When it comes to compensation, it’s not just about the money. Really.

To be sure, client assets and revenue are the lifeblood of the financial advisory business, and advisers who can boost those metrics for their firms continue to be rewarded considerably beyond their base salary.

But in an industry where demand for high-quality advisers far outstrips supply, competition to attract and retain top talent is fierce. As a result, RIAs are increasingly making a delineated career path with established performance goals critical elements of their overall compensation strategy.

“Having a well-defined career path is becoming a really big deal,” says David Canter,

Grant Rawdin, CEO of Wescott Financial Advisory Group, a Philadelphia-based RIA with around $2 billion in assets under management, agrees wholeheartedly.

Rawdin’s fascination with building a business began with the lingerie company his grandfather ran in Brooklyn, New York.

Observing how his grandfather managed to keep employees happy, dedicated and loyal had captivated Rawdin as a child, and set the stage for his attention to business practices such as innovative compensation approaches.

“I knew early on that I wanted to be a lawyer or business owner,” he says. “My grandfather would take my three siblings and me to Woolworth’s and give us a spending allowance. They would get toys. I went to the stationery section and got desk supplies.”

Another family enterprise further fed Rawdin’s passion for law and business, and it also sparked an interest in planning. A part-time job at his uncle’s Manhattan law firm from age 9 into high school led to a full-time job at Philadelphia law firm Duane Morris.

He attended Temple University and later Temple Law at night, and was introduced to financial and tax planning at his day job.

How firms are determining and distributing cash, equity and benefits.

FULFILLING A DREAM

After graduating, Rawdin wanted to fulfill his dream of owning a business while at the same time being able to “solve problems and be impactful in people’s lives.”

Duane Morris staked him to launch Wescott Financial in 1987. He became a CFP and, over three decades, a rapid series of changes in the marketplace underscored his determination to be innovative and “creatively strategic.” That philosophy begins, he adds, by “surrounding yourself with similarly passionate people.”

But to find those kinds of employees — and keep them — Rawdin realized he needed to give advisers a career road map as part of their compensation package.

“Everybody wants to know the next step,” says Rawdin, the firm’s CEO. “They want to know where they’re going, what’s expected of them and what the consequences are. We want to take as much uncertainty as we can out of the process.”

ADVISER AS BUSINESS UNIT

As a result, Wescott advisers have two reviews a year; performance goals are posted online.

A key concept for the firm is an adviser profitability analysis that treats advisers as independent business units.

Wescott calculates an adviser net profit by subtracting overhead, salaries and direct client sales cost from the revenue that the adviser’s clients generate. While an adviser’s profitability margin is a factor that determines compensation, Rawdin insists that advisers are not penalized if their profit margins decline.

“We use the analysis as a tool to make client reassignments,” he says. “The onus is on us to reconfigure the business optimally by assigning new clients to the right advisers and, if we need to, reassign clients to advisers who may be better suited to work with them.”

Human resource studies are underscoring the need for incorporating internal teamwork and defined career paths into compensation and retention strategies: A recent CareerBuilder report found that 21% of U.S. employees were planning to change jobs in the next year, while a recent Gartner study showed employees with mentors are likely to be promoted five times faster than those without.

RIAs must also manage the impact of baby boomer decumulation on assets under management, so finding new ways to boost revenue is particularly important.

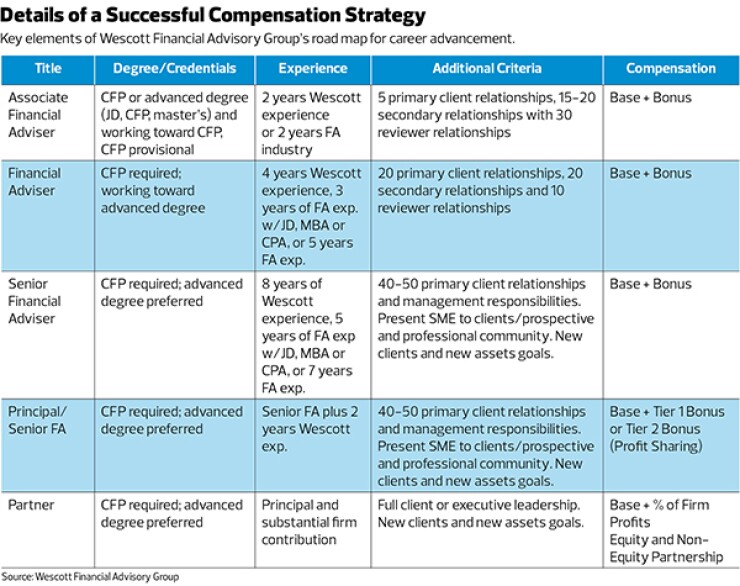

That’s why experience, client relationships and professional designations are other key markers on a Wescott advisers’ career road map.

A full-fledged adviser, for example, must have a CFP certification or be working toward an advanced degree, four years’ experience at Wescott or an equivalent firm, as well as 20 primary client relationships, 20 secondary relationships and 10 peer-reviewed portfolios.

An adviser who is at this level earns a salary ranging from around $70,000 to $100,000; salaries for senior financial advisers can range from around

$100, 000 to $200,000, Rawdin says.

PERFORMANCE GOALS

Bonuses for all advisers are based on a review of a series of performance and personal goals, including civic engagement, subject matter expertise, public speaking and support of corporate initiatives.

But Wescott also stresses team goals as a component of compensation. All advisers are assigned to Wescott Improvement Teams, where mentorship, cooperation and improvements within the firm are noted as being of great importance.

“Performance reviews are subjective; measuring against defined standards is objective,” Rawdin says.

“Nobody is in competition with each other,” he says. “The teams give advisers responsibility and the opportunity to be leaders in specialized areas of expertise. We want to make sure team members provide value and are valued for it.”

FIRM AS ‘TEACHING HOSPITAL’

Compensation and career development strategy at St. Louis-based Buckingham Strategic Wealth also emphasize teamwork and learning new skills.

“We make it clear in our adviser development guidelines that we view the firm as a teaching hospital,” says CEO Adam Birenbaum, an attorney by trade who exemplifies a growing trend among large RIAs (Buckingham has over $10 billion in AUM) to be guided by professional managers who are not necessarily advisers.

“We focus more on well-rounded development of advisers and keeping clients, not just business development and bringing in the next client,” says the firm’s chief talent officer, Shannon O’Toole Kuhlman.

In addition to mastering investment strategy and advanced planning and receiving a credential like a CFP designation, advisers who want to advance at Buckingham “have to be able to lead a team and be committed to self-development and client development,” Birenbaum says.

“We make it clear we’re not a sales organization,” he adds. “We’re a service and expertise culture.”

Associate advisers at Buckingham are paid by salary alone, but incentive compensation is available to both wealth advisers and the firm’s senior leadership.

Growth metrics are set by teams themselves, Birenbaum says. “Instead of saying you have to grow by X, Y or Z, teams are asked to build their own growth plan for the year and each team is different,” he explains. “We shy away from the eat-what-you-kill model.”

VISIONARY VISION STATEMENT

Two years ago, Foster Group, an RIA based in West Des Moines, Iowa, with around $1.5 billion in AUM, decided that its vision statement had to “clearly define the advisory career path” and show how advisers could develop a plan to “accelerate professionally in a way that enhances the client experience and our ability to develop top talent.”

The process began, logically enough, with hiring, says the firm’s director of service, Kate Juelfs. “We wanted to take the guesswork out as much as possible and make it a defined process,” Juelfs says.

-

Sometimes clients lack substantial portfolios. If that’s the case, planners can tread other paths to reach fair compensation.

February 27 -

Adviser Zaneilia Harris seeks out clients who resemble a former version of herself — young, single, African-American women struggling to make wise choices — and keeps them by structuring compensation in an atypical way.

December 28 -

"I lose years of my life. They can settle, write a check and move on," says an adviser whose book of business dropped by $40 million after he alleges he was wrongfully terminated.

December 19 -

Three experts break down how to incentivize employees.

November 17

VALUE OF A ‘VALUES INTERVIEW’

Every hire comes through a referral, special emphasis is put on integrating with the firm’s culture and hiring is capped by a “values interview” with Foster’s CEO, Buck Olsen.

New advisers are given two tests to assess their work style and strengths “to help us indicate how people will integrate into teams and where they will gravitate,” Juelfs says.

Once the assessments are completed, a “personalized career path is created for each adviser,” Olsen says. “They own it and we invest in it.”

"We want to take as much uncertainty as we can out of the process,” says Wescott Financial Advisory Group CEO Grant Rawdin.

Rookie advisers then start 12 weeks of training, begin studying for their Series 65 certification and enroll in a CFP program.

They are assigned to teams where lead advisers are told to give young associates “as many at bats in front of clients as they can,” Juelfs says.

Individual goals that determine compensation and career advancement include metrics related to revenue, AUM, business development, and client and asset retention.

But teamwork and collaborative skills are also taken into account during performance reviews that determine compensation, Olsen says.

“We are far more skewed toward collective activity-based objectives than we are toward revenue-based objectives,” he says.

REVENUE ISN’T A DIRTY WORD

At Cornerstone Wealth, an RIA in suburban Charlotte, North Carolina, with around $600,000 in AUM, revenue is not a dirty word when it comes to compensation and a career path to ultimate partnership.

Factors such as leadership qualities and being able to provide clients with a “comprehensive wealth management experience” are certainly quite important, says CEO Craig Rubrecht. But so are criteria such as bringing in new clients, net new assets, net new revenue and increasing the value of the firm, Rubrecht says.

“Everything has to be accretive,” he explains. For example, the firm will pay a bonus of 10% of net new assets on top of a base salary.

And to receive a bump in compensation as an adviser who increases productivity from $400,000 to $675,000, he or she must also generate a 5% increase in net new assets.

FOSTERING COLLABORATION

To help foster collaboration and teamwork, Rubrecht says, Cornerstone offers advisers who have been with the firm more than three years the opportunity to purchase shares at discounted rates.

The firm will issue advisers additional shares, he says, “based on the spread before the firm’s growth and personal growth.”

Beyond hitting pure financial targets, deciding who is on course for advancement in a firm is surely an imperfect science.

At Wescott Financial, for example, one former adviser, a lawyer, “would analyze prospective recommendations from every conceivable angle, and then was still certain she had missed something and wouldn’t make a decision,” Rawdin recalls. “This over-thoroughness and lack of urgency was not something we could change, and served no one well.”

The adviser ended up returning to her law practice.

“We view the firm as a teaching hospital,” says Buckingham CEO Adam Birenbaum.

Not enough advisory firms are defining career paths and emphasizing teamwork the way Wescott, Buckingham and Foster Group are, according to Canter.

However, he believes that will eventually change.

‘NOT THERE YET’

“We’re not there yet,” he says. “But firms who are growing and want to maximize scale and efficiency see that they can really serve clients better in a team-based fashion.

“And they can more effectively compete for talent by laying out a path for career development in conversations about compensation.”