When looking to the future of asset management, executives are focused on fresh products, emerging technology and the increasing prominence of ESG.

"Portfolio managers and analysts ... must be able to understand, and importantly, measure, the social and environmental impact of each of their investments," says Kate Starr, CIO of Flat World Partners.

ETF growth has been robust in 2018, notes Will Rhind, founder and CEO of GraniteShares.

Still, he adds, ETF issuers "must offer innovative strategies and remedy common investor pain points if they want to remain relevant."

Thomas Hoops, executive vice president and head of business development for Legg Mason, sees an opportunity for active managers in fixed income to outperform.

"The biggest reason for passive product popularity — cost — can be addressed through vehicle choice," he says. "Active ETFs can feature many of the same cost advantages as passive."

Investing in fresh talent

Flat World Partners CIO Kate Starr

Sustainable investing is no longer just a niche part of the asset management industry. Sustainable assets under management are now at $12 trillion in the U.S., and make up one-quarter of all assets under professional management in the country, according to US SIF's 2018 report.

This figure is up 38% from 2016, and it should only increase as more wealth is transferred to women and millennials, who are among the biggest proponents of sustainable investing.

This new normal presents a challenge for asset managers, particularly for firms that have been in business the longest. Managing an impact-oriented fund requires a unique team and range of skillsets. It's not enough to just know how to build a financial model or read a balance sheet; portfolio managers and analysts also must be able to understand and measure the social and environmental impact of each of their investments.

Investors are increasingly demanding that asset managers consider these impacts and report them on a regular basis to ensure funds are not being greenwashed. Therefore, asset managers looking to be a part of the sustainable investing movement need employees who can speak to these investors and help deliver double-bottom-line returns.

Fortunately, an increasing number of young financial professionals are interested in sustainability, providing a ripe talent pool for asset managers to consider.

-

Jeff Kroeger is President of

Insureon , bringing nearly 20 years of commercial insurance experience and deep expertise in small business insurance. He assumed the role following HUB International's acquisition of Insureon in 2022 and leads the company's strategy across customer acquisition, product, technology and agency operations.29m ago -

The sales pitch that private equity funds outperform publicly available investments is drawing much more skepticism. Here are the murky signals in the sector.

36m ago -

Darryl Cohen faces a maximum of 20 years in prison for fraudulently persuading professional atheletes to buy insurance policies at massive markups.

5h ago

These individuals tend to come from leading universities, many of which are now offering courses or majors in sustainable finance. There is also a growing trend of financial professionals forgoing the usual hedge fund or private equity career path to instead join a sustainable investment firm.

With more competition than ever for investor capital, asset management firms can set themselves apart by aggressively investing in human capital. A diverse, multiskilled investment team can mean the difference between winning new mandates and suffering continued outflows of capital. An investment in talent may be the best defense against asset attrition.

Tracking ETF strategies

GraniteShares CEO Will Rhind

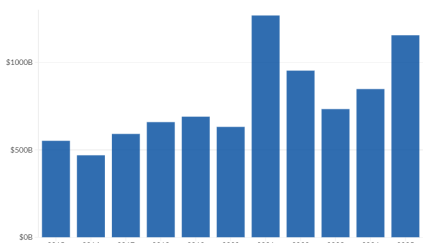

Throughout 2018, the ETF industry has seen tremendous growth. Over 200 ETFs have launched year-to-date, as of Nov. 15.

Despite the positive growth trajectory of the industry, both established ETF issuers and entrants must offer innovative strategies and remedy common investor pain points if they want to remain relevant in this competitive marketplace.

Fee compression, for example, is a perpetual component of the ETF industry, as investors continuously demand cheaper alternatives.

As a result, ETF issuers need to respond accordingly by providing low-cost products. However, value should not come at the expense of quality. Investors still desire superior infrastructure at a fraction of the cost.

ETF issuers additionally need to pay attention to emerging technologies that will dominate the global economy in the coming years.

Megatrends such as artificial intelligence, robotics, cybersecurity, financial technology and internet infrastructure will play an increasingly significant role in the market over the next decade. Subsequently, investors will be on the hunt for strategies that capitalize on and potentially capture returns from these expanding and innovative industry segments.

Fees were nearly half the price of the top-performing active funds.

Additionally, with the U.S. equity market showing signs of weakness, there will be an accelerated demand for investment strategies that protect against downside risk and provide stable sources of income aside from dividends and the traditional bond market.

Heading into 2019, we believe there is still plenty of room for the ETF industry to grow; however, issuers need to deliver on cost, innovation and demand in order to survive in a progressively crowded market.

Moving past passive

AlphaClone CEO Maz Jadallah

The ETF industry as we know it has experienced exponential growth for products following passive, market-cap-weighted strategies.

These products have been so successful over the past several years largely due to their simplistic nature. The ability for investors to understand what a fund does is crucial to the mass adoption of any product, and should be a guiding principle for newcomers in the space.

However, the next phase of growth for ETFs won't be focused on these simple and traditional passive strategies.

Quite frankly, that's already been done.

If ETFs continue to grow at the pace they have, they're going to have to solve for other parts of the portfolio, including active strategies.

As with passive products, the funds that will do well in replacing higher active-share aspects of a portfolio should be simple to understand, regardless of how complicated they might look on the back end.

-

The company is evaluating ways to package both its quantitative and active strategies into the funds, according to a person familiar with the matter.

September 25 -

To encourage a budding relationship with younger clients, firms must provide new offerings and more guidance about how to invest, Schwab says.

September 18 -

Clients will flock to digital advice, but conditions favor incumbent firms, a study found.

September 18

You can see it now, specifically in the complex names of multifactor and defined outcome funds. It's up to the asset management community — in 2019 and beyond — to identify simple-to-understand solutions for underserved areas of portfolios.

Advisors want to use products that they can easily explain to their clients. At the end of the day, of course, this is a people business.

Getting active in bonds

Thomas Hoops, EVP and head of business development, Legg Mason

Financial media has rendered its judgment: passive investment strategies beat active.

This is especially true of benchmark-hugging products, particularly large-cap U.S. equities.

Bond markets, however, are very different. For at least a decade, passive fixed-income strategies have lagged active ones.

These victories are clear, broad and repeated: As of Sept. 30, the median active fixed-income manager has beaten passive strategies over the past one, three, five and seven years.

And they did so with only slightly more volatility, leading to higher Sharpe ratios.

The biggest reason for passive product popularity — cost — can be addressed through vehicle choice. Active ETFs can feature many of the same cost advantages as passive.

Jeff Kroeger is President of

The sales pitch that private equity funds outperform publicly available investments is drawing much more skepticism. Here are the murky signals in the sector.

Darryl Cohen faces a maximum of 20 years in prison for fraudulently persuading professional atheletes to buy insurance policies at massive markups.

We believe active managers are uniquely positioned to deliver outperformance, for several structural reasons stemming from fixed-income benchmarks:

- They can be poorly constructed: The largest weightings typically go to countries and companies that issue the most debt, increasing potential exposure to poor-quality credits.

- They have high concentrations of government and government-supported debt, bonds with unattractive yields still near historical lows.

- Two-thirds of investable bonds are excluded, including bonds not blessed by rating agencies and inflation-linked and foreign currency bonds. This limits returns and diversification.

- Benchmarks have frequent turnover, with steady streams of new issues, repayments, maturities and rating changes. High trading costs may disadvantage passive investors.

- Active investors have timing advantages, trading at any time to obtain new issues at yield premiums. Many passive managers by their mandates can trade only at month-end.

Looking to new fee structures

Christopher Thompson, head of the Americas client group, AllianceBernstein

An important issue weighing on the active vs. passive debate: how can clients be sure the performance is worth the fee?

Here's a possible solution: an actively managed mutual fund that charges a passive, ETF-like fee if it meets or underperforms its benchmark, and only costs more if it outperforms the benchmark. This closely aligns the interests of managers and their clients, and investors will know they are paying a fee commensurate with performance. It's also a compelling alternative to ETFs and index solutions for those who still want the fee benefits of passive without giving up the outperformance potential of active management.

A new performance-fee based model could dramatically improve outcomes for both investors and active managers. How much could it change the game? Under existing fee structures, 42% of active U.S. large-cap managers beat their benchmarks between 1998 and 2017. But under a performance-fee structure, 50% of managers would have outperformed by an average of 27 basis points.

This isn't limited to large-cap equities. The percentage of emerging-market equity managers beating the benchmark would have risen from 50% to 58%, with an average gain of 61 basis points. Because performance fees scale to relative returns, they create an alignment between fees and outcomes.

Factors including low interest rates may have contributed to success.

Mutual fund pricing that's linked to performance is by no means new, but we believe managers need to up the ante with:

- A lower minimum fee comparable with ETF fees as opposed to mutual fund fees.

- A higher performance hurdle for fees. Managers only get paid more when they meaningfully outperform.

- A one-year annual reset. Most traditional fulcrum-fee funds use a three-year rolling period, charging investors higher fees for past results.

Heading into lower-return market conditions, added alpha will be even more essential, and leaving active out in the cold could mean leaving money on the table. The cost of being wrong with active is much lower than the cost of being wrong with passive, and flexibility with fees can adjust the balance.

End-of-year planning

Helios Quantitative Research CEO Chris Shuba

Year-end planning is a vital business practice, considering how emerging trends will impact day-to-day operations and client interactions.

However, one of the most critical components to this annual exercise is determining how you can better serve your clients' wants and needs. For fund managers, this requires careful reflection on how to design the products that advisors and investors want to buy. Making this simple evaluation can yield significant business opportunities. Demand is rising for cost-efficient and sophisticated strategies.

While there is a saturation of basic beta-driven or beta-plus strategies available at reasonable costs, there's a gap between these types of products and strategies targeting true alpha at a cost-efficient price point.

Innovative products will take center stage in 2019 and beyond. Clients want to see fund managers who are not just following the herd. So much development today is done within the same space.

Consider multifactor as one example. It's all the rage now, sure, but everyone is dabbling in the same arena while investors call for original, fresh and truly innovative products.

Complex investment products need simplified stories, and fund managers must be the storytellers.

Investors are becoming increasingly educated on their options, and in turn they want their advisors or institutions to meet them where they are and explain fund choices simply. Fund managers should be sure to make their story both effortless to tell and retail friendly.