom displayed Carson Group's name and logo as a "silver partner" as recently as March, but it no longer appears. The front page of

"The CKA designation perfectly aligns to the emerging industry trend that the future of independent advisors is all about creating differentiated expertise and customized advice services," Kitces is quoted as saying. He didn't respond to emails seeking comment.

The

A

The number of financial firms approving the use of the designation in advisor marketing has roughly doubled,

Kingdom partners have shown varying ties with the organization. A couple of companies noted they simply set up a booth at its annual conference.

The organization has cultivated much longer-standing relationships with Ameriprise, which

In an email interview, West described the group of partners consisting of charities, faith-based investment companies and some of the largest wealth management firms as "a non-exclusive, arms-length sponsor relationship that does not imply any ideological agreement." The organization isn't aware of any conflicts of interest associated with the relationships, West noted. Kingdom also "does not teach or lead discussions on any political issues and does not seek to advance any political agenda," he said.

"Being a partner with Kingdom Advisors does not imply endorsement of any religious views or beliefs," West said. "We also partner with charitable organizations that provide a range of solutions for advisors that may, or may not, align with their client's values and convictions. Kingdom Advisors honors the responsibility of financial professionals in our community to discern whether or not a particular ministry aligns with the needs of their clients."

Record donor-advised fund flows

Charitable givers use donor-advised funds to pay for grants to organizations of their choice that are approved by the sponsor of the products.

Cash and non-cash assets held in the products offer greater tax benefits than private foundations, which are increasingly sending their money to donor-advised funds that aren't required to publicly disclose the original source of their grants or disburse the money to public nonprofits on any schedule.

Kingdom's expansion comes as donor-advised funds reach record flows of assets held in accounts enabling givers to hand over responsibilities to an outside sponsor, choose their grant recipients, avoid capital gains taxes and get bigger deductions than when giving to foundations. Only a portion of the grants from donor-advised funds

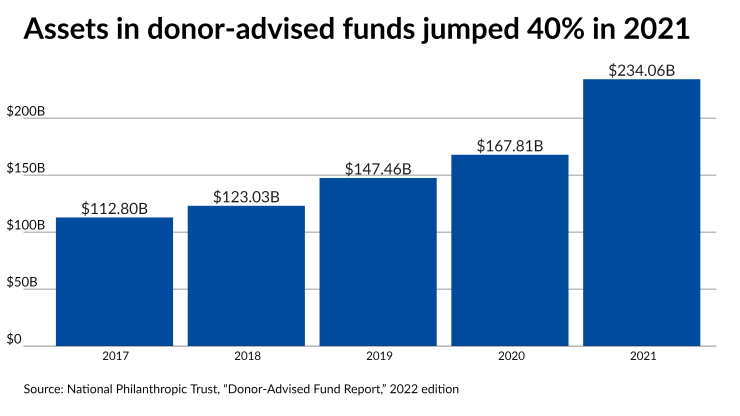

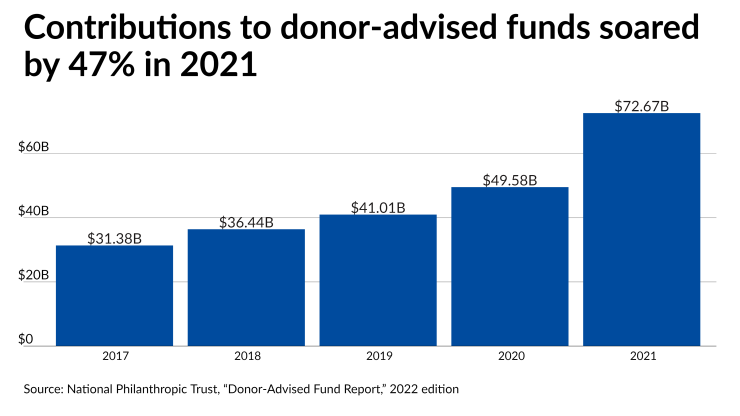

Assets in all donor-advised funds soared by 40% in 2021 to $234.06 billion, with all-time highs in grants at $45.74 billion and contributions of $72.67 billion, according to

Under the law, the money cannot be used to influence legislation or elections or pay for lobbying activities, Gil Nusbaum, the trust's general counsel, said in an email statement.

"DAF donors recommend grants that support a variety of organizations, which may be on the opposite sides of the same issue or cause," Nusbaum said. "DAF sponsors generally remain cause-neutral and do not take a position on which causes our donors support, but we confirm the grant purpose is permissible and that the grantee is a charity in good standing with the IRS. Approving grants to charitable organizations does not mean DAF sponsors are endorsing them."

Other sponsors say the industry needs tighter controls on donor-advised funds in order to reduce grants to hate groups. More than 100 sponsors and nonprofit organizations representing over $3 billion in collective assets have joined a campaign called "

The nonprofit began the effort after investigative news outlet "

Amalgamated Foundation

"I don't think this is about politics. I don't think that hate should be conflated with politics. I think there's a very clear line around hateful activity," Fink said. "There's a real opportunity here for advisors in particular, given the critical role that they play in supporting donors, to ask themselves and ensure that they're working with institutions who are aligned with their donor's values."

LGBTQ advisors and other industry professionals agree that donor-advised funds can be excellent tools for charitable giving that also require scrutiny.

The products display "popularity with financial advisors coupled with their profound lack of transparency compared to other philanthropic vehicles," Rachel Robasciotti, the CEO of

"I'll be really curious to know how they came to be listed as partners and if they're even aware of it," Robasciotti said. "In fact, there's a

Donor-advised funds "can be very beneficial and have a positive impact when used responsibly," but they "can be used negatively against certain groups," advisor Marci Bair, the president of San Diego-based

"I am a supporter of people of all faiths and religions, but not when they negatively impact a community or target a certain group like the LGBTQ+ community," Bair said. "I am glad that there are funds and fund companies that support the LGBTQ+ community that our clients can invest in. It does require us as advisors to do our due diligence because, unfortunately, there are funds that specifically have a mandate to not invest in companies that support the LGBTQ+ community and other social causes that our clients are concerned about."

The list of Kingdom's partners reminded Sloane Ortel, the founder of socially responsible investing startup

"There's this idea that a lot of these tools are morally neutral, and it's just about customizing whatever it is that you, the end client, want," Ortel said. "I don't think anybody really believes that on some level, yet somehow that's the position that the mainstream investment advisory business has found itself in."

The political climate leaves wealth management firms with a choice, according to Davis, the advisor with RIA firm Abacus. Her firm

"I think we just have to be loud about it and be willing to lose clients over it," Davis said. "We did lose one or two clients. Our loudness in how we feel about inclusivity and respect for each other was not their jam. And that was OK because they weren't a good fit for us, either."

The intersection of business and politics

Wealth management firms rarely like to wave goodbye to large clients or successful advisors. Omaha, Nebraska-based

Carson asked Kingdom to remove its name "when we found out that we were labeled as a partner" because "we were there as a participant to interface with advisors," White said. "We're there to talk about our tools for advisors. We show up where advisors show up."

White's firm represented an exception to many firms and organizations that didn't respond to inquiries or sent email statements rather than agreeing to an interview.

The Family Research Council, the Ronald Blue Trust — as well as three entities that the Auten-Schneiders said in

The Family Research Council's

The Barnabus Foundation and Timothy Plan are Kingdom partners. Barnabus "clients have designated more than $2 billion toward the causes close to their hearts,"

"In conjunction with their Kingdom mission and focus, Timothy Partners [the firm's investment advisory arm] provides financial support to numerous ministries including those involved in human trafficking, defending of Christian liberties, and preserving the life of the unborn," according to the

A foundation backed by anonymous families contributing to The Signatry's donor-advised fund launched

The

The alliance devotes

"The truth is, Alliance Defending Freedom is among the largest and most effective legal advocacy organizations dedicated to protecting the religious freedom and free speech rights of all Americans," Tedesco said. "Our record includes 14 Supreme Court victories since 2011 and over 400 victories protecting the free speech rights of students on college campuses."

Kingdom and the foundation respond

Financial Planning asked the National Christian Foundation about the Queer Money Podcast's charge that it's an anti-LGBTQ political group and its fundraising ties to the Alliance Defending Freedom. In addition to those uncovered in the

The foundation "does not rely on third-party designations or labels in our grantmaking process," its spokesman, Chapman, said.

"Because of the nature of donor-advised funds, grants NCF makes originate from the recommendation of givers, who log in to their funds and select charities they wish to support," Chapman said. "Our team at NCF does not initiate charities or causes to support. Every year, we make grants to tens of thousands of giver-recommended charities that work in more than 50 causes such as Bible translation, clean water, anti-human trafficking, and more."

West, of Kingdom, also pushed back on the notion that it or the foundation have a political agenda. Members use the foundation, like other donor-advised funds, for cash and non-cash giving by the clients, and Kingdom "does not control or seek to influence where those charitable donations are granted by donors," West said.

"Donor-advised funds are, by definition, a giving vehicle in which grants originate at the request of the donor," he said. "The NCF platform offers the same access to giving tools as Fidelity, Schwab and others."

The organization's founder, Blue, sat on the Family Resource Council's board more than 25 years ago, which is well before he launched Kingdom. Family Resource Council "has never been a sponsor/partner of Kingdom Advisors and we've never had any kind of relationship with FRC," West said.

"We simply support a broad community of Christian financial professionals and do not take a specific position on theological, cultural, or political issues that fall outside our focus on biblical financial expertise," he added. "Kingdom Advisors does not seek to advance any political agenda."

Asked in a follow-up email interview about the argument that Kingdom isn't political, the Auten-Schneiders said in an email that "it strains credulity." They aren't claiming that the organization tries to steer donations to certain political interests, and they criticized large donor-advised fund platforms for the same reasons as Kingdom in the podcast episode, the Auten-Schneiders said.

"The charge is that Kingdom Advisors has affiliated itself with a number of 'resources' that are pushing a Christian nationalist agenda," they said. "Rather than suggesting that this is out of Kingdom Advisors' hands, Kingdom Advisors could choose to not affiliate with these particular funds. But it won't because it fundamentally supports the Christian nationalist agenda which, by definition, means it's advancing a political agenda. Which is, unironically, why none of the 'resources' happen to support supportive LGBTQ+ organizations like the Human Rights Campaign and The Trevor Project."

They also accused the large wealth management firms that partner with the organization of being "the epitome of rainbow-washing" if the companies try to advocate for LGBTQ+ Americans and "support Kingdom Advisors and its rolodex of hateful resources," at the same time. They asked if "hate groups and organizations that fund and support hate groups align with the values of their organizations."

What the firms say

Among the other companies listed as partners of Kingdom, Ameriprise declined to comment while Crossmark, cfd Investments, Nitrogen, TIFIN Wealth and XY Planning Network didn't respond to requests for comment.

Out of more than 21,000 advisors at LPL, about 1,000 hold the CKA certification, according to spokeswoman Kristin Petrick. Just over 75

The firm's independent advisors "may choose to be members of the Kingdom Advisor organization for networking, fellowship or other support services," she added.

"LPL has no role in recommending where third parties direct charitable funds, nor do we advocate for any political agenda," Petrick said. "LPL stands against all forms of hate and discrimination, and we demonstrate these values through anti-hate group screening applied to LPL Financial Foundation's charitable donations. Nonprofits identified as hate groups, according to the Southern Poverty Law Center, are not eligible and excluded."

Minneapolis-based Thrivent, a financial services firm that is structured as "a fraternal benefit society" and has $162 billion in assets under advisement, grew out of Lutheran organizations more than 100 years ago. It has extended "our common bond to help all Christians achieve financial clarity" since a vote of its members in 2013,

"Thrivent sponsors many different conferences throughout the year, including the Kingdom Advisors annual conference," Thrivent spokeswoman Ginger Plumbo said in a statement. "We also sponsor Kingdom Advisors' annual career fair to engage with college students who are looking to start careers in the financial services industry and have a small number of advisors with the certified kingdom advisor designation. Our workforce, advisors and clients hold a range of personal beliefs and we're committed to fostering a respectful work environment and serving clients who seek to lead lives of service and faith."

Charlotte, North Carolina-based

"The sole purpose of our firm is to support independent financial advisors in their success as business owners, and IAA's connection with Kingdom Advisors has entailed having a booth at their industry conference in February," spokeswoman Dana Ryan said in an email. "As a firm, IAA believes in equal rights for everyone, including the LGBTQ+ community."

"First and foremost, we stand in solidarity with the LGBTQ+ community and condemn any form of discrimination, hate or actions that infringe on the rights of any individual or group. LGBTQ+ rights are human rights, and everyone deserves to be treated with respect, dignity and equality, regardless of their sexual orientation or gender identity," Casady said.

"We participated in the [Kingdom] conference in February because faith-based investors are an important part of the values-based investment community that we are proud to serve," he added. "We felt that it was important to bring the full range of ESG and faith-based investing concerns available on our platform to the Kingdom Advisors conference."

Moving forward … together?

White of Carson Group echoed the sentiments toward LGBTQ and religious people as well. The firm believes "everyone deserves to find their freedom and to have the tools to help them get there," White said. The company has "a large number" of LGBTQ employees and celebrates Pride alongside commemorations of religious holidays and Juneteenth, according to White. The company stands "for inclusion and abundance, not scarcity and division," he said.

"We want people to be able to live their best lives and be their full, authentic selves," White added. "That is our part in this complicated world."

Davis of Abacus views "a dialogue" between religious organizations and LGBTQ professionals as possible, so long as companies are "allowing everyone to be part" of them, she said. The situation reminded her of how she remained a fan of her beloved Chicago Cubs despite staunchly disagreeing with the political stances of the family that owns the baseball team. Advisors should engage with the difficult topics with clients rather than avoiding them, she said.

"As we become more polarized, you almost have to bring the word 'political' in sometimes," Davis said. "I think we're all in uncharted territories about how to handle even just the word 'political.'"

Ortel of InvestVegan says it's "not insane to me that there is a legit diversity problem with respect to the way that people who are devout Christians are treated in the workplace," she said. She identifies as a transgender woman and grew up in a family with a Mormon background, Ortel said. To her, the suggestion that any company or organization like Kingdom Advisors is acting without any political intent just doesn't hold true, though.

"If someone takes an action and that has political consequences for a constituency then — whether or not the actor considers it political — it is," Ortel said.