The second phase of the Department of Labor's fiduciary rule has been pushed back to July 2019, but the changes it has inspired — particularly in the mutual fund industry — are moving ahead, albeit slowly.

"This is going to be an evolution over time, but we don't see it being a wholesale change to one share class," says Keith McRedmond, managing director of business development for Russell Investments' U.S. advisor business.

How the rule itself might evolve remains uncertain, as the DoL is still conducting a regulatory review ordered by President Trump. However, the department hinted at one possibility with direct implications for mutual funds.

In a Federal Register filing, it announced that it "anticipates it will propose in the near future a new and more streamlined class exemption built in large part on recent innovations in the financial services industry."

This likely refers to so-called clean shares of mutual funds that would be free of the sales incentives and other features that can create conflicts of interest for brokers and advisors.

Such products are only the most recent step forward in an industry that has been evolving to compete in a marketplace that has been overtaken by low-cost, transparent products.

As currently written, the fiduciary rule requires that financial advisors must act in the best interest of their clients, and put their clients' interest above their own when making investment recommendations with regard to retirement accounts. Mutual fund share classes that pay broker commissions can create a conflict of interest.

By removing front-end loads, deferred sales charges and 12b-1 fees, clean shares and other new share classes aim to eliminate conflicts that might arise for recommending such products. Any sales fees or other commissions charged by the broker would be handled separately, provided certain conditions are met.

In a July request for information, the DoL noted that some firms had begun developing clean shares as a potential "long-term solution to the problem of mitigating conflicts of interest with respect to mutual funds."

-

The firm has been building its passive business as investors dump active products.

July 31 -

Energy was likely a “headwind,” analysts wrote.

July 21 -

Although the funds experienced a combined $586 billion in outflows over the last two years, this segment reported inflows of $41 billion.

June 7

When the SEC issued a no-action letter on the issue of clean shares to the Capital Group last January, many received the news as a go-ahead for the new structure. Capital Group, which owns American Funds, along with Janus Capital and MFS, have since introduced clean shares. And a far greater number of firms have created T-shares, which charge a standard 2.5% sales fee and 0.25% 12b-1 fee.

Other classes meant to tackle the broker compensation problem have proliferated as well.

Beyond complying with the fiduciary rule, asset managers are also responding to a change in investor demands.

"There had been a push on the part of clients and advisors to move to fee-based advice platforms," says Brian Reid, chief economist at the Investment Company Institute. "Index funds and ETFs fit naturally into this model, and funds that traditionally sold through brokers created no-load share classes to be able to remain on these platforms.”

All posted positive returns over five years, but active saw the largest outflows.

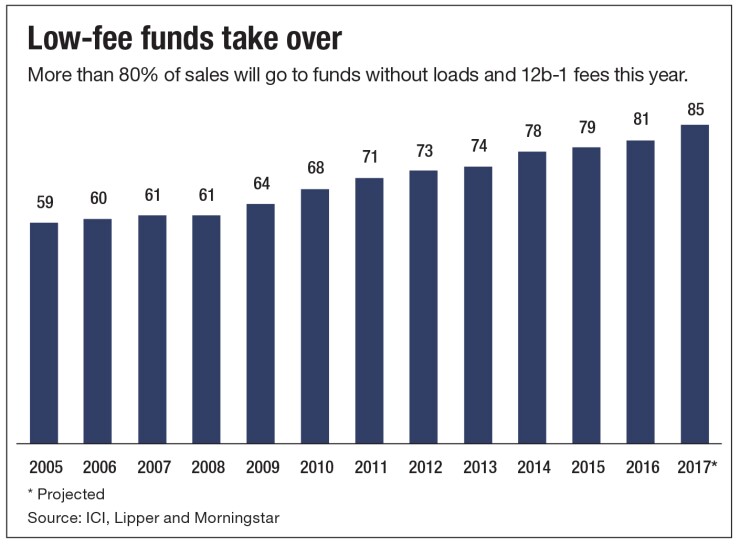

Mutual fund sales are now dominated by low-fee shares, with 80% of all transactions going to classes with no loading or 12b-1 fees, according to data from ICI.

Fund performance may also become more competitive as a result, since these new funds are not dragged down by fees paid to the broker.

"We've seen a big movement in the marketplace to new share classes being launched," says Russell Investments' McRedmond. "That process has been accelerated as firms look to provide solutions under DoL.”

UPSETTING THE STATUS QUO

Morningstar's Director of Policy Research Aron Szapiro in August wrote in a whitepaper that "clean share classes represent the best way to enhance transparency."

But while many agree that clean shares make sense, few are interested in upsetting the status quo before the fiduciary rule's enforcement mechanism — and any other potential changes — have been solidified. As such, the industry won't leave the current mutual fund class structures behind any time soon.

Despite embracing innovative new products, asset managers were among those calling for a delay to the rule. Even Vanguard and BlackRock — whose low-fee funds would likely be unaffected by the rule — were in favor of the delay, citing confusion and the cost of compliance in public comment letters filed to the DoL.

The department said that more time would be needed for the clean share market to develop. But some see a risk that regulatory delays will decrease the industry's appetite for rapid change.

Given the effort involved in developing new products, "asset managers have a motivation to keep things as they are," says Denise Valentine, senior analyst at Aite Group, a financial services research and consulting firm. "It takes time to launch new funds. It takes time to introduce them to your operations. The stopgap could last for a while."

ADAPTING TO THE NEW STANDARD

The DoL's recent decision to delay has also helped to curtail any wholesale shift away from broker compensation within mutual fund fee structures. As for the possibility of a clean share exemption, a DoL spokesman declined to comment on what that might look like, saying that "it would be premature to make any statements about the substance of any streamlined class exemption."

In the meantime, the alphabet soup of mutual fund share classes is likely to grow. Rather than entirely abandon the marketplace of mutual funds that may pose conflicts of interest, advisors are relying on stopgap solutions to comply with the fiduciary standard. The reason, says Valentine, is that advisory firms have committed to an operational framework built around certain products.

Adapting to the new standard can involve selling traditional mutual fund shares and rebating some or all of the sales load.

"Broker-dealer firms have said, 'We're going to work with the shares we have and rebate to bring prices in line with what we think are appropriate,'" says Valentine. "You don't just throw all the existing funds out the window."

For advisors coming to grips with new-found responsibility, documentation and justification of retirement advice have gained importance. That's why, beyond creating new products, asset managers are competing to serve advisors through fiduciary education, creating specialized teams as well as pamphlets, webinars and other material for clients.

"We're developing educational material to succeed in an environment where they are meant to be fiduciaries," says McRedmond.